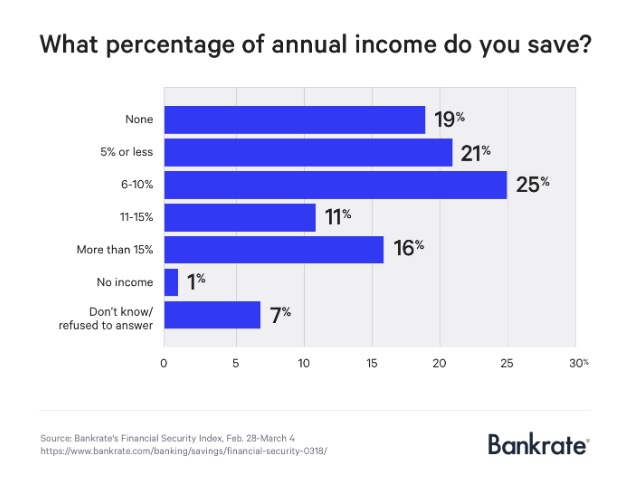

Unemployment is at a near-50-year low and wages are rising, but the vast majority of Americans are saving very little and a fifth are saving none of their yearly income, according to a recent survey by Bankrate.com.

In fact, a staggering 19 percent of Americans don’t save anything at all, another 21 percent save just 5 percent or less of their income, and another 25 percent save 6 to 10 percent of their income, and they will likely struggle mightily when it’s time to retire.

Experts generally recommend everyone save 15 percent or more of their annual income. According to the survey, only 16 percent of Americans save 15 percent or more, setting themselves up to go broke in retirement, Bankrate says.

Per CNBC:

“With a steady, significant share of the working population saving nothing or relatively little, it’s virtually guaranteed that they’ll be unable to afford a modest emergency expense or finance retirement,” says Mark Hamrick, senior economic analyst at Bankrate. “That amounts to a financial fail.”

The economy might be prospering now, but that won’t last forever: “The party has to stop sometime, and when it does, employers will lay off workers,” the study says.

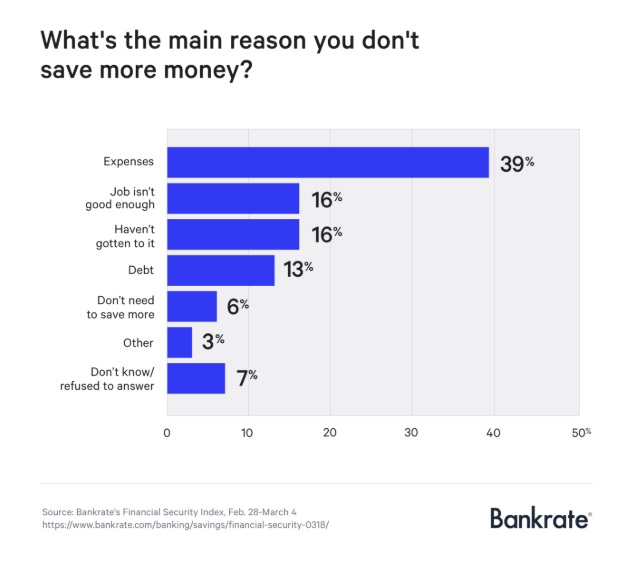

What’s keeping Americans from saving? “Expenses” was the No. 1 answer of 39 percent of respondents. Another 16 percent say they don’t have a “good enough job” to be able to save, which presumably means they aren’t earning enough.

“The average American has less than $5,000 in a financial account, a quarter to a fifth of what you should have, and those aged 55 to 64 who have retirement savings only carry $120,000 — which won’t last long in the absence of paychecks,” the survey reports.

When it comes to saving for retirement, you should lower expenses any way possible by downsizing your home, eliminating debt and cutting back anywhere you can. You can also rent out spare rooms.

Keep scrolling down for more Money & Markets tips on saving for retirement.