Economists often define problems in specific ways.

For example, high debt levels aren’t always a problem.

High debt servicing costs are the problem.

Which means it’s okay to borrow as long as you can afford the payments.

Some argue this is a way to look at inflation.

The reported level of inflation is not the problem.

It’s inflation expectations that matter.

Argentina Shows Why Inflation Expectations Matter

Argentina offers some proof for this idea.

With a history of high inflation and June numbers at 64%, consumers add to inflationary pressures.

The New York Times explains:

That is the mantra of Argentina. Pesos disintegrate in value, so you better spend them as quickly as you can. People go out to eat or buy appliances, art or cars, while shop owners stock up on inventory, betting prices will only go up.

“When I think of my savings in pesos, I say, ‘Let’s pay for a trip, let’s renew something in the house, let’s buy stuff,’” said Eduardo Levy Yeyati, an Argentine economist and visiting professor at Harvard University.

“Otherwise I feel like I’m losing money every day by keeping it in the bank.”

This explains why Federal Reserve officials watch inflation expectations.

Drop in Expectations Caught the Fed’s Attention

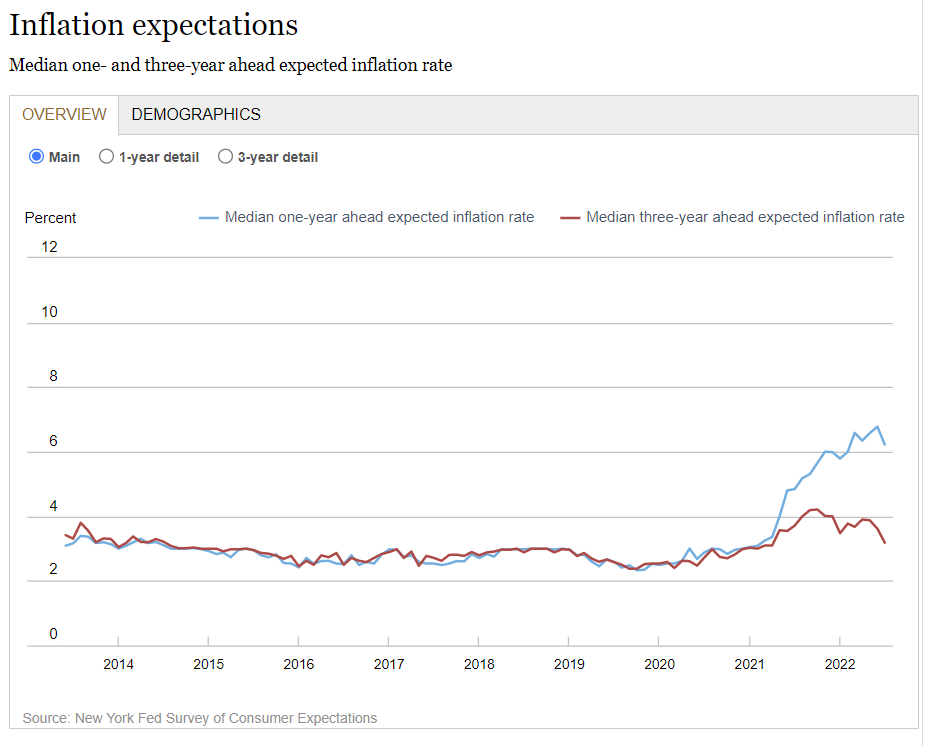

Recent data shows a drop in expectations.

Source: Federal Reserve.

Respondents’ median expectation in July is an annual inflation rate of 6.2% in one year.

This is down from the 6.8% expected in June.

Survey participants expect inflation to be down to 3.2% in three years. That’s down from the 3.6% expected in June.

Within five years (not on the chart), inflation is expected to be 2.3%, down half a percentage point from previous expectations.

Bottom line: This is good news for the Fed.

It shows that inflation could be under control by this time next year.

That means the central bank could start cutting rates again.

This might be needed, as the current level of inflation increases recession chances.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.