America is building.

Everywhere I go in South Florida, I see massive cranes swinging steel frames into position, or trucks hauling away dirt as companies lay the foundation for a new apartment building or entertainment bloc.

And maybe you’ve noticed it in your own area too. The Department of Commerce estimates U.S. construction spending hit $1.82 trillion in January.

That’s down slightly from December, but it’s still 5.7% higher than the same month last year.

It indicates a steady stream of outlays for construction projects across the country.

In order to complete these projects, contractors need reliable heavy equipment — such as earthmovers, backhoes and forklifts.

Research firm Precedence Research projects the global construction equipment market will reach a value of $234.6 billion by 2030:

That’s 58% growth from where the market was at the end of last year.

Today’s Power Stock is a heavy equipment provider for the construction industry that has just pushed into mid-cap territory.

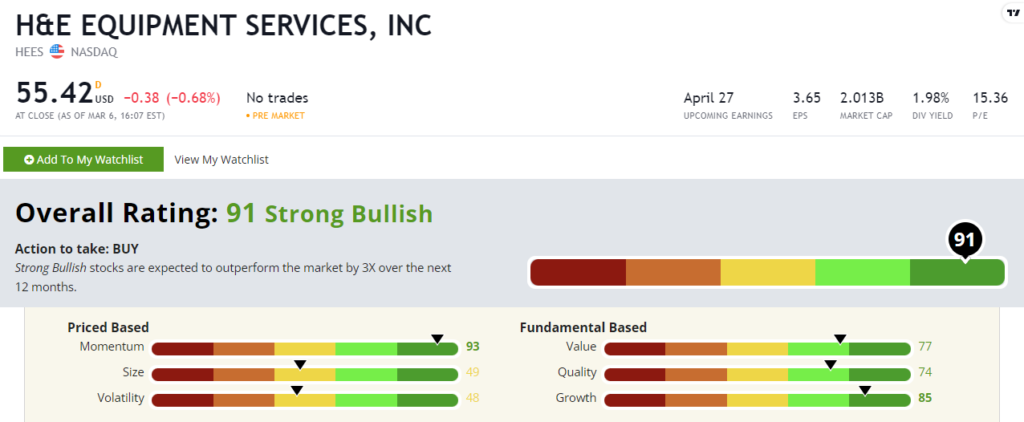

And H&E Equipment Services Inc. (Nasdaq: HEES) scores a “Strong Bullish” 91 out of 100 on our proprietary Stock Power Ratings system.

HEES stock is a one-stop shop for construction and industrial equipment. Not only does it sell and rent new and used machinery, it also provides service and repair work.

Some of the equipment it provides includes:

- Earthmoving equipment such as dozers, excavators and backhoes.

- Aerial work platforms.

- Forklifts.

HEES stock scores a “Strong Bullish” 91 out of 100 on our Stock Power Ratings system. We expect it to beat the broader market by 3X in the next 12 months.

HEES Stock: Outstanding Momentum With Sustainable Growth

HEES recently reported its fourth-quarter and full-year financials for fiscal 2022.

Here are two high points:

- Its quarterly revenue was $353.1 million — a 25.6% increase over the same period a year ago!

- For all of fiscal 2022, the company’s revenue was $956 million —31% higher than fiscal 2021.

These sales figures show why HEES stock scores an 85 on our growth factor in our Stock Power Ratings system.

It’s also a solid value stock — scoring a 77 there. HEES’ price-to-cash flow is nearly half the industry average.

The lower the number means the company is undervalued in terms of its cash flows.

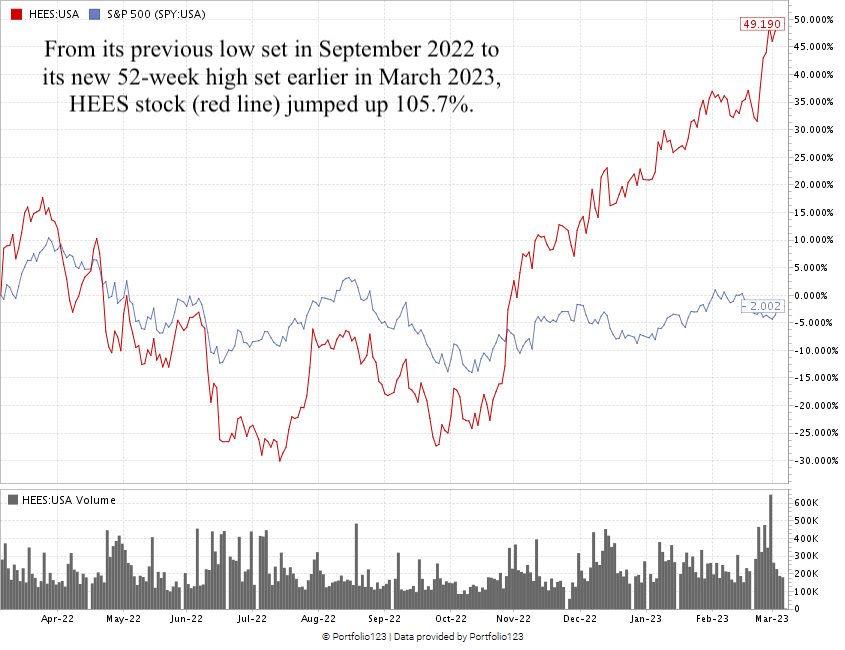

But its market-busting momentum is the real story:

Created in March 2023.

HEES stock price has increased 49.2% over the last 12 months.

But it’s really been on a tear in the last six months or so.

From its recent low in September 2022 HEES stock has climbed 105.7%!

That shows the “maximum momentum” we want to see in stocks…

HEES stock scores a 91 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least 3X in the next 12 months.

Bonus: HEES’ 2.02% forward dividend yield pays shareholders $1.10 annually for every share they own.

Construction is booming in the U.S. I see heavy equipment everywhere I go as I travel around South Florida.

In order to construct massive apartment buildings, roads and bridges, contractors rely on companies like HEES to supply the heavy equipment they need to get the job done.

That’s why HEES, as a heavy equipment and construction stock, is a great addition to your portfolio.

Stay Tuned: Another Way to Play the U.S. Construction Boom

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Tomorrow, I’m going to reveal a company that plays a critical role in processing wood for construction projects that range from fixing your porch out back, to building out infrastructure for massive electrical and communications infrastructure.

Until then…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets