Editor’s Note: This is a transcript of Adam O’Dell’s latest Ask Adam Anything video. If you’d like to watch the back-and-forth between Adam and Matt Clark instead, click here to watch it on our YouTube channel.

Adam:

My Twitter feed is going bananas over this major bank’s clerical mistake.

Look, the bank has already admitted its mistake to the SEC, and it’s calculated that it will take a loss of nearly $600 million … all because of this clerical mistake.

But I estimate that the fallout could be much larger if things really hit the fan. It is almost guaranteed that this bank will lose upward of $600 million fixing this clerical mistake, but it could lose another $150 million in revenue per year.

The bank is already 35% less valuable than it was earlier this year, based on its market cap and share price. And if this bank goes belly up, we could see another $33 billion in market cap erased from the stock market.

So I’ve put together a trade to take advantage of this unique situation. And no, we aren’t just shorting Barclays, the British bank in question. More on that in a bit.

First, I want to explain what’s going on.

We need to answer two important questions:

- Could this bank’s clerical error delete my grandmother’s savings?

- What will be the next shoe to drop in the Barclays saga?

Let’s get into it.

Barclays’ $600 Million Mistake

Matt: OK, you got my attention. Are you really worried about your grandma’s savings though?

Adam: Yes, Matt, of course. She’s in her mid-90s, and she and my grandpa worked hard for every single dollar they have.

In fact, I always think about my grandma’s savings any time I give advice to subscribers. While not all of the trades I recommend are appropriate for my grandmother, I keep that in the front of my mind.

Matt: OK. So why is this clerical error debacle threatening to your grandma’s savings?

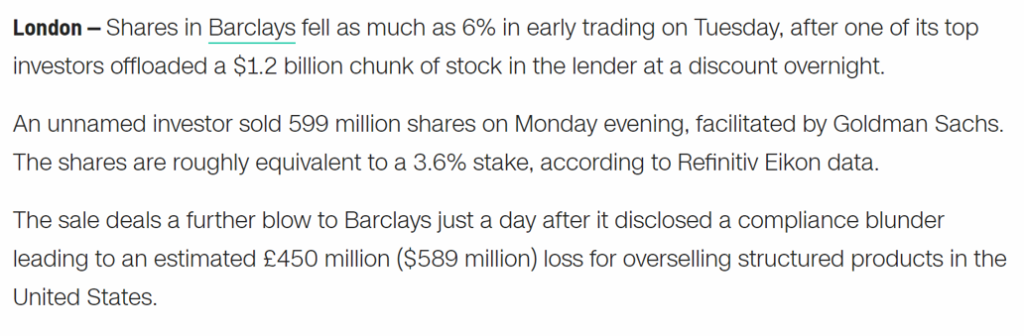

Adam: Well, Matt, check out this section of a recent CNN Business piece:

Capital Group is one of the world’s largest investment firms and parent to the American Funds brand of mutual funds that is popular among millions of U.S. investors and retirement savers.

It just sold 399 million shares of Barclays! And this wasn’t the only large holder of Barclays stock that dumped shares. In the same article, another unnamed holder of the stock sold 599 million shares of Barclays on Monday evening. They did it in a block trade after hours with Goldman Sachs. And it is just incredible to see large block trades like this selling out of Barclays.

Matt: Selling off 900 million shares in a day? That hurts. So why are these large Wall Street investors, some of whom manage money for older Americans and retirees like your grandma, for example, bailing out of Barclays?

Adam: Look, Matt, no joke. It’s all because of a clerical error.

So here’s what happened. Barclays managed a product and the ticker symbol for this product is VXX. It’s the iPath S&P 500 VIX ETN (NYSE: VXX).

You’ve heard of the volatility index. When people are fearful, the volatility index shoots up, and when people are complacent, it drifts lower.

Well, to be able to position yourself, either to hedge your stock portfolio or to make bets on crisis plays, you can trade VXX. Prior to the past couple of weeks, you could trade this in pretty much any brokerage account.

In order to sell this product, Barclays has to do what’s called a shelf registration with the Securities and Exchange Commission (SEC). Barclays basically says, “Look, over the next several months and years, we intend to sell like $20 billion worth of this product.”

And that’s the number that they chose back in 2019. Typically the bank keeps track of how much of that $20 billion limit it’s sold. And any time they get close to the limit, like $18 billion, someone will send the SEC an email and say, “Hey, we’d like to sell another $20 billion of this product.” And the SEC will say, “Sure, just update your shelf registration. And you can keep on doing business as you’d like.”

Well, somebody messed up at Barclays. It went on for over a year, and they just realized in the past couple of weeks that instead of selling $20 billion worth of this product, they sold about $35 billion worth of it. They almost went over their allowed amount by double!

And when they realized this happened, Barclays started putting out press releases that they were going to change the way that they created shares of VXX. And they obviously alerted the SEC and they’re trying to sort things out now.

