Over the weekend, I tweaked my lower back to the point where it hurts to sit or stand for a long period of time.

I remarked to my wife: “I really don’t want to get old because I’m just going to fall apart.”

That was a bit melodramatic, but living in South Florida, I’ve learned that people will go to great lengths to sidestep the aging process.

So, as I usually do, I started to think about that in investment terms.

I used Adam O’Dell’s six-factor Green Zone Ratings system and found a company that develops aesthetic medical products (products that help us look younger than we are).

We are “Bullish” on this company’s stock, which means it’s in good shape to outperform the broader market by at least two times over the next 12 months.

And a trend in anti-aging is going to push this company even higher in the coming years.

There’s Money in Anti-Aging Treatments

Millions around the world are looking for ways to stem the tide of looking older.

To be clear, I am not one of those people (I just want my salt-and-pepper hair to be all gray at this point).

Products range from creams and serums to injections and hair transplants.

Companies who develop and market these products are set to make a lot of money.

In 2020, the anti-aging market (money spent on products to help look younger) was $58.5 billion globally.

By 2026, that market is expected to grow to $88.3 billion — a 51% jump in market value — according to research firm IMARC Group.

Investors in this trend are positioned to see strong profits by investing in this one company.

Anti-Aging Stock to Buy: InMode Ltd.

InMode Ltd. (Nasdaq: INMD) is an Israeli-based company that develops and markets minimally invasive anti-aging medical products.

From liposuction to skin rejuvenation cellulite treatment, InMode offers its products in more than 50 countries, including the United States, Canada, Spain, Australia and France.

In 2020, the company reported total revenue of $206 million.

Estimates show that InMode’s total revenue could reach $430.5 million by 2023 — a 109% increase in annual top-line revenue.

That’s due to the increasing number of people getting older and using its products.

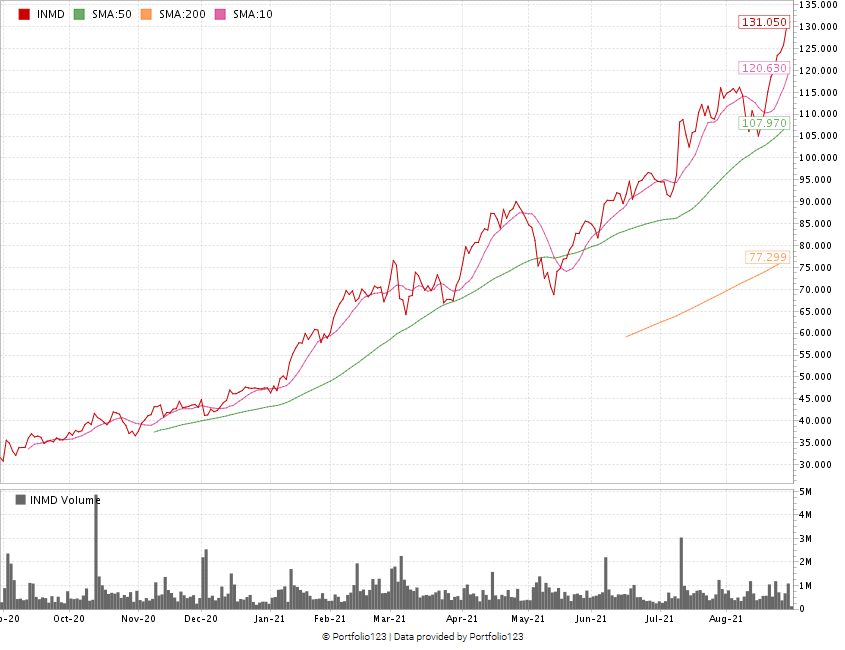

InMode Stock Trading Above All Moving Averages

Currently, InMode’s stock (red line) is trading above its 200-day (orange line), 50-day (green line) and 10-day (pink line) moving averages.

This suggests INMD remains in a bullish pattern as it's just shy of its 52-week high of $134.11.

In the last 12 months, INMD has jumped more than 315% in price — and it continues to move higher.

InMode Stock Rating

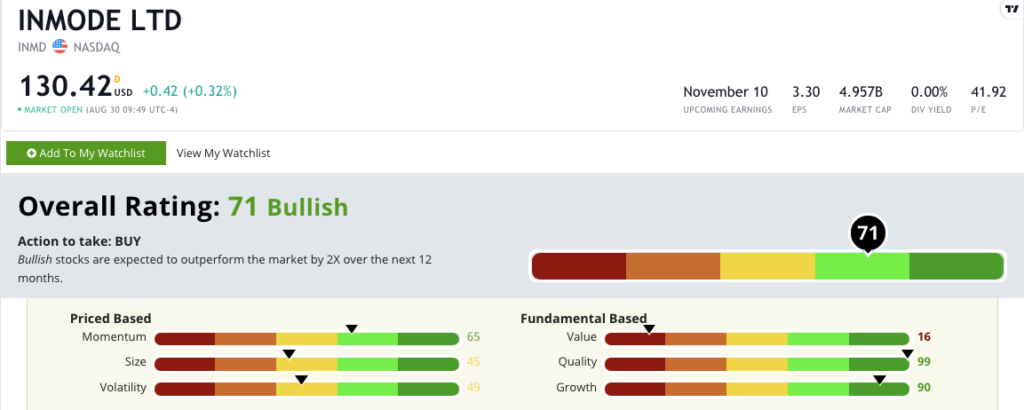

Using Adam’s six-factor Green Zone Ratings system, InMode scores a 71 overall. That means we are “Bullish” on this anti-aging stock and expect it to outperform the broader market by two times in the next 12 months.

InMode Ltd.’s Green Zone Rating on Aug. 30, 2021.

InMode rates in the green in:

- Quality — InMode has very strong returns on assets, equity and investments (all more than 40%) compared to the other medical devices industry averages, which are all negative. The company earns a 99 on quality.

- Growth — Annual sales for InMode went from $156.4 million in 2019 to $206.1 million in 2020 — a 32% gain. The company’s three-year annual earnings-per-share growth rate is almost 100%. It earns a 90 on this metric.

- Momentum — InMode’s stock has been on fire, gaining 90% since dropping 23% in the first half of May. The company earns a 65 on momentum.

InMode earns a 49 on volatility due to its price drop in May and a 45 on size with a market cap of nearly $5 billion.

The company also earns a 16 on value with its price-to-earnings, price-to-sales and price-to-book values all above the industry averages.

Bottom line: We’re all getting older. It’s a fact of life.

But more and more people are looking to stop the aging process by any means necessary. InMode‘s sales and profits are only going to go higher.

That’s why InMode Ltd. is an anti-aging stock to look at for your portfolio.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.