We’ve discussed bonds. We’ve discussed stocks. We’ve discussed stocks versus bonds.

Now let’s look deeper into fundamental financial planning tools…

Asset allocation isn’t exciting, but it is essential if you’re trying to secure returns while also reducing risk within your portfolio.

In today’s Investing With Charles, Research Analyst Matt Clark and I dive into asset allocation and give you insights on how to get the most out of your portfolio as the bear market rages on.

Watch our latest video below or keep scrolling for some highlights.

Asset Allocation Defined

Matt: Let’s get a 30,000-foot view here…

Whether you’re a novice or an experienced investor, you hear about it all the time. What is asset allocation?

Charles: It’s funny. Asset allocation does not sound exciting at first. My mental image is Ferris Bueller’s Day Off and Ben Stein, the professor…

“Anyone? Anyone? Bueller?”

That’s the vibe there, right?

But it’s one of the fundamental aspects of finance and financial planning. This is the stuff that can make the difference between retiring with a healthy, productive portfolio and retiring broke because it blew up.

It’s critical to your well-being.

Asset allocation, in a nutshell, is arranging the pieces of your portfolio top-down to get that correct mixture of risk and return.

Finance is one of those places where you have alchemy.

You have the ability to make gold out of lead here, in that the whole can be worth more than the parts. That’s where asset allocation comes into play.

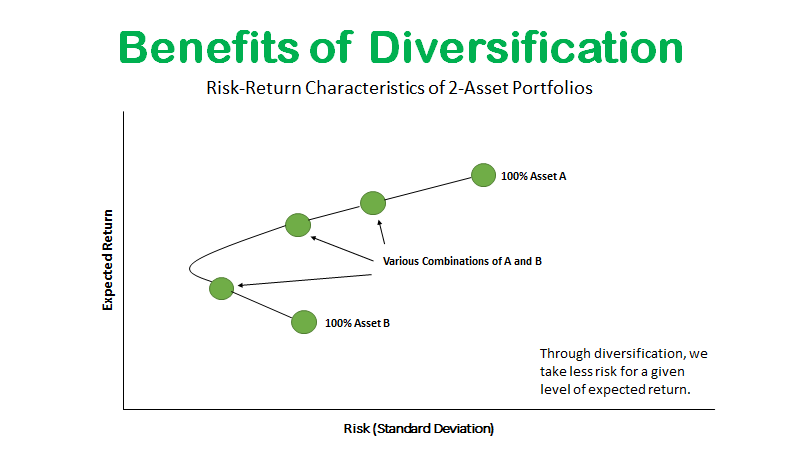

With solid diversification, you can get more return for a given level of risk … or less risk for a given level of return. The total there gives you more than the sum of the parts.

The Heart of Asset Allocation: Diversification

Matt: How does diversification work into this?

Charles: We all have this concept of what diversification is.

It’s not just putting all your eggs in one basket and spreading things around. That’s part of it, but it’s more than that.

Where this magic of diversification comes into play is when you have two assets that are not perfectly correlated. In plain English: Their prices don’t move together.

They can move together, but you get some benefit if they don’t move in lockstep. The less correlated they are to each other, the more that diversification helps.

Diversification in Action

Let’s look at a hypothetical portfolio of two assets. It could be a stock or bond portfolio. It could be stock A and stock B, or Pokémon cards and baseball cards. What the assets are doesn’t matter.

Look at 100% Asset B in the chart above. This portfolio is where all your eggs are in that specific basket. Then you see 100% Asset A. That’s all your eggs in that basket. Notice it’s not a straight line between the two.

The line bends inward. This illustrates a higher expected return, while your risk — your standard deviation in technical terms — is moving inward.

When that standard deviation pulls back, you’re taking less risk for a given amount of return.

Then there’s the turning point of the curve. That’s the minimum, minimum, minimum variance … or the lowest-risk portfolio you can have for that combination.

Scale it up by adding a little bit more of asset A. You can take more risks, but this allows you to optimize.

You don’t have to make a chart like this on your own. But intuitively, if you have any two assets, whether it’s Microsoft stock and Apple stock or bonds and the S&P 500… Whatever it is, when you combine a portfolio, you get that magic juice.

You’re getting a higher return for that given level of risk or you’re getting a lower risk for that given level of return.

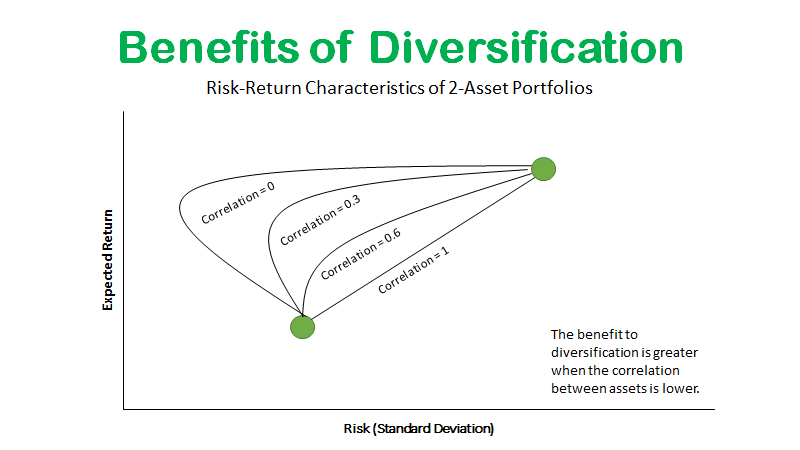

Another way to illustrate this is the second chart here, which has a different model of portfolios.

The one that looks like a straight line is a correlation of one. That’s a perfect correlation.

These are two stocks that move in lockstep together. Your return here and your risk is the simple average of the two.

If one has an expected return of 10%, and the other has an expected return of 5%, your return is 7.5%.

The less correlated they are, that curve bends back.

It looks like a bow and arrow, the bow being pulled back, right? At a correlation of 0.6, it bows in a little bit. A correlation of 0.3, it bows in more. The correlation of zero really bows in.

Bottom line: You get more bang for your buck the less correlated the assets in your portfolio are. That’s the essence of asset allocation.

Diversification + Active Rebalancing

Matt: The idea here is that if you have two stocks in your portfolio that are linear, then it’s more vanilla. However, if you have stock A with a vast difference from stock B, different asset classes, for example… You’ve got a little bit more, I don’t want to say excitement…

Charles: Nothing about this is exciting, but it is important.

A lot of this is pretty intuitive.

In your 401(k) plan, you don’t put all of your eggs in just one growth-fund basket. You spread out between stocks and bonds. And then, within the stock bucket, you diversify between large and small caps, U.S. stocks and foreign stocks. On the bond side, you diversify between shorter term and long term, between corporate bonds and government bonds.

Doing that, it reduces your risk. It also reduces your risk for a given level of return.

Once you have this diversification in place, that’s great. Active rebalancing is the next step.

You can dive deeper into how to rebalance your portfolio and enhance diversification by watching today’s video.

Where to Find Us

Coming up this week, Matt will have more on his latest episode of The Stock Power Podcast, so stay tuned.

Don’t forget to check out our Ask Adam Anything video series, where Chief Investment Strategist Adam O’Dell answers your questions.

You can also catch Matt every week on his Marijuana Market Update. If you are into cannabis investing, you don’t want to miss his weekly insights.

Remember, you can email my team and me at Feedback@MoneyandMarkets.com — or leave a comment on YouTube. We love to hear from you! We may even feature your question or comment in a future edition of Investing With Charles.

To safe profits,

Charles Sizemore, Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.