In December 1913, Henry Ford did something revolutionary.

The automaker first installed the moving assembly line at his plant — reducing the time it took to build a car from 12 hours to 1 hour, 33 minutes.

It transformed how work was done.

Plants and factories are undergoing a similar transformation now. New technology is changing how mass assembled products are put together.

I experienced this first-hand when I visited the BMW Spartanburg automotive assembly plant in South Carolina nearly 10 years ago.

I witnessed humans working alongside robots and computer programs to build BMW’s full line of sport-utility vehicles.

Today, the plant that employs more than 9,000 people produces more than 1,500 vehicles every day. Automation is a huge reason for those impressive numbers.

Using Adam O’Dell’s six-factor Green Zone Ratings system, I found a company that has a strong share of the automation market. It’s one automation stock we are “Strong Bullish” on.

The underlying stock is situated to outperform the broader market by at least three times over the next 12 months.

Before we get into the stock, let’s look at where factory automation is going in the future.

Factories Are Getting “Smart” With Production

Manufacturing plants are tasked with doing more with less.

Their challenge is producing more product without increasing their bottom-line expenses.

A sure-fire way to do that is to introduce automation into their production line.

By using computer programs to eliminate assembly-line chokepoints (areas where production slows down), factories can do just that.

Factory Automation Market to Reach $230 Billion By 2025

By 2025, the market size of industrial control and factory automation is expected to reach around $230 billion in the U.S. alone.

That’s a 52% increase from the $151 billion the market is worth now.

Factories are adapting to this revolution at a rapid pace.

Companies that produce automation software and hardware are going to see profits explode.

So will investors in those companies.

Automation Stock to Buy: Magic Software Enterprises

In addition to providing a wide range of information technology software and hardware, Israel-based Magic Software Enterprises Ltd. (Nasdaq: MGIC) also provides software used by manufacturing companies.

Its FactoryEye software gives companies insight into the production process from the time an order is received to when it is shipped to the customer.

That insight helps companies be nimbler and make production adjustments quickly.

Magic’s Total Revenue to Reach $470 Million Next Year

In 2016, Magic reported $201.6 million in total revenue.

The company experienced increases every year through 2020.

By 2022, the company expects its top-line revenue to be close to $470 million — a 134% increase from 2016.

Magic expects great growth as more factories and manufacturers streamline their processes and using software to do it.

Magic Stock Bounces, But Still Hits High Mark

In the last 12 months, Magic’s stock has bounced.

But those bounces have produced higher highs and higher lows, signaling the potential for more gains in the future.

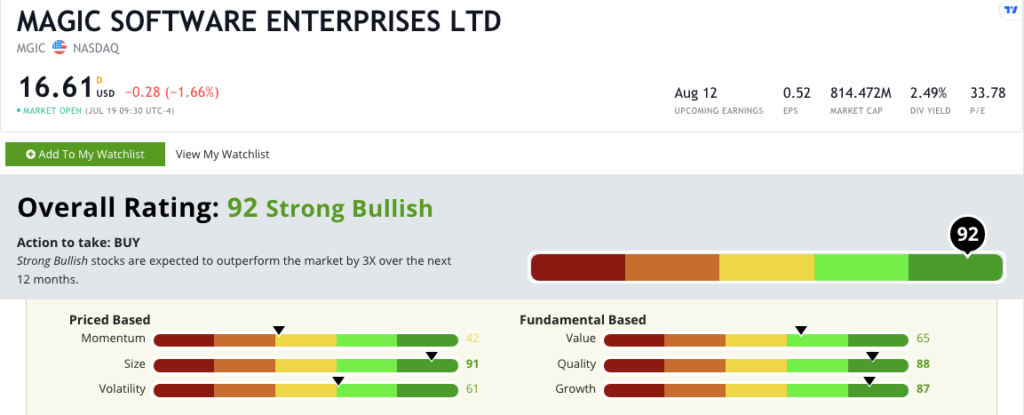

Using Adam’s six-factor Green Zone Ratings system, Magic Software Enterprises scores a 92 overall. That means we are “Strong Bullish” on this automation stock and expect it to outperform the broader market by three times in the next 12 months.

Magic Software’s Green Zone Rating on July 19, 2021.

Magic rates in the green in five of our six factors:

- Size — MGIC comes in with a market cap of $814.5 million, putting it under $1 billion and a perfect size for companies we look for to produce big gains. It scores 91 on this metric.

- Quality — The company’s returns on assets, equity and investments are all positive and higher than the technology industry averages. Magic earns an 88 on quality.

- Growth — MGIC has a one-year annual earnings-per-share growth rate of 86% and a sales growth rate of 14%. Its quarterly sales have risen in each of the last four quarters. That earns it an 87 on growth.

- Value — At its current stock price, Magic’s price-to ratios (earnings, sales and book) are all lower than the technology industry average, making it a good value stock. It scores a 65 on this metric.

- Volatility — Despite its up and down movement over the last 12 months, Magic’s stock price continues to find higher highs and higher lows. It earns a 61 on volatility.

Magic earns a 42 on momentum — near the middle of all other stocks rated. This is because of that up and down movement in the stock price. However, the movement continues to produce higher highs and higher lows in the share price.

Bottom line: Factories and manufacturers are always looking for ways to improve their processes and become more efficient.

Those companies are going to look to companies like Magic Software Enterprises for solutions to streamline their productivity.

That means more profits for MGIC … and more profits for smart investors who take advantage of this trend now.

It all means Magic Software Enterprises is worth looking at for your portfolio.

P.S. This is one of Adam’s “market breaker” stocks of 2021. He believes these stocks have the potential to help mint an unprecedented number of new millionaires in the next 12 months. To find out more, including details on Adam’s No. 1 market breaker stock, click here to view his Millionaire Market Summit.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.