AT&T Inc. (NYSE: T) dropped a major bomb on investors this week, and the news is going to be felt in AT&T’s dividend.

AT&T is punting on its Time Warner media business which includes heavyweight properties like HBO, CNN and the DC comic universe. Instead, it’s opting to spin off and merge it into Discovery Inc.’s (Nasdaq: DISCA) content empire. The deal creates a much larger content company, one that might compete with Netflix Inc. (Nasdaq: NFLX) and The Walt Disney Co. (NYSE: DIS).

Once the Warner assets are spun off, AT&T will be a dedicated communications utility again. As part of the deal, AT&T will shed about $43 billion in debt — which is great for the long-term health of the company — but it will also sport a lower dividend going forward.

Time to Buy AT&T’s New Dividend?

We don’t know how much lower the dividend will be, but the company said it was targeting an “annual dividend payout ratio of 40% to 43% of anticipated free cash flow of $20 billion plus.” Assuming no other changes, that puts the new yield in the ballpark of 4%. That’s down from about 6.5% today.

A 4% yield is still competitive. But should you buy the AT&T dividend after the cut?

Let’s ponder a couple of things first.

- Who is running this ship? AT&T bet the farm on the Warner merger only three years ago. Sometimes deals don’t go as planned. But we’re talking about undoing a major, once-in-a-generation strategic pivot.

- A pure play communications utility is essentially a commodity business. One mobile carrier is as good as another in most cases. That makes it hard to compete on anything other than cost. The media assets were supposed to be the high-margin business that made AT&T attractive.

AT&T’s New Green Zone Rating

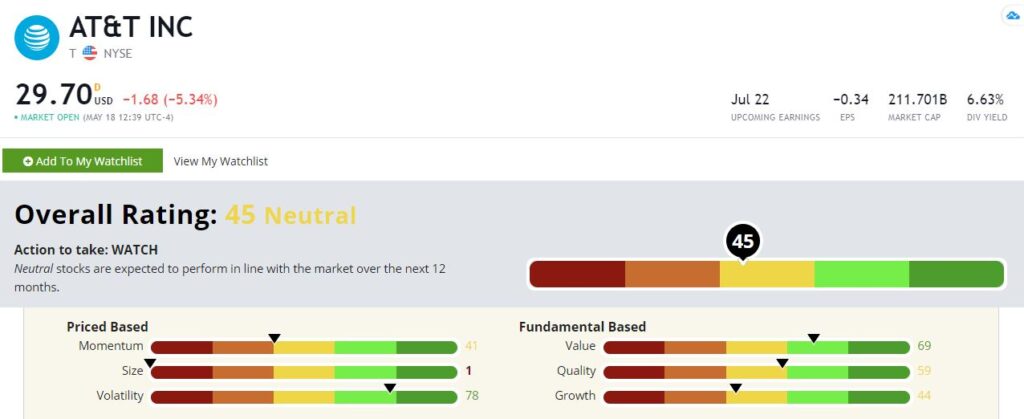

All the same, let’s give AT&T a look through the lens of our Green Zone Ratings system. Not much has changed since I last looked at AT&T back in November 2020.

AT&T Inc.’s Green Zone Rating on May 18, 2021.

Overall, it rates a 45, which is the definition of average. It’s right in the middle of the pack. But that’s not a deal-breaker, particularly if you are buying AT&T stock for the dividend yield. Let’s dig a little deeper.

Volatility — AT&T rates well on volatility with a score of 78. While I could see this score dipping in the short-term due to the divestment of the Warner assets (it fell more than 5% on Tuesday), I don’t see this changing over the long term. AT&T is a stodgy old stock with minimal volatility, and that’s not a bad thing for dividend investors.

Value — AT&T also rates well on value with a score of 69. Once Warner assets are stripped out, we might see this number shift a bit, but at least for the time being, AT&T represents a decent value at current prices.

Quality — Our quality score may sound subjective, but it’s based on hard numbers of profit margins and balance sheet management. AT&T rates a 59 here, putting it in the top half of all stocks in our universe.

Growth — AT&T is a slow-growth communications utility. The score of 44 isn’t a deal-breaker for a dividend play.

Momentum — AT&T rates a 41 on momentum. That’s not awful considering that the market of the past several years has favored go-go growth stocks over staid income payers. But higher momentum means a stock has support to run to a higher price.

Size — AT&T is a large company with a market capitalization (outstanding shares times share price) of more than $210 billion. That comes with a size rating of 1. That’s not such a bad thing, as size represents stability in a dividend stock. But we aren’t going to see the bounce higher that smaller stocks enjoy.

Bottom line: So, what is a dividend investor to do? Back in November I stocks in the “Neutral” range (41-60 points) of our Green Zone Ratings system should still keep pace with the S&P 500 over time. So this isn’t a bad stock for your income portfolio by any means.

Given the question marks on the Warner divestment, I recommend you wait and see before you make a major new investment in AT&T stock. If your objective is consistent income over a long period of time, the AT&T dividend will continue to be one of the higher-yielders in the S&P 500. Just don’t expect fireworks from a stodgy utility like this.

To safe profits,

Charles Sizemore

Editor, Green Zone Fortunes

Charles Sizemore is the editor of Green Zone Fortunes and specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.