With the rise of online gambling over the last few years, you’ve noticed an increase in commercials and ads for companies like DraftKings (DKNG) and Hard Rock…

Gambling ads are everywhere these days — especially when you’re watching sports.

With so much coverage in the media, you might assume that casinos are raking it in hand-over-fist, making more money than ever.

But the reality is quite different. And it paints a distressing picture about the state of consumer spending right now.

Click below for the full story:

Video Transcript:

Welcome to another episode of Moneyball Economics with me, your host, Andrew Zatlin.

Today I want to share with you what I think is my path to getting a Nobel Prize in economics and your path to building a little bit more wealth…

I want to share with you a very critical dataset that nobody’s looking at, and yet to me is probably one of the most critical pieces of information that we should be tracking this dataset. It’s got a robust 30-year history of a near perfect track record of predicting interest rate hikes and cuts.

Let me say that again:

This dataset that I’m excited to share with you tells me when the Fed is going to make a move, how much of a move they’re going to make, and the kicker it leads by two years. That’s right. Standing here today in 2025, I know what the fed’s going to do all the way in through 2026!

So today I want to share that with you because let’s face it, right now, the stock market and bond market are on edge. They want to know what’s going on with interest rates. Once those interest rates happen, they want to know how deep you and I are going to have the keys to that kingdom. So before I share that dataset with you, I want to talk a little bit about something that’s related.

I want to talk about consumer spending…

I’ve always been fascinated by consumer spending.

I remember back when I was 10 years old, for example. I’d go and buy these big Halloween bags of candy. You remember those? I got like 50 pieces in a bag. I’d take ’em to school and the playground. This was me. I would sell one piece for 10 cents, two pieces for 15 cents. End of the day, I’m all sold out.

I take that money, I go out and I buy another bag, maybe two, but I definitely would buy my comic books and my candy.

Hey, I didn’t get an allowance. This is how I got by.

It was great up until the school principal ratted me out to my mom. See, apparently I thought I was a young entrepreneur. The school thought I was basically the equivalent of the school drug dealer. I was getting all these kids hopped up on sugar. They were going back into the classrooms getting rowdy as all hell, man.

So unfortunately, the school ratted me out and my mom stopped that. But it fed into my interest of consumer behavior in particular wants versus needs. I mean, here were kids. They had money in their pocket, allowances or birthday money or whatever. They didn’t need to spend it on anything, so anything they purchased was pure want.

It was a pure luxury, and it was interesting to see what would get them to spend. Fast forward, I remember at Kyoto University, it was a research fellow at the Institute of Economic Research, and I was studying consumer trends in Japan because there was this really crazy inflection going on until Reagan came in and forced the Japanese to open up their economy.

They didn’t really have much of a consumer economy, and the one they had was kind of perverse. What they were doing is, let’s say they would go on a trip to Hawaii. You and I would go on a trip to Hawaii, our airfare, our hotels and everything. Maybe it’s five grand, I don’t know. They would spend 10 grand. They would pay twice as much for the airline ticket or twice as much for the hotel, and sometimes they knew it, but they were proud of it. It was crazy.

But all of a sudden, once they got a taste of consumerism, things changed. This concept of spending on luxuries has stayed with me and I pursued it. And what’s interesting is it’s hard to track.

Now, you and I know at just an experiential level, at an academic level, people who have money in their pockets will spend it more likely on wants than needs. That was my experience as a 10-year-old. Adults are the same way.

When we have money in our pocket and we feel comfortable that we’re going to have that same amount of money tomorrow, we’re going to go maybe little thrills, a little fun, a little crazy times. Could be going out and drinking, could be gambling, whatever it is, we kind of spend it on luxuries a watch or something like that. But the problem is how do you track that spending?

Oh, if I want to track Rolexes and how much Tiffany’s are selling and stuff like that, I can do that, but the problem is there’s not a lot of data and it’s very skinny. It’s the top 1%. If I want to track who spends money at Tiffany’s, I’m not getting lower- and middle-class income spending, and that is the bulk of our economy.

So that’s always been the problem for economists when they want to look at luxury spending, they know that this is the be all and the end all for knowing whether the consumer is going to spend more or less going forward in the core economy. They just haven’t had the ability to track it. Well, guess what I do, and that’s what I want to share with you. I track a lot of vice spending. I track spending on cannabis, I track spending on alcohol.

I track hookernomics, I track it on prostitution. I also track it on gambling, and today I want to share with you some of the gambling data and show you the power of being able to track luxury spending a little history, and when we look at gambling today, it’s an amazingly rich source of economic data.

For example, when they report consumer confidence or consumer sentiment, they’re polling a few hundred people. All this view about where the economy’s going is coming from maybe 400 people.

That’s garbage data.

Quite frankly, it’s a garbage methodology. It dates from the seventies.

In fact, when I first got into my Moneyball economics, that was the perennial problem. All of these data collection methodologies and datasets, so old and antiquated, it’s not funny. So I’ve set out to find better ones and gambling is one of those better ones, excuse me, for a variety of reasons.

