I didn’t have many toys growing up.

But with kids of my own and a new grandson, I see how crucial they are to children’s development and learning.

It wasn’t until I started digging into the toy industry in the U.S. that the importance of toys to the market took hold.

As you can see above, Americans spent $12.2 billion on toys in 2020. By 2025, that figure will climb by 96.5%.

That tells us that no matter what outside forces do to the economy (inflation, pandemic, etc.), we are still hungry for toys to make our children happy.

Companies that provide popular toys benefit from such a massive jump in spending, including today's Power Stock: Build-A-Bear Workshop Inc. (NYSE: BBW).

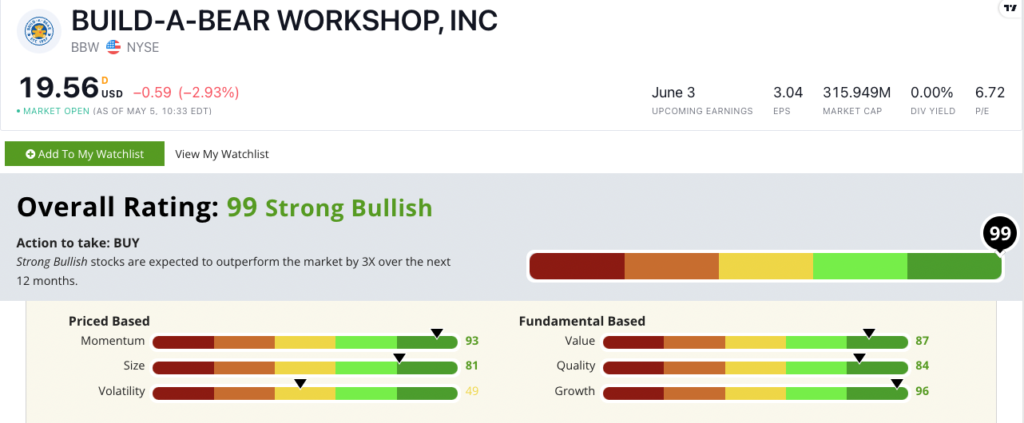

BBW Stock Power Ratings in May 2022.

Build-A-Bear Workshop bills itself as an “interactive retail entertainment” company.

Most people know BBW has brick-and-mortar locations where you can build a stuffed animal from scratch … complete with hand-picked clothes and even voices.

The company operates 346 stores worldwide and has a website where you can order your personalized toy.

Kids love Build-A-Bear … and investors should too!

Build-A-Bear stock scores a “Strong Bullish” 99 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

BBW Stock: Top-Tier Fundamentals and Strong Momentum

Researching BBW, a couple of items stood out:

- While it has not released its full 2021 earnings, BBW reported total revenues of $411.5 million for the year — a 61.2% increase over 2020.

- The company also reported a gross profit margin of 53%, topping the 38.2% it announced in 2020.

BBW is an outstanding stock based on technical factors. It scores in the green on value, quality and growth according to our proprietary Stock Power Ratings system.

Its one-year annual earnings-per-share growth rate of 290.4% and sales growth rate of 61.2% earn it a 96 on our growth metric — putting it in the top 4% of all stocks we rate!

BBW’s stock valuation metrics align with the broader electronic and entertainment retail sector. Its price-to-earnings ratio is 6.88 — right around the sector average of 7.44.

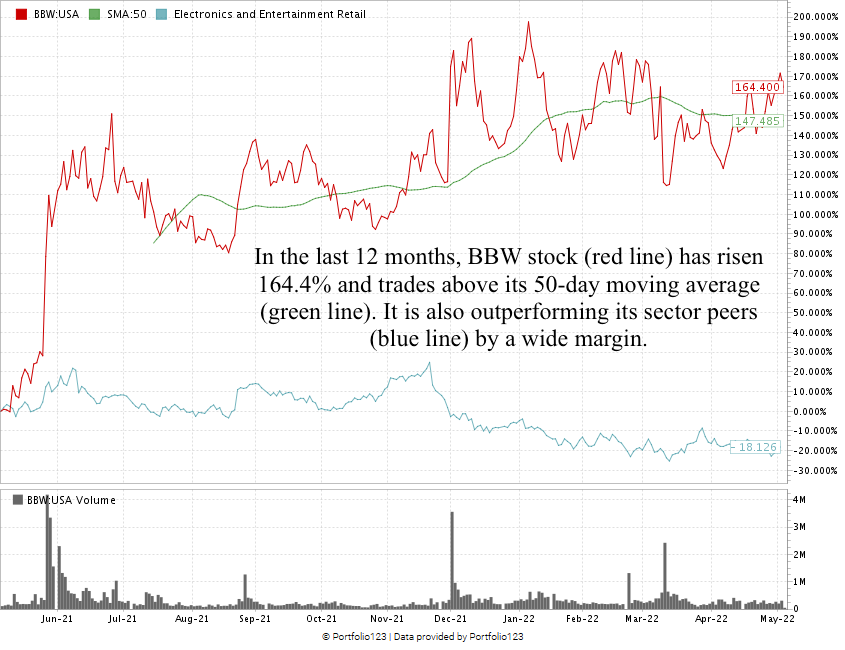

BBW stock jumped 151% in a month last year, from May to June 2021.

It reached a 52-week high in January 2022.

Despite a slight market downturn, BBW is now moving upward and could test that 52-week high in the coming weeks.

BBW is up 164.4% in the last year, decimating its peers in the electronics and entertainment retail sector, which is down 18.1%.

Build-A-Bear Workshop stock scores a 99 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Toys are never going out of style, and BBW provides a fantastic niche product that will keep customers demanding more.

Stay Tuned: Russia-Proof Energy Stock Scores a 94!

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an energy play profiting from the world’s pivot away from Russian energy.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets