Would you like to know more about Amazon.com Inc. (Nasdaq: AMZN), the company behind the largest online store in the world? Let’s find out more about Amazon stock.

Today, we’ll take a look at its history, business model and stock price.

You might be surprised to learn that Amazon is much more than just an e-commerce giant.

Amazon: From Bookseller to E-Comm Giant

Amazon has revolutionized the way the world shops.

Founded in 1994 by Jeff Bezos, Amazon was the first of its kind — a marketplace with all kinds of products that could be accessed from anywhere in the world.

Amazon has gone on to become the world’s largest online retailer. It has taken away geographical boundaries and made products accessible to anyone, anytime, from all corners of the world. It’s a far cry from where the company started.

In 26 years and Amazon has gone from selling books to just about everything, from clothes to electronics to even food and groceries.

Now, Amazon is one of the leading providers of many items with expansive delivery options along with features like Amazon Prime.

Amazon’s Stock Power Ratings

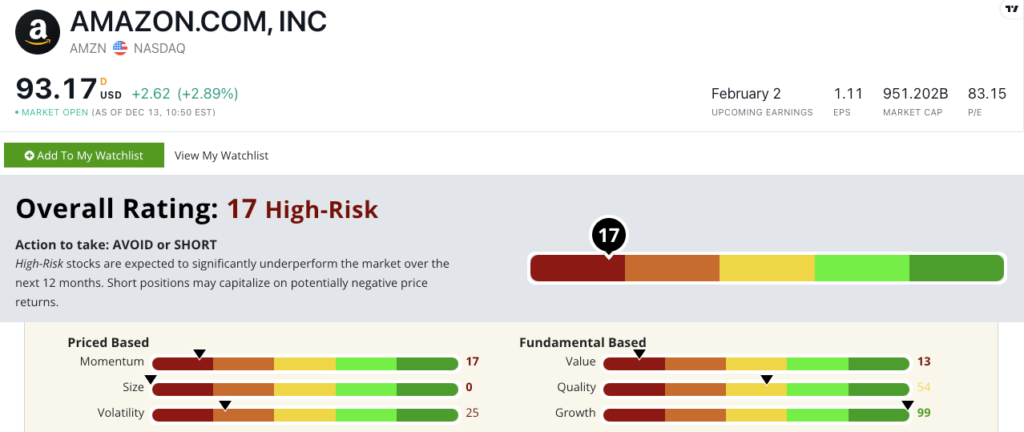

AMZN stock scores a 17 out of 100 on our proprietary Stock Power Ratings system.

This means we consider the stock a “High Risk” and expect it to underperform the broader market over the next 12 months.

Amazon’s one-year annual sales growth rate is 21.7% and its earnings-per-share growth is 55% — earning it a 99 on our growth factor.

However, the stock is considered overvalued.

Its price-to-earnings ratio is more than double the general merchandise retail industry.

All of its price-to ratios (sales, cash flow and book value) are higher than its industry peers — giving it a 13 on our value factor.

AMZN scores a 0 on our size factor with a market cap that’s close to $1 trillion.

Our research shows that stocks of the largest companies tend to lag the returns of otherwise equally rated smaller companies.

While sales growth is good, zooming out at the larger picture shows us Amazon stock is “High-Risk.”

Amazon’s Market Impact

Leveraging its digital clout, Amazon has pushed into almost every sector imaginable and continues to expand, driving other big players out of the market.

Amazon’s offerings for goods and services not only provide consumers with convenience and savings, but Amazon also drives innovation by using technology that other companies are slow to adopt.

Amazon’s success has helped power up digital shopping as a whole.

The bottom line: Amazon has been a giant in the tech industry since its founding in 1994 and it doesn’t look like that’s going to change anytime soon.

If you’re thinking about investing in Amazon, use our proprietary Stock Power Ratings system to consider whether or not this company is a good fit for your portfolio.

Click here to see how Amazon stock rates today.