You want to know the key to longevity in this business?

It’s not stock selection, though that helps. Nor is it trend-following, though that’s something near and dear to my particular style of trading.

The key to longevity as a trader is position sizing.

No trader has a perfect batting average. No matter how good your model is, you’re going to get a few trades wrong. But if you size your positions within your portfolio appropriately, that’s OK. It won’t kill you to whiff on a few.

It’s only when you bet the farm … and then swing and miss… that you put yourself in any real danger of ruin.

Risk Isn’t a Dirty Word

Keeping this in mind, there’s no asset class that is “too risky,” per se.

You can dabble in small caps, options, cryptocurrencies… or, for that matter, you can blow money at the roulette wheel in Las Vegas. But you shouldn’t allocate more to a shoot-the-moon trade as you might a stable company with a 20-year history of paying dividends.

You don’t have to take my word for it. The legendary Ray Dalio built Bridgewater, a $150 billion hedge fund, based on the same concept. He dubbed it “risk parity.”

I had this in my mind as I was reviewing the recent performance of electric vehicle (EV) stocks.

EVs Are the Future

If you’ve read my work in Green Zone Fortunes, you know that I’m extremely bullish on the long-term prospects of green energy.

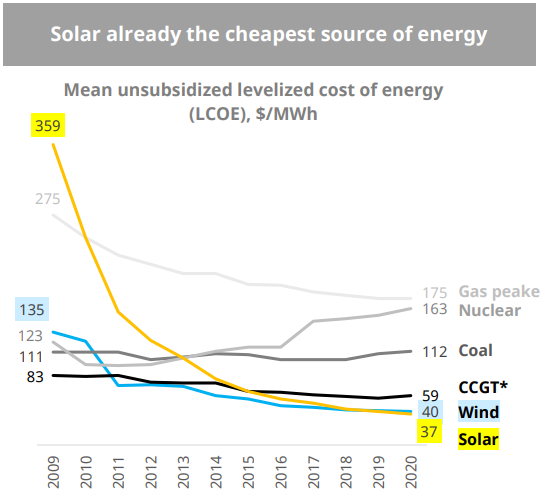

The cost of new wind and renewable solar projects has fallen so far so fast. It’s now often cheaper to produce renewable energy than it is to burn coal or natural gas.

Source: Canadian Solar investors presentation, May 2021.

Electric vehicles require far less maintenance than traditional autos. (They have fewer moving parts to potentially break.)

EVs are still more expensive to manufacture than traditional cars, but the difference gets smaller every year. Lower maintenance costs over the vehicle’s life make them a better buy in a lot of cases.

This isn’t politics. It’s economics. Money talks and economics are pushing us towards a greener future. This is a durable trend that we need to be following.

The question is how.

Balance Risk With EV Stocks

Most EV and battery stocks are wildly speculative.

Think of a barbell with equal weight on both sides. It’s a simple image of a powerful investing strategy.

I like the long-term trend. But I can’t justify making more than a small bet on an early-stage company in a fiercely competitive market.

This is why it pays to take a “barbell” approach.

It’s fine to be aggressive and make speculative plays with a part of your portfolio. But this should be balanced out with positions in more stable and established companies.

In Green Zone Fortunes, I opted to stay on the more conservative side of the barbell for now.

Earlier this year, I wrote about the fortunes being made in the electric vehicle space. But I wasn’t comfortable recommending that my readers pile into the more speculative names dominating the headlines at the time, such as NIO Inc. (NYSE: NIO).

Instead, I recommended they buy shares of a traditional automaker that is quietly, behind the scenes, emerging as a dominant player in the electric vehicle space.

Unlike the newer names like Lucid Group Inc. (Nasdaq: LCID) or Rivian Automotive Inc. (Nasdaq: RIVN), this company has been around for decades. It has a global distribution network and the capacity to dominate. Oh, and unlike most EV manufacturers, the company is actually profitable.

And the beauty of the barbell approach is you can apply it to any market sector. I’ve recommended an established biotech company with a portfolio of neurological treatments to my Green Zone Fortunes readers, while also recommending an early-stage genomics play. We’re up almost 200% on half the position!

If you’d like to find out more about these recommendations, watch my “Imperium” presentation now. You’ll see why I am so excited about the genomics revolution that I’m confident will be the No. 1 stock mega trend of the next 10 years.

And once you join Green Zone Fortunes (for under $4 a month), you’ll gain access to the EV stock recommendation I mentioned earlier. Balance out your LCID and RVIN trades with a company that is quietly emerging as an EV leader.

To good profits,

Adam O’Dell

Chief Investment Strategist