AutoZone Inc. (NYSE: AZO) is a leading retailer and distributor of automotive parts, accessories and services in the United States. How does AutoZone stock rate?

The company was founded in 1979. Today, it operates over 5,000 stores across the country.

AutoZone is dedicated to providing its customers with quality products and outstanding service.

In addition to its retail operations, AutoZone has built out a robust ecommerce website and a commercial division that provides parts and services to businesses.

Today, we’ll look at AutoZone’s history and its Stock Power Ratings to see how AZO stacks up.

AutoZone Grew From Small Beginnings

AutoZone has been a well-known name in the aftermarket automotive business for over 40 years now.

Founded in 1979, AutoZone is the leading retailer of auto parts, offering one of the biggest inventories in the industry.

AutoZone stocks everything from everyday auto necessities such as brakes, batteries and engine coolants to specialty items such as suspensions, transmissions and exhausts. AutoZone also offers professional advice from its staff.

Founded in Memphis, Tennessee, and employing around 112,000 people, AutoZone is one of the leading automotive parts and accessories companies in the world.

And it offers so much more than just auto parts, including online resources for DIY auto repair projects so that anyone can learn and perform simple repairs and avoid overpriced mechanics.

AutoZone Stock Power Ratings

Let’s look at AutoZone’s Stock Power Ratings to get a clear picture of the stock:

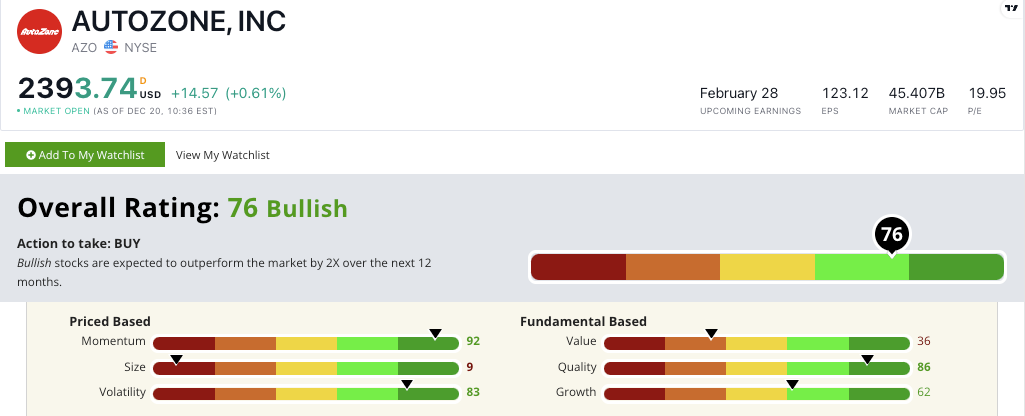

AZO scores a 76 out of 100 on our proprietary Stock Power Ratings system.

That means we are “Bullish” on the stock and expect it to outperform the broader market by 2X over the next 12 months.

It’s highest factor rating is on momentum, where is scores a 92.

This is helped by AutoZone stock’s 20% jump from December 2021 to December 2022.

On quality, AZO scores an 86.

This is based on double-digit returns on assets and investment along with a 54.3% gross margin.

This company knows how to make money.

AutoZone had a strong fiscal year 2022.

The company reported revenue of $16.3 billion and operating profit of $3.3 billion.

That’s an 11.6% increase in total revenue year-over-year and a 13% jump in operating profit.

These numbers earn AZO a 62 on our growth factor.

The bottom line: AutoZone is a household name for any would-be mechanics.

The company has a massive footprint — with more than 6,000 stores in the U.S. alone.

It also has stores in Mexico and Brazil.

AZO has expanded its net sales in each of the last five years, showing a strong pattern of growth.

If you are interested in investing in AutoZone stock, keep a sharp eye on our Stock Power Ratings system to guide you.