Russia’s invasion of Ukraine has reverberated throughout the global economy.

International sanctions against Russia have thrown European and other oil and gas markets into disarray.

It’s led to a surge in natural gas demand as countries seek alternative sources for their energy needs.

Using Chief Investment Strategist Adam O’Dell’s proprietary six-factor Stock Power Ratings system, I found a “Strong Bullish” natural gas stock:

- It increased its annual sales by 16% from 2020 to 2021.

- Its stock ran up 77.3% from July 2022 to September 2022.

- The company scores a 99 on our Stock Power Ratings system.

Let’s see why this natural gas stock is on track to keep its strong performance throughout 2022 and beyond.

Argentina Needs Natural Gas

Natural gas is a big source of electricity around the world.

This, coupled with shutting off supply from Russia — one of the largest natural gas providers in the world — has led to an increase in demand.

One country that would be in tough spot without this resource is Argentina:

The chart above shows how Argentina generates its energy.

In 2021, natural gas accounted for 63% of all electricity generated in the country.

Bottom line: Argentina, like many European countries, needs natural gas.

Bullish Breakdown of Transportadora De Gas Del Sur (NYSE: TGS)

The rise in international energy prices isn’t weakening Argentina’s demand for natural gas.

Transportadora De Gas Del Sur TGS. (NYSE: TGS) is an Argentinian company that produces and sells natural gas in South America.

Let’s dive into how this stock has performed.

TGS Stock’s 77.3% Jump Over 2 Months

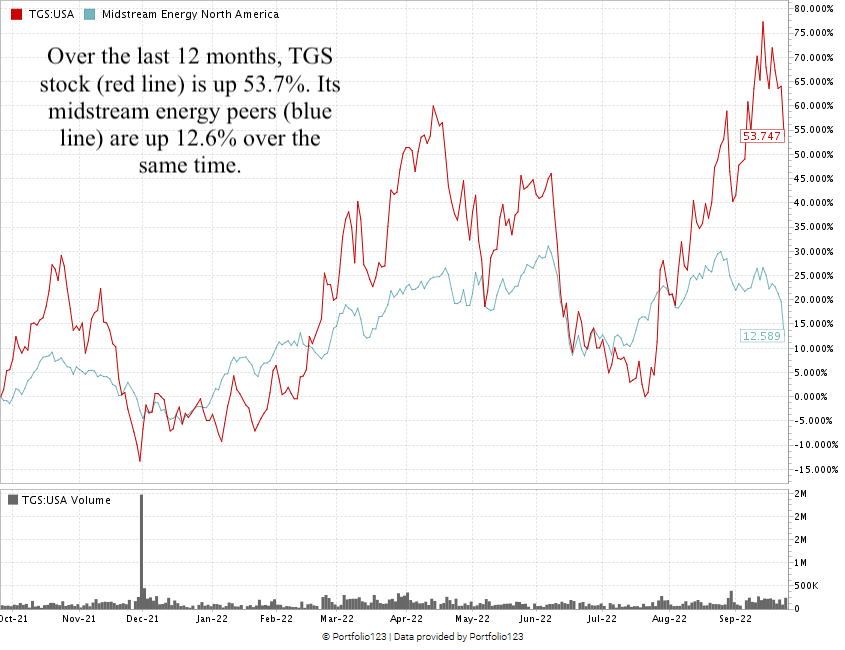

Over the last 12 months, TGS crushed its industry peers by more than four times.

From a low point in July to a 52-week high in September, the stock climbed 77.3%!

I have strong conviction this stock is going higher.

Transportadora De Gas Del Sur Stock Power Ratings

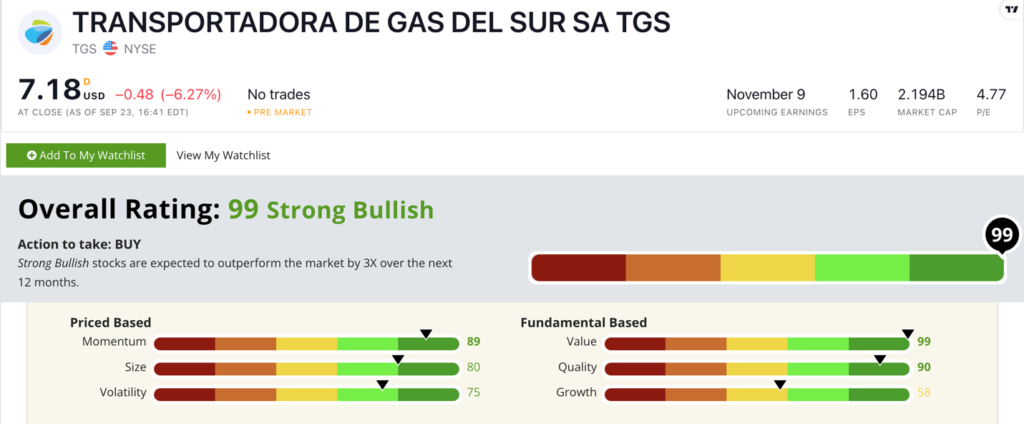

Using Adam’s six-factor Stock Power Ratings system, Transportadora De Gas Del Sur stock scores a 99 overall.

That means we’re “Strong Bullish” on the stock and expect it to beat the broader market by at least 3X over the next 12 months.

TGS’ Stock Power Ratings in September 2022.

TGS rates in the green on five of our six factors:

- Value — TGS’ price-to-earnings ratio is three times lower than the midstream energy industry average of 14.4. Transportadora earns a 99 on value.

- Quality — Transportadora’s net margin is 25.5%, compared to the industry average of 8.7%. Its return on assets is 11.8% — almost four times higher than its peers’! TGS scores a 90 on quality.

- Momentum — Transportadora saw a 77.3% run-up from a low in July 2022 to its 52-week high set in September 2022. TGS earns an 89 on momentum.

- Size — With a market cap of $2.2 billion, Transportadora is a large company, but one that can still produce outsized gains. TGS earns an 80 on size.

- Volatility — The stock’s upward trajectory has come with little downside since June. It scores a 75 on volatility.

Its annual sales growth rate is 16%, and its earnings-per-share growth rate is 378.9%.

This earns TGS a 58 on growth.

That’s why TGS will be a strong stock for your portfolio going forward.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist/editor for 25 years, covering college sports, business and politics.