April is here. And in the financial world, that means another round of bank earnings.

The latest round of earnings reports will be highly scrutinized as the Federal Reserve contemplates its next interest rate move.

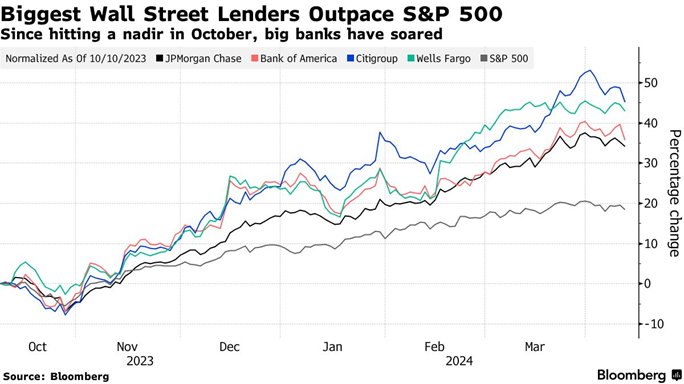

Since hitting a low in October 2023, some of Wall Street’s biggest bank stocks have been on a tear, outpacing the S&P 500:

JPMorgan Chase (JPM), Bank of America (BAC), Citigroup (C) and Wells Fargo (WFC) stocks have gained as much as 50% since the low, while the broader index has bounced around 20% higher over the same time.

It’s a much different market than even just a year ago when Silicon Valley Bank’s collapse put tremendous pressure on the entire sector.

Today, I’ll share the near-term outlook of the banking industry and use Adam O’Dell’s Green Zone Power Ratings system to see just where the sector stands today.

Light Earnings Growth for the Financial Sector

You may not realize, but 50% of S&P 500 companies reporting over the first two weeks of earnings season are in the financial sector.

And it’s more than just banks.

The financial sector consists of five main industries: insurance, consumer finance, financial services, capital markets and banks.

Data firm FactSet projected the year-over-year growth rate of all five industries in the first quarter:

- Insurance: +37%.

- Consumer Finance: +13%.

- Financial Services: +11%.

- Capital Markets: 0%.

- Banks: -18%.

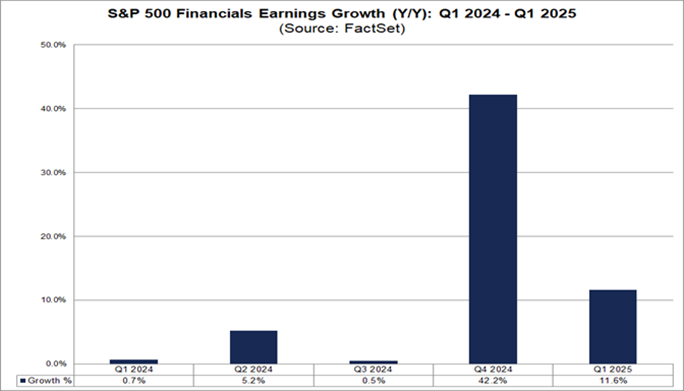

The average earnings growth for the entire sector in the first quarter is 0.7%.

As you can see, the insurance industry is boosting the sector while the banking industry is dragging it down.

It also shows just how much weight the banking industry has on the broader financial sector.

Looking ahead, analysts project the year-over-year earnings growth of financials to be strong at the end of 2024 and into 2025:

Earnings growth is projected at 5.2% for the second quarter and just 0.5% for the third. However, the sector is expected to see a massive swing upward in the fourth quarter and into 2025.

As the Fed considers potential rate cuts, banks will see deposit costs start to fall, leading to increased net interest margins.

This margin is important because it shows how much a bank earns in interest on loans compared to how much it pays out in interest on deposits. The higher the ratio, the better for banks.

Banks on the Green Zone Power Ratings System

In order to get a picture of how banks look today, I ran an X-ray on one of the leading banking exchange-traded funds (ETF), the SPDR S&P Bank ETF (NYSE: KBE).

KBE holds 92 bank stocks and tracks the performance of the S&P Banks Select Industry Index.

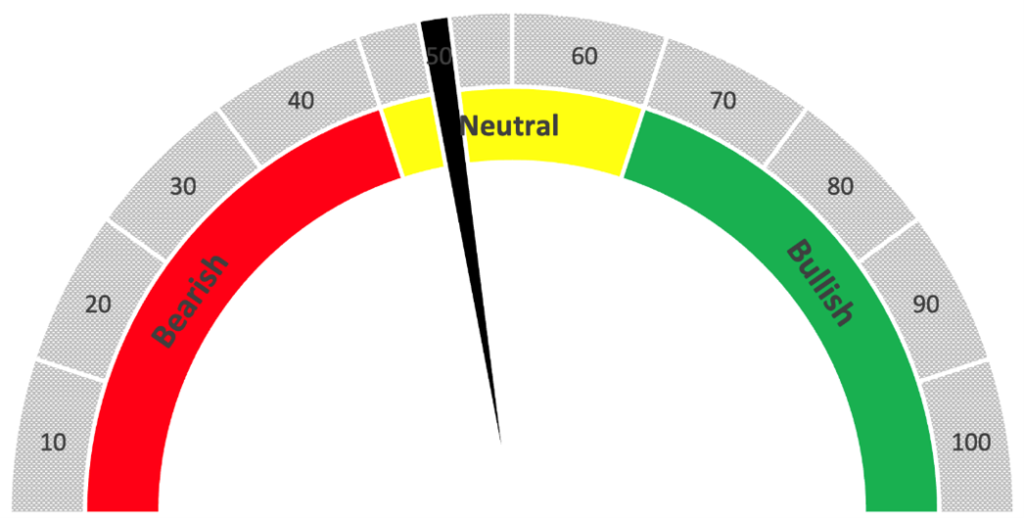

KBE Rates “Neutral”

The average total rating of all 92 holdings is a “Neutral” 50. That means we expect the ETF to perform in line with the broader market over the next 12 months.

To break it down further, only 19 stocks rate a “Bullish” 70 or above, while 19 others are rated below 30. The rest fall in between 30 and 70.

Looking at the individual factors within Green Zone Power Ratings, KBE scores the highest on Value with a 63. Its lowest rating is on Size at 40.

Bottom line: The banking sector’s “Neutral” rating on the Green Zone Power Ratings system fits with the potential for modest earnings gains this quarter.

But, the overall “Neutral” rating doesn’t mean there aren’t diamonds in the rough… if you know where to look.

Here are a couple I found after some digging.

International Bancshares Corp. (Nasdaq: IBOC) is a financial holding company that operates banks in South Texas and all of Oklahoma. It rates 91 out of 100, which means we are “Strong Bullish” on the stock and expect it to outperform the broader market by 3x over the next 12 months.

Then, there’s the well-known bank, JPMorgan Chase & Co. (NYSE: JPM). It’s the largest bank in the world in terms of market capitalization. It rates 86 out of 100 on our system, which, like IBOC, means it’s set to crush the market by 3X over the next year.

This is why it is important to use the Green Zone Power Ratings system to find gems before you hit the “buy” button on your trading platform if you are aiming to invest in bank stocks.

As for the broader financial industry, I see gains coming, but not until later in the year.

Until next time…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets