Things were initially looking peachy for the financial sector last week…

Big banks reported blockbuster quarters driven by investment revenues, with JPMorgan Chase (JPM) bringing in $700 million more than expected and reporting a 12% jump in profits.

I was sure we’d see the financial sector (XLF) lead the pack in our analysis today.

But then … a financial bombshell dropped on Thursday morning as Zion, a regional bank based out of Salt Lake City, reported a $60 million loss due to a string of bad loans.

That news naturally sparked worry of a repeat of 2023’s banking crisis, as JPMorgan CEO Jamie Dimon warned: “When you see one cockroach, there are probably more.”

By the end of the week, the financial sector (XLF) had given back its gains and merely ended the week flat.

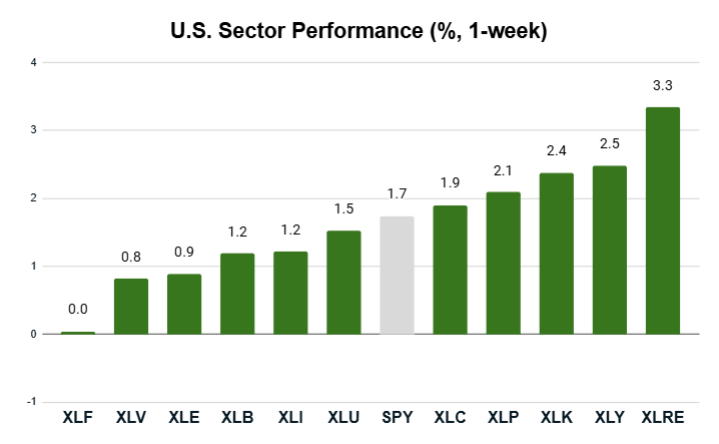

Here’s how things shook out for the S&P 500 and its 11 sectors overall:

Key Insights:

- The S&P 500 (SPY) closed the week 1.7% higher.

- Five sectors beat the S&P 500, while six lagged the index.

- The real estate record almost doubled the major index with a 3.3% gain.

- The financial sector finished flat for the week.

It will likely take more time for anymore “cockroaches” to appear in the banking segment, but it’s a perfect opportunity to see how some of these stocks look through the lens of my Green Zone Power Rating system.

Let’s do just that now…

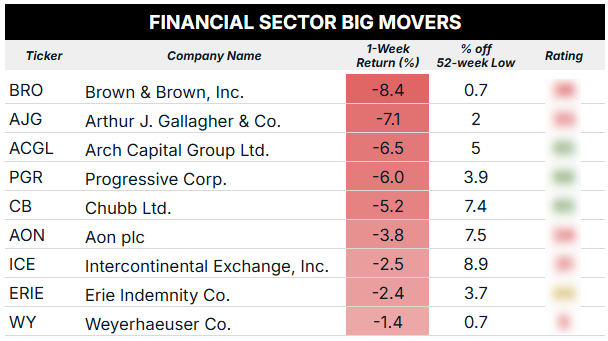

Financial Sector’s Big Movers

Here are the nine financial sector stocks that sank last week, ultimately closing within 10% of their 52-week lows:

The first thing you might notice here is that Zions Bancorporation (ZION) is not on this list. The regional banker’s stock is still trading well above its 52-week low, so even last week’s loan scare wasn’t enough to force an all-out crash in the stock. Even this morning, investors are pushing ZION shares higher after the brief sell-off.

Looking at the list above, I’ll note that the two worst-performing stocks (BRO and AJG) were already rated “Bearish” in my Green Zone Power Rating system. It was already waving a red flag on those stocks so to speak.

Let’s move on to the sector that led the pack last week…

Real Estate Rebounds

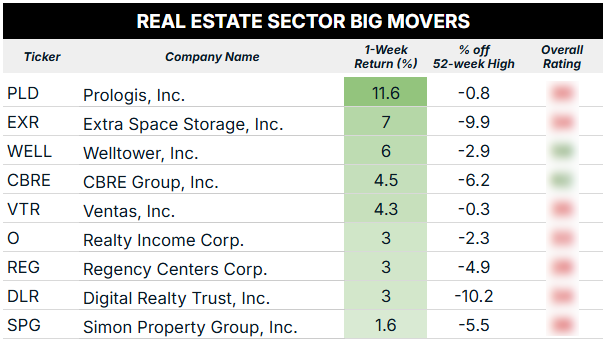

It’s been a rocky 2025 for the S&P 500 real estate sector (XLRE). Year to date, the sector is up only 4.9%, well below the broader S&P 500’s 14.2% rise.

Time will tell if last week’s almost 2X outperformance was the start of a new momentous trend, but we can at least use my system to see how the stocks driving that performance are looking currently.

Below, you’ll find the nine best-performing real estate sector stocks that posted a positive gain and closed within 10% of their 52-week highs.

Prologis Inc. (PLD), an industrial REIT giant, kicked off the third-quarter earnings season with an impressive earnings per share beat (82 cents versus 67 cents expected). Investors jumped in on the news, pushing the stock to new 52-week highs.

But looking at my Green Zone Power Rating system, PLD is still well below the mark that points to that outperformance continuing. The stock is firmly in “Bearish” territory, with poor ratings on Value, Momentum and Volatility.

This has all the makings of an earnings “pump-and-dump.” I could be wrong, because it’s impossible to predict anything with 100% certainty. But in these situations, I’d rather find a stock that my system is already regarding highly due to stronger underlying data.

In fact, looking at the nine stocks above, and the fact that only two barely rate “Bullish,” I would still tread lightly in the broad real estate sector for now.

To see how any of these stocks rate overall, as well as on the six factors that drive my system, click here to join me in Green Zone Fortunes today. One of many benefits for joining is the freedom to look up any of these stocks (or thousands of others) with just a few clicks of your mouse.

To good profits,

Editor, What My System Says Today