I’ll admit my alcohol consumption might have spiked a little in 2020. The two months when I was marooned on the farm in Peru under lockdown were especially rough. I didn’t have much else to do, and it helped drown out the screams of my children, the sound of my wife screaming at my children, the sound of my mother-in-law screaming at my wife and the sound of my father-in-law screaming at everyone.

But I’ve been making a real attempt to get healthier this year. I’ve been eating better and drinking less. And I can’t remember the last time I had a cigar. I’m getting my pre-pandemic groove back.

I bring this up because I know I’m not alone. And this matters to beer brewers like Anheuser-Busch InBev SA (NYSE: BUD). Apart from the iconic Budweiser and Bud Lite brands, BUD is the owner or distributor of Stella Artois, Corona, Michelob Ultra and about 400 other brands.

“Big beer” has struggled for years. Today’s drinkers have drifted away from established beer brands toward smaller, often locally-made craft beers. There has also been a shift away from beer altogether and toward cocktails and hard seltzers. As people drink less at home in 2021 and start flocking to bars again, I don’t see that trend reversing.

These shifts in drinking habits have hit BUD hard. Shares topped out at $136 in late 2016 and have struggled ever since. They hit a low of $32 last year before recovering to about $70 today.

With the shares still down by nearly half from their highs, BUD warrants a closer look. Is there some value hiding in the back of the beer fridge?

BUD’s Green Zone Rating

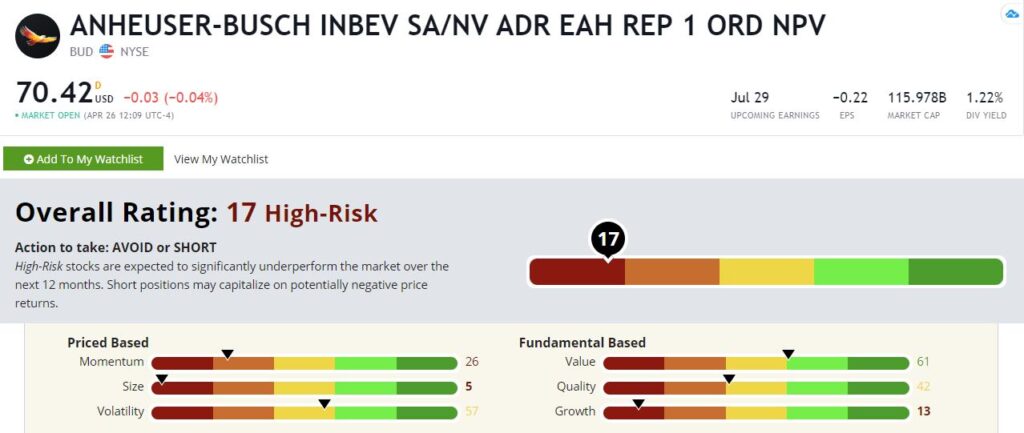

Our Green Zone Ratings system suggests that the keg is kicked. BUD rates a 17 out of 100, making it a “High-Risk” stock in our system. High-Risk stocks are expected to dramatically underperform the market over the following 12 months.

Anheuser-Busch InBev’s Green Zone Rating on April 26, 2021.

Let’s take a closer look.

Value — Given how far the shares have fallen, BUD rates the highest on value. But it’s only a 61 out of 100. That places it in the top half of all stocks, but it isn’t close to deep value territory. BUD trades at a forward price-to-earnings ratio of 23 and a price-to-sales ratio of 2.99. To pay a premium like that, we need to see a good growth pipeline or at least a solid dividend. That’s not the case with BUD. It rates low on growth, and its dividend yield is a paltry 1.6%.

Volatility — BUD rates in the middle of the pack based on volatility at 57. That’s not a deal-breaker if other strong factors compensate. But that’s not the case here. BUD is a stock with average volatility and below-average ratings on almost everything else.

Quality — I’ll admit I was a little surprised to see a quality rating of only 42. Companies with strong branding usually rate higher here. The brand enables them to charge a premium that translates into higher profitability. But today’s market is different. Drinkers pay a premium for smaller brands today, not larger ones.

Momentum — BUD rates poorly on momentum with a score of 26. No surprise here. The shares have done well over the past year, but so have the shares of virtually every other stock out there. This is a raging bull market. And the multi-year downtrend remains firmly in place.

Growth — Given everything I’ve said to this point, I might have still considered BUD as a contrarian buy if its growth rating was at least in the middle of the pack. Perhaps I’m nostalgic, but I really do believe in the power of established brands. Well, BUD’s growth rating is not in the middle of the pack. It rates an abysmal 13 out of 100.

Size — To cap it off, BUD is a gigantic company with a market cap (total shares multiplied by the current stock price) of nearly $140 billion. In an industry where drinkers prefer smaller brands, being large is a liability. And because the company is as large as it is, simply buying smaller, trendier competitors won’t move the needle much. It rates a 5 on size.

Bottom line: If you’re looking for value in a market where almost everything looks expensive, keep looking. BUD’s stock price is depressed, but there’s no compelling reason to believe that will change any time soon.

To safe profits,

Charles Sizemore

Editor, Green Zone Fortunes

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.