Advanced Micro Devices Inc. (Nasdaq: AMD) issued financial results for the last quarter of 2023 that brought positive signs.

The company makes computer chips used in data centers, PCs and other electronics. Their report showed sales increased to a new record of $6.2 billion for the October-December period.

We’ll look at what did well for AMD in the last quarter of 2023 and what Adam O’Dell’s Green Zone Power Ratings system tells us about the stock.

Data and Chips Shine For AMD

Two parts of AMD’s business did exceedingly well.

First is data centers. These are large-scale complexes companies use to store information online. AMD creates customized processors, maximizing data center efficiency.

Companies are building more data centers lately, needing faster servers and chips. AMD met this demand, shipping more advanced data center chips last quarter.

This caused their data center revenue to jump 38% compared to last year.

Second is AMD’s personal computing chips. New 2023 product releases like the Ryzen 7000 laptop processor line also helped AMD sell way more PC chips.

Bringing updated features attracted computer makers to use the latest AMD silicon. So AMD’s PC chip sales expanded over 60% annually by selling more Ryzen products.

On the other hand, sections like gaming processors softened recently as customers worked through excess inventory amid shaky consumer budgets.

AMD’s Green Zone Ratings

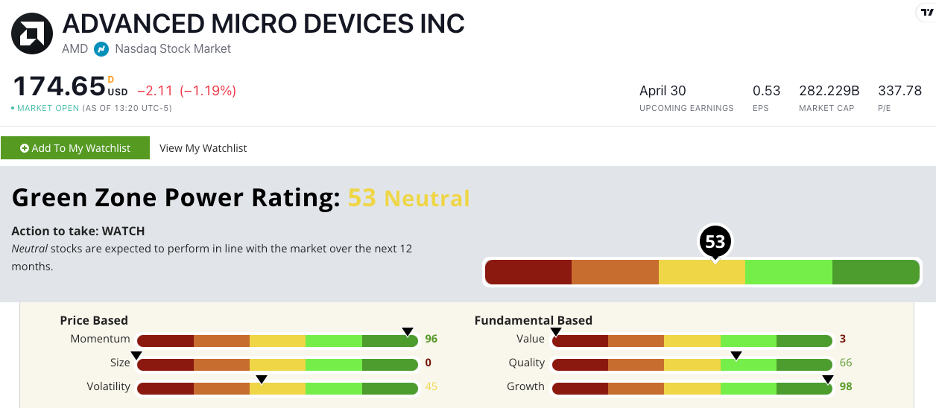

Advanced Micro Devices’ stock earns a 53 out of 100 on Adam’s Green Zone Power Ratings system.

That means we are “Neutral” on the stock and expect it to perform in line with the rest of the market over the next 12 months.

AMD earns a 98 on Growth thanks to a 10.2% quarter-over-quarter sales growth rate.

Its 96 on Momentum is due in large part to a 107.5% up move over the last 52 weeks.

The company earns a 66 out of 100 on our Quality factor. Its returns on assets, equity, and investment are all higher than the industry average, along with its operating and net margins.

The stock scores a low 3 on our Value factor with a price-to-earnings ratio nearly 10 times higher than the semiconductor manufacturing industry average. Its price-to-sales and price-to-book value ratios are also notably higher than its sector peer averages.

Bottom line: Financials showed AMD’s effort transitioning to more corporate-focused products like data infrastructure paid off last quarter.

Less exposure to items like gaming console chips provides stability when shoppers pull back. Sustaining data center and PC momentum is critical if the global economic climate stays cloudy.

However, the recently achieved growth suggests AMD found the right formula for adapting during uncertainty.