On Friday, Federal Reserve Chair Jerome Powell single-handedly saved the market from what would have otherwise been a rough “down” week.

It was telling of just how hungry investors are for the next round of interest rate cuts, which should add more “juice” to the bull market’s already-incredible run.

The Dow Jones jumped 800 points on Friday alone, closing at a new record-high, effectively joining the party the S&P 500 and Nasdaq have been enjoying over the last few weeks.

Even so, it wasn’t enough to save one sector … technology.

Key Insights:

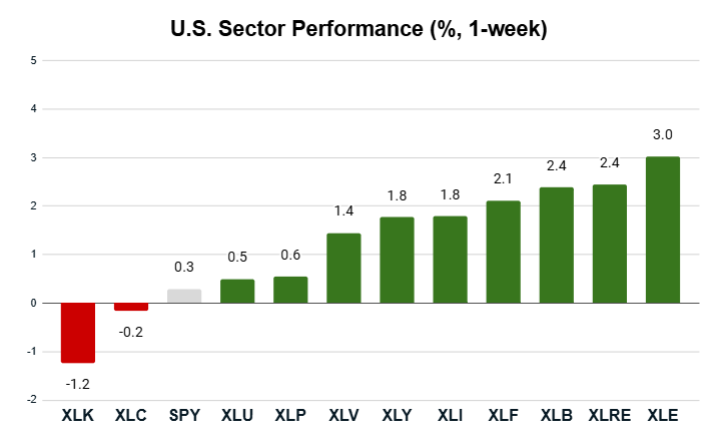

- The S&P 500 (SPY) closed with a slight 0.3% gain.

- Nine sectors beat the S&P 500, while only two lagged.

- The energy sector (XLE) topped the rest with a 3% gain.

- The tech sector (XLK) lagged with a 1.2% decline.

As always, one week doesn’t make a trend, but such a stark difference between the tech sector’s performance compared to the rest of the market is certainly something to watch.

It also points to how overweight the S&P 500 is on tech holdings …

It took a whopping nine sectors beating the broader index, most of them by a full one to two percentage points, just to offset a -1.2% loss in the tech sector.

This provides something of a warning for being too heavy into tech, but it’s also a very positive sign for the rest of the market’s sectors.

Let’s look below the surface and see how some of last week’s best and worst performers look within my Green Zone Power Rating system…

Big Names Boosted the Energy Sector

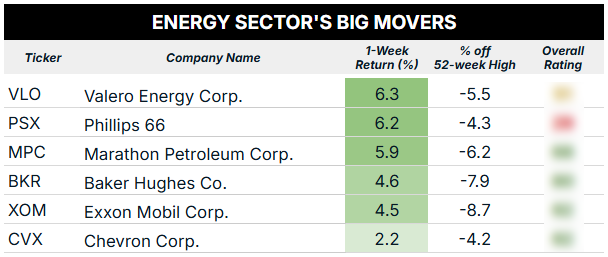

We thought the health sector outperforming the market by almost 5X the week before last was impressive …

How about a 10X performance from the energy sector as it gained 3% compared to the S&P 500’s 0.3%?

We can’t expect that degree of outperformance over the long run, but short-term bursts of energy like this can often catalyze market-beating trends that last several weeks to months.

Let’s see which stocks helped XLE lead the rest of the pack…

Below, you’ll find six energy stocks that closed last week within 10% of their 52-week highs and how they stack up in my Green Zone Power Rating system:

To look any of these ratings up yourself, go ahead and click here to see how you can join up in Green Zone Fortunes and gain full access to my system. You’ll also get to see the handful of energy stocks I’ve recommended for our model portfolio if you’d rather just follow my guidance.

Now let’s move on to the worst performers…

Big Names Dragged Tech Sector Down

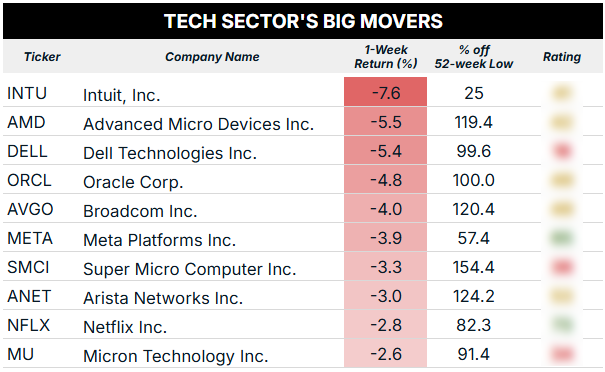

As I’ve mentioned, we’re seeing some cracks in the technology sector’s leadership of this market…

Last week, my colleague Matt Clark showed you how many tech stocks are trading at incredibly high valuations, pointing to a tech bubble that could burst at any time.

While I’m not ready to ring the alarm just yet, we should expect more tech profit-taking, especially in some of the biggest names that have enjoyed the bullish run over the last few years.

To give you a sense of what’s going on, I removed my typical threshold that limits my screen to only the stocks trading near 52-week lows.

Below, you’ll see the 10 worst-performing stocks in XLK during last week’s five-day trading period:

The first thing I will note is that only two of the stocks rate “Bullish” in my Green Zone Power Rating system. We have five stocks that rate “Neutral,” meaning they should track the broader market’s performance over the next 12 months, and three “Bearish” stocks that are set to underperform.

The other thing I want to note here is the incredible run some of these stocks have enjoyed. We have five stocks that are more than 100% above their 52-week low, meaning they have more than doubled their value!

Since the longer-term trend in many of these high-flying tech stocks is still positive, we’ll caution you against trying to “short” them. But you should also be cautious about throwing new money into the most overdone ones, as there are clearly better “deals” on bullish opportunities in other sectors.

To good profits,

Editor, What My System Says Today