Grocery store chain Kroger Co. (NYSE: KR) announced plans to acquire Albertsons.

When combined, the new chain will be the second-largest grocer in the country.

Kroger serves the public through about 2,800 stores.

Its 25 brands include:

- King Soopers.

- Food Lion.

- Ralphs.

- Dillons.

- And Harris Teeter.

Albertsons operates about 2,200 supermarkets under 22 brands, including:

- Albertsons.

- Safeway.

- And Vons.

Combined, it will have a few hundred more stores than Walmart, the nation’s largest grocer, with 4,700 stores selling a full selection of food products.

Kroger’s Merger Takes on a Grocery Giant

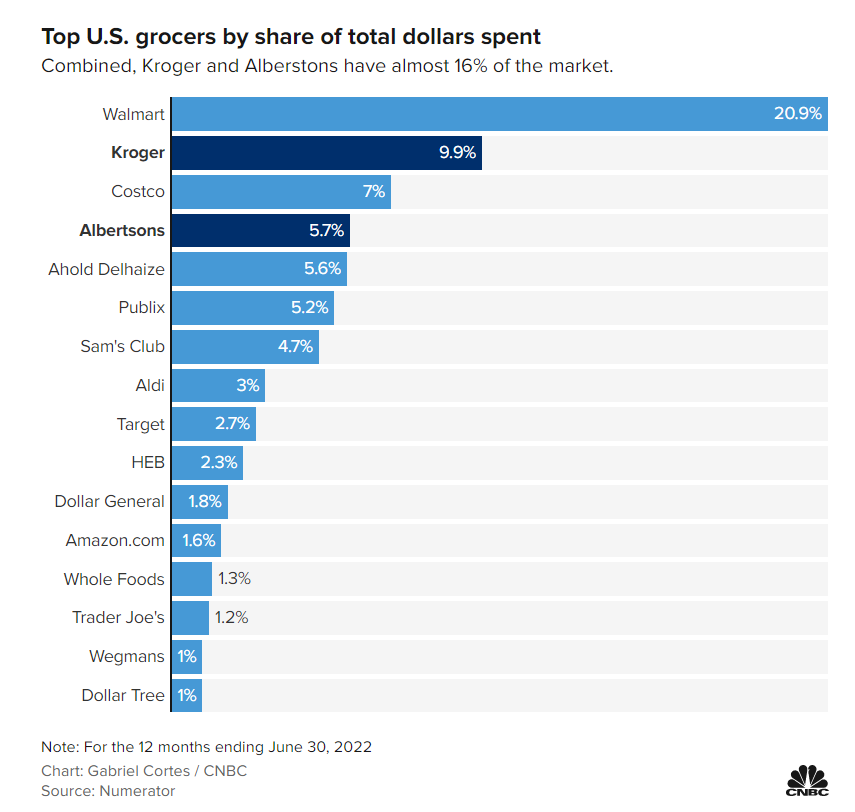

The combination would make Kroger-Albertsons the second-largest grocer by market share.

Source: CNBC.

Large acquisitions always raise antitrust concerns.

This one is no different.

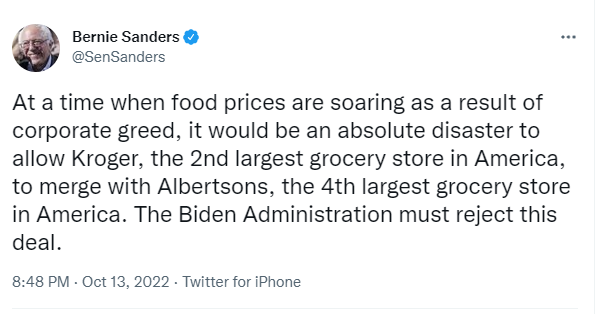

Senators Elizabeth Warren and Bernie Sanders have both made statements against the merger.

Source: Twitter.

Sanders tweeted:

At a time when food prices are soaring as a result of corporate greed, it would be an absolute disaster to allow Kroger, the 2nd largest grocery store in America, to merge with Albertsons, the 4th largest grocery store in America. The Biden Administration must reject this deal.

And Warren told MSNBC:

What happens when only a handful of giant grocery store chains like Kroger dominate an industry? They can force high food prices onto Americans while raking in record profits. We need to strengthen our antitrust laws to break up giant corporations and lower prices.

There is research supporting their concerns.

Even With Concerns, the Deal Looks Done

A 2008 study showed that grocery store mergers led to price increases of 3% to 7%.

Inflation is already squeezing consumers.

But higher prices pressure retailers as well.

Kroger’s CEO expects to realize savings of $500 million a year after the deal is complete.

Those cost savings could reduce costs for consumers.

Traders need to consider whether regulators will agree with Sanders and Warren.

While the combined share of the new company will be almost 16% of the national market, groceries are a fragmented industry.

Regulators may seek a few concessions, and the companies may sell a few stores.

Bottom line: But the deal should go through.

This creates an opportunity for traders to profit from Albertsons Companies Inc. (NYSE: ACI).

Kroger offered $34.10 per share. The stock fell below $27 on the deal news.

There could be an excellent reward for patient buyers who purchase shares now.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.