But again, this was a clerical error that basically is going to result in Barclays having to make right on these trades and buy back this product from the purchasers. The number Barclays put out is upwards of $600 million in losses that it will have to directly incur while fixing this error.

The REAL Barclays Fallout

Matt: But now you’re suggesting that the fallout could actually be worse than that, right?

Adam: It could. The $600 million is a direct hit that it is almost guaranteed to take. But I’ve seen estimates that it could sell upward of $15 billion worth of this product per year.

If the bank earns a 1% fee on that 15 billion dollars, we’re talking about $150 million in revenue potential every single year that Barclays isn’t offering this product going ahead. Not to mention, billions of dollars’ worth of market cap have already been chunked off of this company from those large block trades, those institutional investors that are bailing on Barclays.

Worst case scenario is if Barclays went belly up. It’s a $33 billion market cap bank right now. So that’s $33 billion that stands to get wiped out of the stock market if the worst case happens.

Matt: But do you think it’s going to go belly up?

Adam: Here’s the thing, I don’t think that Barclays is likely to go belly up over this.

Look, Barclays has been around since 1690. I didn’t reverse that. It’s not 1960. It’s been around since 1690! This is a big bank with a long history.

A few years ago, I think it was 2017, it got into some trouble with the SEC for the overcharging of some customers for products. It might have been an innocent mistake, but my point is that these big banks typically rectify these situations by paying some fines and making right to the customers that they wronged and then they move forward.

This is not the type of incident that I believe that is going to put Barclays under.

Why This Trade Looks Good

Matt: OK. So now the trade idea than you teased earlier. I’m going to venture a guess we’re not talking about shorting Barclays, are we?

Adam: No, I don’t think, at this point, shorting Barclays is the right trade. Maybe you can make some money on that, but I think that there’s a better trade to be had.

And here’s what it is.

So, when Barclays started admitting that it made this mistake, it didn’t come right out and say what it had done. It sent out a press release on March 14 saying that it would no longer create new shares of VXX. If you wanted to buy VXX, you could buy the note on the open market. You could buy from somebody who was wanting to sell it, but you couldn’t buy it from an authorized participant or bank. There was no new share creation.

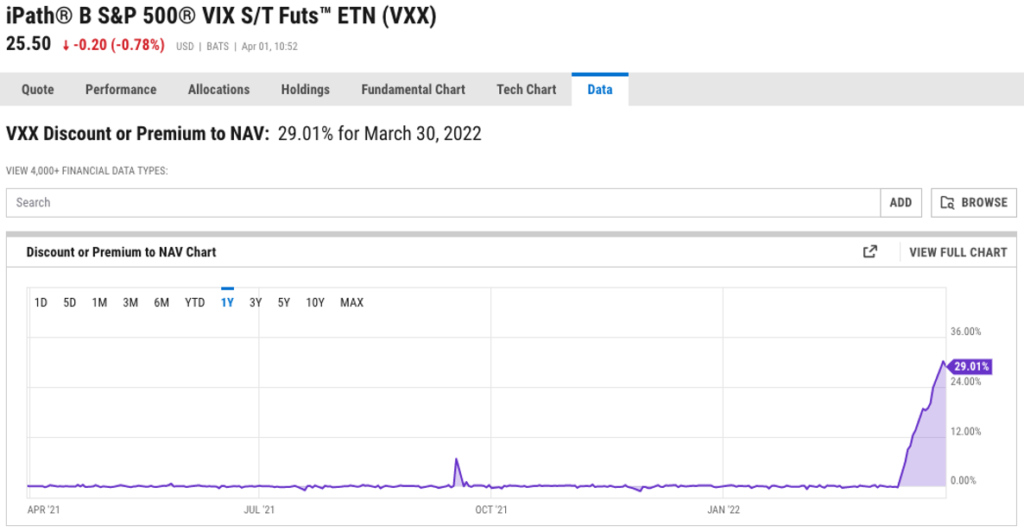

That’s kind of like inside baseball, but, in short, that decision meant that the market price of VXX became untethered from the price of the index that VXX is committed to tracking. So basically it was kind of trading way off of its index value.

Here’s a chart of the premium in VXX.

So if you compare the market value of VXX to the index that it’s supposed to track, there is a 30% difference.

The market price is higher, and that is the opportunity that I see us being able to take advantage of.

Matt: Explain this in layman’s terms. You’ve put together this idea, and what does all this mean?

Adam: So I think that the next shoe to drop, so to speak, with this Barclay saga is: Barclays will do a shelf registration with the SCC, resume creation of shares, and VXX will start trading as it did prior to March 14th.

Now, a lot of people are speculating that Barclays will fold VXX, that it will close down the product altogether. There’s even a Financial Times piece that ends with the very last line is saying that VXX may be the sacrificial lamb for Barclays — its way to exit the structured notes business.

I just think that the pessimism around this situation is overblown.

