In September 2023, Amazon.com Inc. (Nasdaq: AMZN) wrote a check for $1.25 billion to a little-known company called Anthropic.

This small research startup created a generative AI model called ClaudeAI.

Amazon’s investment didn’t get a lot of press because, earlier in the year, Microsoft Corp. (Nasdaq: MSFT) threw down $10 billion to extend its partnership with ChatGPT creator OpenAI.

However, part of Amazon’s deal with Anthropic was the option to increase its investment to $4 billion before the end of March 2024.

And last week, Amazon did just that, pouring another $2.75 billion into the AI startup.

This was not only one of the largest investments ever made by Amazon … it was also a clear signal that it intends to compete with Microsoft and Google parent Alphabet Inc. (Nasdaq: GOOGL) in the race for AI dominance.

But I see these significant investments as an indicator of something even bigger on the horizon.

Let me explain…

Investment in AI Continues to Skyrocket

In 2015, the total global investment in AI was around $10 billion.

That’s less than the combined $14 billion Microsoft and Amazon have spent on AI just since last January.

Total investment in AI has grown to more than $110 billion — a 1,000% increase in less than a decade.

And the amount of money flowing into AI is only going to keep growing:

By 2025, the total worldwide investment in AI is projected to reach $158 billion — with $82 billion of that happening in the United States alone.

The reason for this massive boost in investment is simple: Generative AI (the AI that creates new content like text, images, audio and music) will bring about sweeping changes to the global economy.

Estimates suggest AI could drive a 7% (or around $7 trillion) increase in global GDP in the next decade. That increase comes with a 1.5 percentage point jump in labor productivity.

We haven’t seen that kind of impact of innovation since electricity in the early 1920s and information technology in the early 2000s.

And we aren’t even close to large-scale adoption of AI.

The first electric street lights were installed in London in 1878. However, significant increases in electricity investment didn’t happen until after 1915, and productivity due to electricity didn’t spike until around 1925 — nearly 50 years after London got street lights.

With rapid adoption, these AI estimates could be much higher — think $200 billion in worldwide investment by 2025.

And we’re already starting to see AI’s impact on share prices…

AI Is Already Pushing Stocks Higher

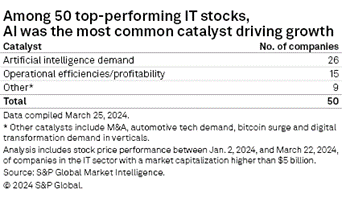

Analysis of technology companies with more than a $5 billion market cap shows that those with the largest share price gain have one thing to thank for those gains: AI.

More than half of the tech companies with the largest share price growth in 2024 have cited AI demand as the biggest reason their stock price has gone up.

Here’s a look at those big movers and their tie back to AI:

- Super Micro Computers (SMCI) — Specializes in AI-optimized servers. +241%.

- Pure Storage (PSTG) — AI-optimized storage solutions. +50%.

- Applied Materials Inc. (AMAT) — High bandwidth memory packaging. +36%

- Micron Technologies Inc. (MU) — High bandwidth memory chips. +34%.

- Fortinet Inc. (FTNT) — Network security. +18%.

As you can see, AI is incorporated into everything from cybersecurity to cloud storage.

But I believe we are still in the early adoption phase, and the gains made by these companies — and others like them — aren’t finished yet.

Bottom line: While AI (or the idea of AI) has been around for some time, we’re just getting started with adopting the technology into our everyday lives.

But trust me, it’s going to happen.

In the meantime, this AI mega trend will continue to grow … and take share prices with it.

If there was a better time to spot a trend and invest in it before it rockets to new highs, I don’t know when it was.

Which brings us to Adam’s latest Green Zone Fortunes recommendation…

This company is a pioneer in the emerging field of “Closed AI,” with a multiyear head start against the competition.

It developed technology that promises to disrupt the AI market.

Adam is stepping out of the box for this one … and recommending the stock before it becomes “Strong Bullish” on his Green Zone Power Ratings system.

That’s because he believes NOW is the time to buy this stock … not months or years later when AI has fully taken off, and the massive potential gains of this stock have already been realized.

Some of the most successful tech investors in history have already bought in … dubbing this stock “The Next Google.”

Watch Adam’s special presentation on the stock HERE, and make sure you take action before May 5!

Until next time…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets