In this week’s Marijuana Market Update, I discuss recent NFL investment into cannabis research. I also answer a viewer’s question on Avant Brands (OTC: AVTBF) and Planet 13 Holdings (OTC: PLNHF).

First, some big news.

NFL Awards $1 Million to Cannabis Research

The NFL awarded $1 million to two universities to study the effects cannabinoids have on players’ pain management.

Medical teams at the University of California San Diego and Canada’s University of Regina will study how cannabinoids affect pain from sports-related injuries. It will also examine their use to help with concussions and participation in contact sports.

While the NFL bans cannabis use during the regular season, players can only be fined for testing positive — rather than fired.

Why’s this big? The NFL’s move could set the stage for other sports leagues to follow suit.

Now, onto a viewer’s question…

Avant Brands Stock Analysis

Skylar tweeted me and asked:

Hey Matt. Appreciate all the content you do. Have you looked at Avant Brands — previously GTEC? That’s my second-biggest cannabis holding next to Planet 13.

Thank you for the question, Skylar.

Now, Avant Brands (OTC: AVTBF) is headquartered in Kelowna, Canada. It produces, markets and distributes ultra-premium cannabis in Canada.

Avant’s cannabis brands include:

- BLK MKT.

- Tenzo.

- Cognoscente.

- Treehugger.

- And Pristine Seeds.

It also has a medical cannabis brand called GreenTec. Most of its products are sold in Canada, and its medical cannabis is distributed across the country directly to qualified medical patients through an online portal.

There aren’t any forward-looking financial projections for Avant. However, we can look for trends in its past performance.

Let’s start with its total revenue:

In its first two years of operation, the company was more in a research and development phase, so it didn’t generate much income.

In 2019, Avant started to sell its product and generated about $1.9 million in total annual revenue.

That grew to $6.2 million in 2020. Through the third quarter of 2021, Avant reported about $7.4 million in total revenue.

Avant Brands has grown its total annual revenue by 289.4% in a short amount of time. That’s impressive growth considering its limited Canadian market.

While that seems impressive, the company’s earnings from operations tells a different story.

Now, negative earnings aren’t a surprise in the research and development phase. Companies are spending money, not making any.

However, Avant has had a steady string of negative earnings from operations — including an $8.7 million loss through the third quarter of 2021.

While Avant has no debt, it’s not profitable by a long shot. A big issue is its production.

In the third quarter of 2021, the company reported selling 525 kilograms of product while producing 732 kilograms. That led to a $2.6 million loss in net income … for the quarter.

That, coupled with the standard headwinds cannabis companies face, has pressured Avant’s over-the-counter stock price.

AVTBF’s Struggles

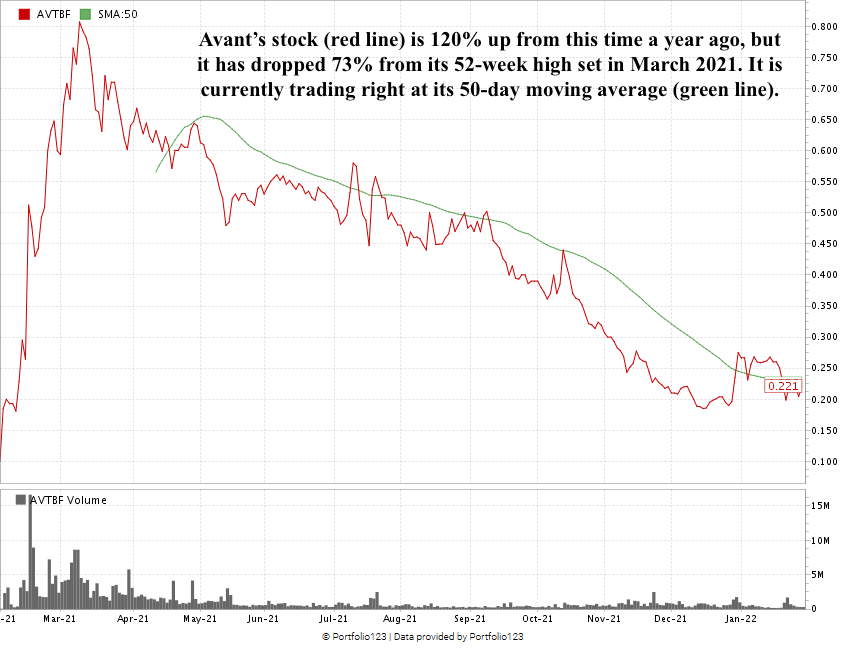

In the last 12 months, Avant’s stock has grown by 120%. However, unless you bought in before February 2021, your position is likely in negative territory.

From February 2021 to March 2021, the stock exploded 710% higher. It tried to maintain that gain after paying back a $6 million loan in April 2021 — eliminating all debt.

But Avant’s stock is now 72% off its March 2021 high.

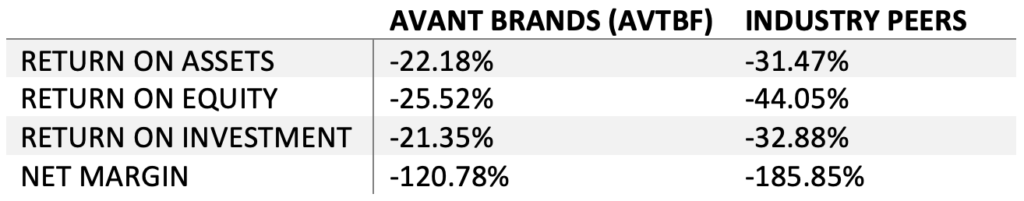

Its returns on assets, equity and investments are all still in negative territory, but not as bad as its peers:

The Takeaway

With the state of the market and Avant’s financials, it is going to take the stock a good bit to reach that level again.

I would proceed with caution on this stock. It’s a small, thinly-traded company, so its growth potential is not as high as other companies.

It only sells in Canada, and I don’t see any growth strategy in place. The company may just be trying to build a foundation.

If you bought AVTBF early, you are still looking at good gains. However, buying now means you have to be willing to hold the position for quite a while before your portfolio may see any kind of gain from the stock.

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast, so stay tuned.

Make sure you subscribe to our YouTube channel and get notified each and every time we post a new video.

We have a lot of great weekly video features on our channel, including:

- Ask Adam Anything — Where I get to sit down with chief investment strategist Adam O’Dell and ask him any question (from you or me) and get his insights into the stock market.

- Investing With Charles — Green Zone Fortunes co-editor Charles Sizemore and I talk about all things related to stocks and the economy, including comparing stocks to give you the best investment advice.

- The Bull & The Bear — Our weekly podcast where I show you the trends and analysis that moves the market.

All of these series are on our YouTube channel.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist and editor for 25 years, covering college sports, business and politics.