Tech bulls led the charge last week, as the S&P 500 tech sector (XLK) jumped 3% higher!

The Federal Reserve’s lowering of interest rates for the first time in 2025 certainly helped … and points to more growth ahead for both the technology, communication services and consumer discretionary sectors.

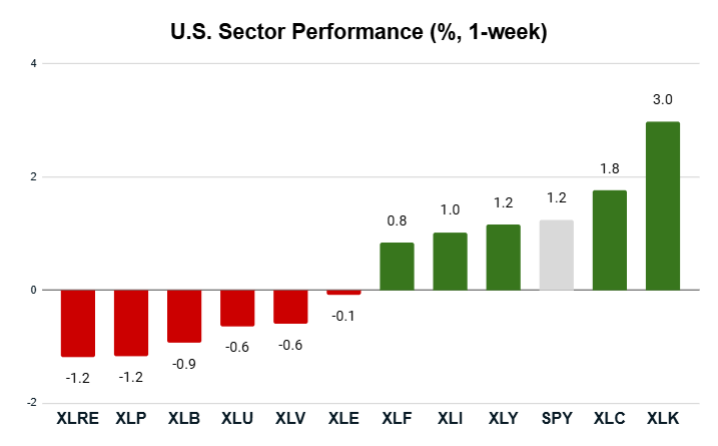

Here’s how S&P 500 sector performance shook out last week:

Key Insights:

- The S&P 500 (SPY) gained 1.2% to close the week at a record high.

- Two sectors beat the S&P 500’s performance, while nine sectors lagged.

- Six sectors closed the week lower.

- The tech sector (XLK) led the pack again with a 3% gain.

- The real estate sector’s (XLRE) 1.2% edged out consumer staples (XLP) for the worst performance of the week.

Once again, the tech and communications sectors did a lot of work to buoy the broader S&P 500 as the nine other sectors lagged the index.

Overall, it was a strong week for stocks. Even the worst performers didn’t fall behind too badly.

Let’s look closer at the best and worst from the week…

Tech Tears Higher Again

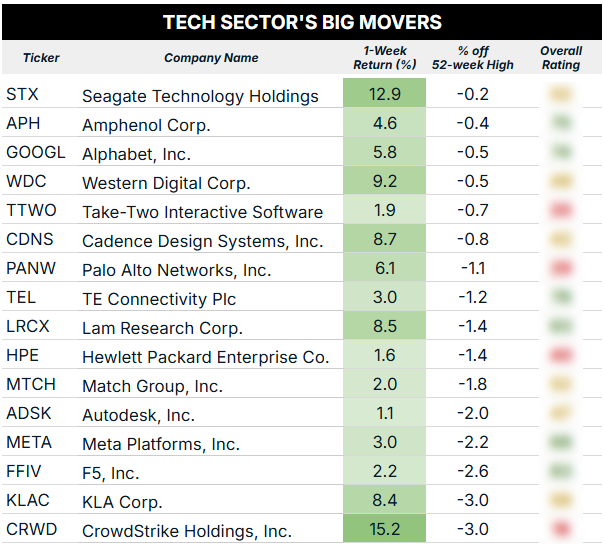

Once again, the tech sector’s 3% gain last week was more than double the broader S&P 500’s still respectable 1.2% gain.

With 39 tech stocks closing within 10% of their 52-week high, I had to tailor our screen to be more restrictive.

Below, you can see the 16 tech stocks that closed within 3% of their 52-week highs:

Note: Intel Corp. (INTC) popped 25% higher on Thursday to a new 52-week high after announcing Nvidia Corp. (NVDA) was investing $5 billion to bolster its AI chipmaking business. After some profit-taking, INTC stock closed within 9% of that high.

Looking at the list above, it’s impressive to see so many tech stocks trading near their 52-week highs. However, I will note that only 6 of the 16 tickers above currently rate “Bullish” in my Green Zone Power Rating system. Only one rates “Strong Bullish,” pointing to 3X outperformance over the next 12 months.

Much of that is because of how expensive the tech sector has become, as we noted last week in our tech sector x-ray analysis.

As such, I would tread lightly when looking for new buys in the sector.

As an example, CrowdStrike Holdings Inc. (CRWD) had a monster week, gaining more than 15% after providing rosy guidance during an investor day event. But the stock is still rated “High-Risk” in my system, with awful ratings on my Size, Volatility and Value factors. With four quarters of negative earnings per share, the stock’s price-to-earnings ratio cannot be calculated, which is decidedly bad for the stock’s Value rating.

Sentiment may still be strong, but I’d rather use my Green Zone Power Rating system to find a more well-rounded tech stock.

If you’re looking to “roll up your sleeves” and run some of these tickers through my system to see how they really stack up, click here to see how you can join up in Green Zone Fortunes today.

Now, let’s switch gears and review a sector that hasn’t been mentioned very often in our Monday analysis…

Real Estate Lags the Rest

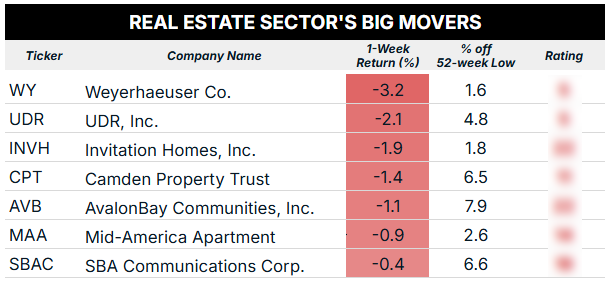

Despite the Fed announcing a 25 basis-point cut to its benchmark interest rate, the real estate sector (XLRE) just edged out consumer staples as the worst-performing sector last week.

Here are the seven real estate stocks that closed within 10% of their all-time lows:

These aren’t massive losses … they range between -0.4% and -3.2%. But I will note that every one of these stocks rates “Bearish” or “High Risk” in my Green Zone Power Rating system right now.

The real estate sector has been struggling in this higher interest-rate environment. The sector is down 7.4% over the last year, lagging the S&P 500’s 16.4% gain by a wide margin.

There are some positive signs as mortgage rates on a 30-year loan trended lower again to 6.2% by Friday. That trend should continue as the Fed lowers its benchmark rate further.

But it’s still a massive and expensive commitment for anyone looking to buy a home. Sellers are in a similar bind as they face those same high rates on any new mortgage after completing the sale.

You can see how that stalemate has pressured XLRE’s overall performance.

We’ll look below the surface in tomorrow’s Green Zone Power Ratings “X-ray” to get a better idea of where the real estate sector stands now.

To good profits,

Editor, What My System Says Today