A new year calls for something special: one of my favorite high-yield dividend payers.

There aren’t a lot of companies touting the perfect combination of capital gains potential and a big dividend payout.

Enter Ares Capital Corp. (NYSE: ARCC).

Ares is a low-risk, steady-eddy income machine.

At current prices, ARCC yields a fat 7.8%. That’s hard to beat in this market!

Ares is a business development company (BDC), which is essentially a private equity fund for ordinary investors like you and me. BDCs provide debt and equity capital to middle-market companies that are a little too big to take out a bank loan but not large enough to issue stocks and bonds to the public either. BDCs are where Main Street meets Wall Street.

These investment vehicles also benefit from preferential tax treatment. So long as the company distributes at least 90% of its profits as dividends, it pays no federal income taxes. BDCs are similar to real estate investment trusts (REITs) in this respect.

Eliminating the tax bill frees up a lot more cash for dividend payments, so high yields in the BDC space are normal.

Ares Capital Has Market-Crushing Potential

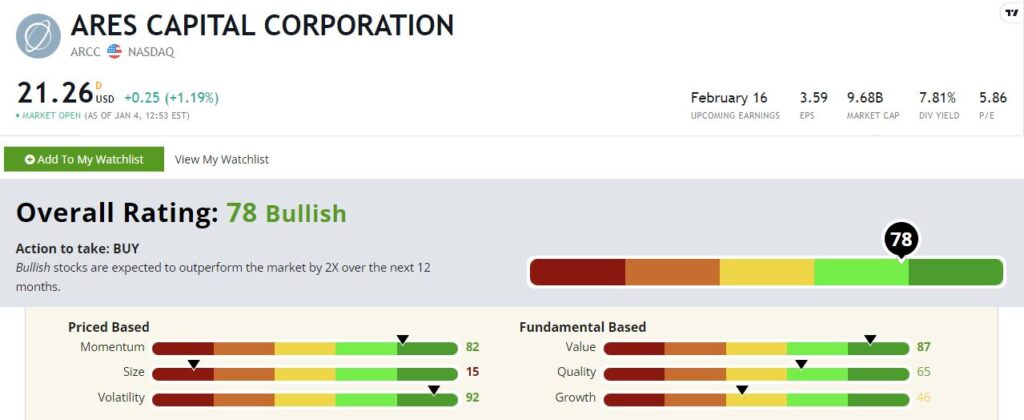

Ares Capital rates a “Bullish” 78 on our Green Zone Ratings system.

Historically, Bullish-rated stocks have outperformed the market by at least two times..

Let’s see where Ares thrives in Adam O’Dell’s six-factor system.

Volatility — I mentioned that Ares was a “low-risk, steady-eddy income machine.” You see this in ARCC’s volatility factor rating of 92. The higher the volatility score in our system means this stock is less prone to huge price swings up or down.

This isn’t to say that Ares avoided volatility in the past. It took a tumble during the 2008 crisis and again during the COVID bear markets. But under normal market conditions, you aren’t going to see a lot of wild swings here.

Value — Ares is also a well-priced stock with a value rating of 87. The COVID-19 pandemic was rough for Ares in 2020, as many of the companies within its underlying portfolio came under stress. But as those companies returned to health in 2021, we saw the results flow through to Ares’ revenues and earnings. This helps typical valuation ratios like the price-to-earnings and price-to-sales ratios.

Momentum — Despite being a low-volatility stock, Ares has shown serious signs of life of late and rates an impressive 82 on our momentum factor. Some of this is because ARCC got hammered so hard in 2020, and it had some catching up to do in 2021. Shares are still trending higher, and I expect that to continue.

Quality — Like REITs, most BDCs don’t rate well on our quality score. This is partly because BDCs often carry a lot of debt on their balance sheets. That said, Ares rates a respectable 65 on our quality factor. ARCC’s high return-on-equity helps a lot here.

Growth — Ares isn’t a growth dynamo. As I’ve tried to drive home, this is a slow, steady dividend payer. But even so, Ares rates a 46 on growth, which puts it in the middle of the pack. For a stock that rates as high as Ares on our volatility and value scores, an average growth score isn’t going to bother me.

Size — Ares is large by BDC standards, with a market cap of nearly $10 billion. It rates a 15 on our size factor.

Bottom line: Like many other high-yielding dividend payers, Ares is not a get-rich-quick stock by any stretch of the imagination. But it is a fantastic long-term wealth builder. I expect it to enjoy competitive returns over the next several years.

To safe profits,

Charles Sizemore

Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.