I’m thrilled to share an energy stock that I think of as the Lionel Messi of energy stocks.

If you follow sports, you know of Lionel Messi.

Born in Argentina, most folks think of him as soccer’s greatest of all time (GOAT).

No matter the team he plays against, he adapts and elevates his game to the highest level.

I’ll show you how, like Messi, this energy stock is a steady performer with strong value that can adapt to different situations and still perform at the highest level.

Using Chief Investment Strategist Adam O’Dell’s proprietary six-factor Green Zone Ratings system, I found a “Strong Bullish” energy stock:

- It’s an energy giant in Argentina.

- It jumped 80% in the last 12 months.

- Right now, it trades at a new 52-week high.

This stock is poised to get even bigger thanks to — of all things — the government.

Here’s why you should buy this energy stock now.

South American Natural Gas Consumption Surges

In the 1990s, oil was king in South America, generating more than half of the continent’s electricity.

But we’ve seen a seismic shift toward hydroelectric and natural gas power in South America, as you can see in the chart below:

Across the region, BP expects natural gas consumption to rise 377% from 1990 to 2030.

Companies such as this one, which specializes in natural gas and hydroelectric power generation, will deliver strong profits to investors for years.

Value Energy Stock Player: Pampa Energia SA

Unless you study the global oil and gas sector, I doubt you’ve heard of this stock.

Pampa Energia SA (NYSE: PAM) isn’t the biggest player in the game, but it’s steady … even amid government regulation in its home country.

In addition to using renewables and natural gas to generate and transmit energy in Argentina, it operates in oil and petrochemicals.

I’ll show you why its performance is so strong.

Due to economic conditions in Argentina, the government regulates the profits a company can earn.

During the COVID-19 pandemic in 2020, the government cracked down and lowered the profitability of energy companies with price freezes. It’s why PAM’s total revenue dropped 20% from 2019 to 2020.

Now that COVID has subsided in the country, the government lightened those regulations.

PAM expects its revenue to reach new highs in the next two years.

By 2023, the company expects its total revenue to reach $1.73 billion — a 62% increase from 2020.

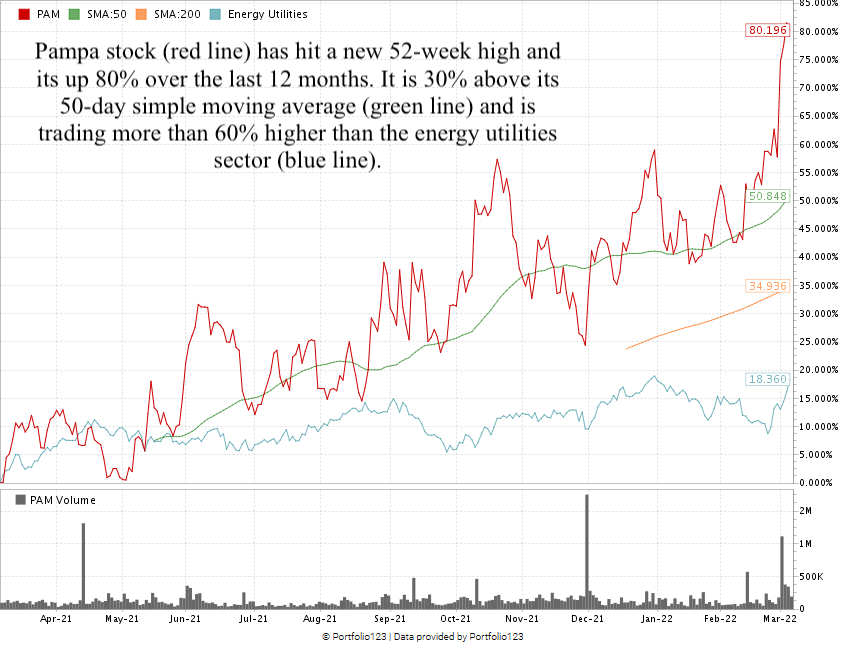

PAM stock has had a terrific 12 months.

