Midterm elections are less than three weeks away and more is at stake than many might realize if the Democrats are able to wrest control of the House as is expected — and that is not want most investors want to see.

According to a recent article in InvestmentNews, financial advisers are on pins and needles, hoping for a GOP win.

Per InvestmentNews:

“Please let the Republicans maintain the House and Senate,” said Gary Wolfe, wealth management adviser at Northwestern Mutual. “If the Democrats win the House, the first thing they’re going to do is go for impeachment [of Mr. Trump], and I don’t know why.”

A shift from Republican to Democrat majority in the House after midterm elections will affect a number of issues including the SEC’s advice rule, additional tax reform, efforts to increase retirement savings and even the aforementioned impeachment proceedings against President Donald Trump.

Watch for Rep. Maxine Waters, D-Calif., to be elevated to chairwoman of the House Financial Services Committee. In that position, she would be the most prominent Democratic voice in the House when it comes to congressional oversight of the Securities and Exchange Commission. That responsibility would undoubtedly include a keen and critical eye on the agency’s massive new advice-standards proposal.

Democrats have vehemently opposed the Trump administrations Tax Cuts and Jobs Act, and will end the GOP’s efforts to make the tax cuts permanent because they say they mostly benefit corporations and the rich.

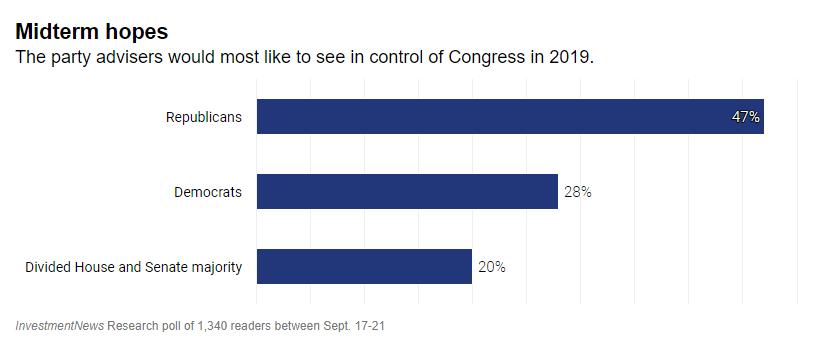

A recent InvestmentNews poll conducted Sept. 17-21 shows the vast majority of financial advisers want to see Republicans maintain control after the midterm elections: 47 percent want Republicans completely in charge, 28 percent want total Democrat control and 20 percent want power to be divided.

SEC Advice Rule

Advisers say if Democrats take control of the House, the most noticeable change will come to the SEC advice-reform proposal. The highly controversial and anti-Trump Maxine Waters, D-Calif., will likely be the chair of the House Financial Services Committee.

“She would use [the committee] platform to express her concern about the SEC rule proposal in hopes that it would be strengthened to better protect investors,” said Neil Simon, vice president for government relations at the Investment Adviser Association.

Waters and her Democratic colleagues have previously said the SEC failed to explain how the Regulation Best Interest is different from suitability.

“What you’re going to see is [Democrats] looking over the SEC’s shoulders and prodding them toward a tougher rule,” said Dan Barry, managing director of Atlantic Policy Solutions.

So what does that mean exactly?

There’s a chance a Democratic House takeover could alter progress on the proposal in a counterintuitive way: quicker adoption. “It’s possible [SEC Chair Jay Clayton] will try to get it done this year before the new Congress is in place,” Mr. Simon said. “Congressional interest in this could potentially affect the [SEC] vote.”

Tax Cuts

A Democratic takeover after midterm elections will kill any chances of Republicans continuing their tax cut momentum. Tim Steffen, the director of advanced planning for R.W. Baird & Co., says the general theme will likely be higher taxes on higher-income people and lower taxes for lower- and middle-class taxpayers. If Republicans can maintain control of the Senate, which is likely, the two chambers will cancel each other out.

“In order to pass something significant, you almost need one-party control over the House, Senate and White House,” Mr. Steffen said. “It could be two years of wandering in the desert.”

Retirement Savings

There is hope for bipartisanship on the retirement front. The Retirement and Savings Act that encourages workplace savings programs have drawn support from both sides of the aisle.

Rep. Richard Neal, D-Mass., would likely become the chair of the House Ways and Means Committee, and helping people with their retirement is reportedly one of his top priorities.

“Mr. Neal has clearly communicated to us, both privately and in public statements, that retirement security is one of his top priorities,” said Paul Richman, vice president of government affairs at the Insured Retirement Institute. “We think that could be a positive development.”

Parts of the second tax reform Democrats formerly opposed could now be back on the table.

Elements such as enabling small businesses to band together to offer 401(k) plans, relaxing required minimum distribution requirements for individual retirement accounts, and making it easier to use annuities within 401(k) plans could gain wider backing if they move separately later this year or in the new Congress next year.