One of them is the amount of transactions and people who are involved is in the millions per month. Millions of people are gambling each month, so you’ve got a larger database than just a few hundred. Secondly, it cuts across all socioeconomic striations, old, young, male, female, religious, not religious, white, black, you name it, everybody’s participating. So that means we’ve got a broad and relatively deep slice of the American consumer base.

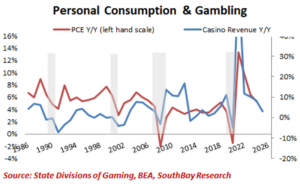

The question though is to what degree does this data really give us line of sight to what’s going on to say spending in the economy? We’ll take a look at this chart going back 30 years. This chart shows you the strong correlation between personal consumption expenditures.

PCE is the end-all-be-all for us economists. It’s after you get your money, after you pay your taxes, after you’ve paid rent and auto.

Basically it is your pure discretionary spending after everything’s covered.

Well, if you look at it year over, you look at the ebb and flow. Are people opening up their wallets or are they closing them? That’s what matters. What you see is this huge and over time strengthening correlation to gambling, which makes sense. Gambling’s a pure luxury.

If you don’t have money in your pocket and you don’t expect more money in your pocket because of inflation, wage pressure, whatever, you’re not going to gamble. It’s one of the first things to get cut. That’s why economists want to look at luxury spending. It’s the first thing to come on board.

It’s the first thing to get cut, and gambling has gotten stronger over time for basic practical reasons. Back in the eighties, you could only gamble if you went to Vegas or Atlantic City. That presents a problem.

Those are destinations.

You had to get on a plane, you had to get a hotel room food. This was a commitment. This was an expensive commitment, and therefore gambling in the eighties, up until the eighties, it was basically middle and upper class people. Fast forward today, you’ve got pretty much casinos in almost every state.

You’ve got lotteries, you’ve got online gambling. In other words, everyone can participate. And as a result, the cost of entry, those barriers have come down. You don’t have to fly anywhere. You can drive across town.

If you’re in Detroit, for example, key point, more people participating, and as a result, it became a much better indicator of what’s happening with the consumer in real time. Now, if you look at this data, you’ll say, wait a second, this is coincident. Basically, the lines are moving at the same pace in the same ways. And the answer is, it is coincident.

What happens in February with gaming and gambling is what we’re going to probably see with the consumer PCE in February. But the difference is this. We’re standing here, it’s almost April and I already know what’s happening in March data, whereas we haven’t even heard about the February PCE data. So it always has almost a two month lead.

Knowing what’s going on in the consumer economy is huge. It’s very important because this is 70% of our GDP spending consuming. So knowing if it is growing or shrinking is important, and it’s important not just for academic reasons. The Fed needs to know if the economy is starting to sputter or starting to get too hot, and they look at PCE very closely because PCE tells them whether they need to be cutting or raising interest rates.

Well, let’s go back to gambling. How good is gambling? If you look at this PCE before we move on, if you look at this PCE chart, what you’ll see is my data is starting to show. The gaming data is starting to show a severe accelerating drop.

That means we can expect PCE, we can expect consumers to start to sharply slow down and possibly contract in their spending. And that is the kiss of death for the economy.

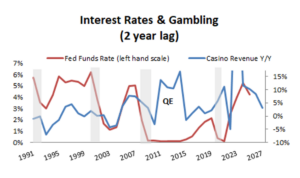

And that is going to force the fed to move. The question is when and how and by how much. Take a look at this chart, which tracks interest rates and gambling. Remember I told you, 30 year robust, near perfect record. There are two times that gambling has not predicted with a two year forward accuracy. Two times in 30 years it’s been wrong.

One was QE and one was covid. And you know what they had in common? 0% interest rates. See, it turns out that when you give away money to people, we’re not talking oh, 3%, 4%. When you make it 0%, people go nuts. Gambling during QE rocketed up rates should have gone up a lot sooner as the gambling data shows, and eventually it did. Same story with covid. 0% gambling gets turbocharged, the sugar high that those 10 year olds had, and yet the Fed was late to start raising rates.

Since Covid, as the Fed has raised rates, this divergence that we’ve seen, the Covid and QE, it’s gone. We are back to the historical correlation. And with that in mind, what the gambling data is telling us right now is that interest rates need to be around 3%.

That’s a big, big drop from where we are now, and it’s a lot bigger than what the consensus expectations are. It’s a lot bigger than what the Federal Reserve thinks they should be. And that my friends, is the opportunity.

Interest rates are going to be cut a lot deeper, a lot faster, and a lot more frequently than the markets expect or we tumble over into a recession. Pick your poison.

So get ready. You need to play this very carefully. If interest rates get cut, the bond market is going to rip, it is going to surge, so will gold. It’s very likely that so will real estate. So right off the bat, those are three assets that you could look at, which are immune from all this tariff nonsense.

We’re in it to win it, folks. Zatlin out.

Andrew Zatlin

Editor, Superforecast Trader & Moneyball Economics