It is up 80% after jumping 15% in the first few trading days of March thanks to increases in hydro, thermal and renewable energy generation.

Pampa Energia SA Stock Rating

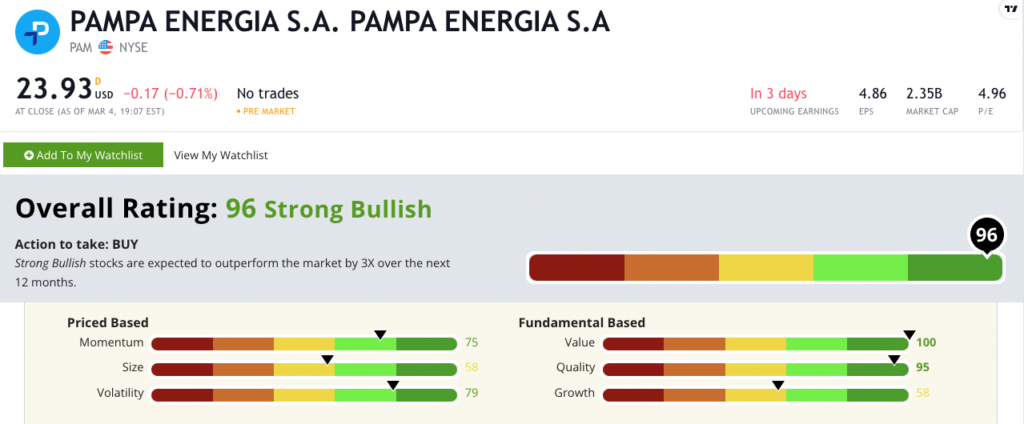

Using Adam’s six-factor Green Zone Ratings system, Pampa Energia SA stock scores a 96 overall. That means we’re “Strong Bullish” on the stock and expect it to beat the broader market by at least three times in the next 12 months.

PAM rates in the green in four of our six rating factors:

- Value — PAM’s trading ratios are all lower than the industry average, indicating better-than-average-value. How much better? Its price-to-earnings is at 4.93, while the energy utilities’ average is 23.13. PAM’s price-to-book is 0.77, and the industry average is 2.04. It scores a perfect 100 on value.

- Quality — The company’s returns on assets, equity and investment are all higher than the rest of the industry. It also operates with a net margin of 22.3% — higher than the 7.8% from its peers. The company scores a 95 on quality — meaning it’s in the top 5% of all stocks we analyze.

- Volatility — PAM reached its 52-week high with only some resistance. The company scores a 79 on volatility. It’s less volatile than 79% of the stocks we rate.

- Momentum — PAM stock jumped more than 80% in the last 12 months — including a 15% increase in the first four trading days of March. It rates a 75 on momentum.

The stock rates a neutral 58 in two categories…

Pampa’s $2.35 billion market cap earns it a 58 on size. It’s at the low end of what’s considered “mid-cap” ($2 billion to $10 billion), so it has plenty of room to grow.

PAM’s growth scores 58. But as I mentioned, the government lightened its profit regulations. PAM's middle-of-the-pack growth ratings should improve from here. And 58 is far from bearish territory.

Bottom line: Government regulations stifled profits for big Argentine oil and gas companies.

But now that COVID has subsided in the region, the gloves are coming off. Companies that suffered in 2020 are gearing up for massive rebounds.

PAM is a “Strong Bullish” stock with outstanding value, excellent quality and solid momentum. That makes the Argentine oil, gas and electricity stock a promising addition to your portfolio.

Note: Old energy is surging right now, and PAM is a smart play on that momentum.

But we know the future lies in renewables.

Adam just released a presentation that highlights the largest untapped energy source in the world.

This source is worth trillions of dollars and makes massive oil fields look tiny in comparison.

We’re still in the early stages, and this breakthrough is set to turn the global energy market on its head.

Make sure to click here for more information about this revolutionary new renewable tech (and one company behind it all).

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.