While tech IPOs have dominated the financial news space this week, one of America’s stalwart industries faces a reckoning.

The United Auto Workers’ (UAW) coordinated strike against the Detroit Three (GM, Ford and Stellantis) is unprecedented. While the union has struck against U.S. automakers before, it’s never targeted all three at the same time.

By the time you’re reading this, there could be a new deal in place. But all signs point to that not being likely. UAW negotiators rebuffed Stellantis NV’s fifth iteration of a deal on Wednesday, citing a lack of job security guarantees among other issues.

Right now, just under 10% (around 13,000) are picketing. If a deal isn’t resolved today, the strike could expand to include more of the 146,000 U.S. autoworkers.

As someone who is in the market for a new-to-me vehicle, an industry-wide strike makes me cringe at the thought of what this could do to already exorbitant car prices. We won’t likely know for months as manufacturers work through their on-hand inventory.

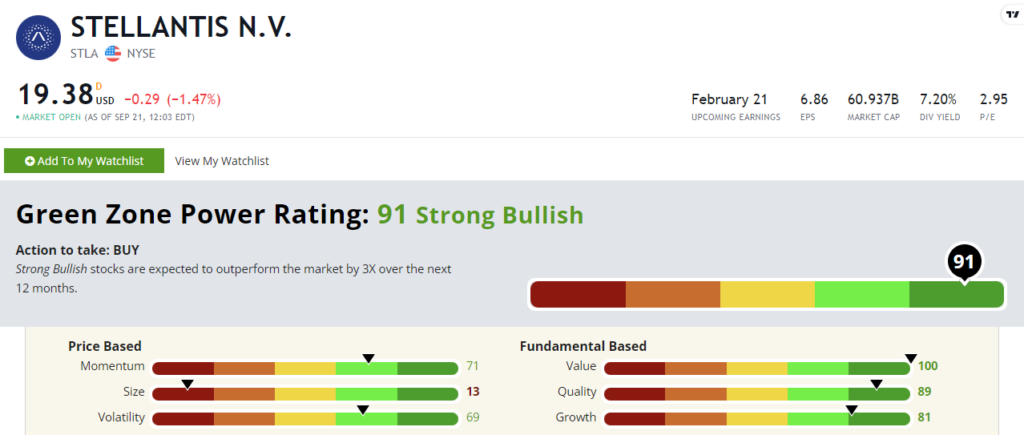

And as an investor, I thought this was the perfect kind of event to look at through the lens of Adam O’Dell’s proprietary Green Zone Power Ratings system.

In moments, I was able to go to our homepage (www.MoneyandMarkets.com), type in some tickers in our search bar and see how these big three auto stocks’ prospects look from here.

That’s what I love about this system … you can take a headline idea and run with it.

Let’s dive in!

2 to Watch … or Avoid

We’ve covered Ford Motor Co. (NYSE: F) a few times here in the Stock Power Daily. And I’ll just say, it’s only gotten worse for Ford’s Green Zone Power Ratings since Matt wrote about the automaker in August.

It now rates a “High-Risk” 17 out of 100 on Adam’s system. Stocks in this category are slated to vastly underperform the broader market over the next 12 months.

Its only strong rating is on the Value factor at 87. Every other factor scores in the 30s or lower. Since Matt wrote about F stock, its share price has declined by more than 4%, reflecting its 24 on our Momentum factor rating.

I can’t imagine an ongoing autoworker strike is going to help its rating improve from here, either…

What about Ford’s biggest competitor, General Motors Co. (NYSE: GM)?

Things look a little better here, but still not great.

GM stock rates a “Neutral” 42 out of 100…

Momentum, Size and Volatility look rough, but GM’s fundamental factor ratings look much better than Ford’s.

GM boasted a 25% year-over-year increase in revenue during its latest quarterly earnings call, which contributes to that 87 rating on Growth.

This is still just a stock to watch in my books, though. It’s down almost 2% year to date, while the broader S&P 500 has gained almost 14%. And again, a prolonged worker strike won’t do GM stock any favors.

So far, we’re 0 for 2…

An Automaker Stock Ratings Surprise

I was expecting strike 3 (no pun intended) when I typed STLA into the search bar. But I was met by a Green Zone Power Ratings surprise!

Stellantis NV (NYSE: STLA) rates a “Strong Bullish” 91 out of 100. Strong Bullish stocks are set to beat the market by 3X over the next 12 months.

There’s one thing that separates Stellantis from its Detroit neighbors. The company is actually based in the Netherlands. While its U.S. presence is strong (popular brands such as Jeep, Dodge and Ram Trucks fall under its umbrella), I’d argue Stellantis is a step ahead on the electric vehicle and tech front.

STLA rates a 100 on Value. Its price-to-earnings (P/E) ratio is 2.9. That’s lower than its Detroit Three counterparts — GM sports a 4.6 P/E ratio, while Ford’s is more than four times higher at 12! The broader automotive industry is sitting at a 17.8 P/E ratio.

Looking at its stock price action, STLA has gained more than 32% this year. That’s reflected in its 71 score on Momentum. With a heavy focus on innovative tech, that price action makes sense amid this year’s tech rally.

This stock still has potential, according to Green Zone Power Ratings.

Bottom line: After punching in some tickers at www.MoneyandMarkets.com, we got a mixed bag of automotive stock ratings.

I’ll definitely continue tracking these in my own watchlist as the bitter negotiations in Detroit continue…

Until next time,

Chad Stone

Managing Editor, Money & Markets

P.S. Stellantis stock rates well on the three factors at the core of Adam’s brand-new Infinite Momentum Alert, but it didn’t make the cut for his first 10 stocks to buy. If you want to find out which ones did, click here for information on how to join his new elite stock research service now.