So, again, my thought is that Barclays will make things right. It will file its shelf registration with the SEC in the next several weeks or months. And basically it’ll be able to create new shares of VXX like it did normally. And when that happens … the share price of VXX on the open market is going to collapse down to the index value.

Matt: So that’s interesting. What you’re saying is it almost guarantees that the drop is going to happen.

Adam: It does. My idea is not a risk-free trade. It doesn’t guarantee that will happen. Barclays could go belly up. It could decide to shut down the product rather than file another shelf registration.

But look, again, it’s sold $15 billion worth of this product annually. And again, if it makes a 1% fee, we’re talking about $150 million worth of revenue annually.

Why would a bank like Barclays forgo that type of revenue and walk away from that over a clerical error it could correct?

How to Trade Barclays’ VXX Debacle

Matt: So this is not a risk-free trade. So, what is the trade Adam?

Adam: OK, so the trade is an options trade. Sorry, grandma, this is not for you. This is probably not a trade for my grandmother.

What I’m thinking is I’m looking at options to trade this scenario. The great thing about when you buy an option contract is that you can never lose more than you pay for that contract. And the types of contracts that I typically recommend in my trading services are rarely more than a few hundred bucks.

So you’re putting a few hundred bucks into an option trade, and if it doesn’t go well, that’s all you’ve lost. So the one I have in mind, at last glance, was trading for about $200. You could buy the contract for $200.

Matt: Sounds great. What is it?

Adam: All right.

Matt: I’m just hitting you right with it. What is it?

Adam: I’m looking at the June 17, 2022 expirations on VXX. Those expire in about two and a half months, I’m looking at the $19 strike put options on VXX. It’s a bet that shares of VXX will fall back lower, and you’ll start making money on those $19 strike put options.

Matt: I understand, right, you’re putting that $19 strike option because that’s where VXX should be without that big 30% premium it’s at right now.

Adam: You catch on quickly, Matt.

So, right now, VXX, we’re recording this on Friday afternoon (April 1) … and the open market shares with VXX are trading for about $25.50, give or take. And the index value published by Barclays, as of Thursday night’s (March 31) close, was $19.38.

Basically, if Barclays came out with a press release tomorrow that said, “Look, we’ve cleared everything up with the SEC. We’re now registered. We’ve got our shelf registration updated. We can create new shares.” The market is going to realize that 30% premium is completely erroneous, and it will evaporate.

So shares of VXX on the open market should collapse from whatever they are trading at, when an announcement comes, back down to the index value.

The other thing about VXX is that it’s mechanically designed to go down over time, the way it rolls contracts and the futures markets. Again, inside baseball, that doesn’t matter. But I think there’s a lot of upside potential in this trade.

Matt: Now, it’s interesting. I want to look at the other side of things. The downside, if this bet doesn’t work out, if say things don’t even out … we’re looking at a downside of give or take $200. Is that what we’re thinking here?

Adam: That’s the downside. If somebody makes this trade buying the $19 strike put options June 17 expiration on VXX for about $200, and VXX goes to the moon or something else happens, the most you could lose on this trade for buying that put option is about $200. Give or take whatever you actually pay for it.

Of course, the other downside is that I probably get made fun of by a lot of people on the comments below in this trade.

So, it’s again, not a risk-free trade. It’s not guaranteed trade. But I think it’s an interesting idea and a unique situation.

Matt: Now circle back. What’s the upside here?

Adam: Well, that’s what I love about buying options. When you buy an option, your risk is 100% limited. You cannot lose more than minus 100%. You can’t lose more than what you put into that stock option that you buy.

The upside, however, is completely unlimited. And in my trading services, we routinely make profits of 200%, 300%, 400% and even more. I can’t say exactly what the upside on this trade is, but I do think it’s, well, many orders of magnitude above what the potential risk is.

Matt: And you do think that that kind of upside that 200%, 300% or even 400% is possible with this trade.

Adam: I do. Absolutely.

Learn More About Trading Options

Matt: Okay. So where else can people learn about the different style of options trading that you do?

Adam: I got you. Home Run Profits is a service that I’ve been running since 2012. So for 10 years now we’ve bought and will continue to buy options.

Most of the time we buy call options because I’m an optimistic, opportunistic, bullish most-of-the-time investor. So we do buy mostly call options, which are bullish bets on individual stocks and ETFs.

Most of the contracts I recommend, you can buy them for a couple or a few hundred dollars. And we target gains of 100%, 200%, 300% or more, closing them out in 71 days on average. If this type of idea sounds interesting, you should check out Home Run Profits.

Matt: It’s also a fun service to be a part of. Options can be somewhat complex and can appear to be convoluted. But Adam, the way he does it, it’s very simple and very easy to follow. It’s actually quite fun, especially when you’re cashing in gains of 200%, 300% or 400% like his subscribers have had before.

To good profits,

Adam O’Dell

Chief Investment Strategist