As a smart investor, you look at a range of factors before buying a stock.

It all comes down to your ultimate investment goals.

From targeting specific sectors to overarching strategies like value or income investing, there are different guidelines to follow.

Today, I’m going to focus on income investing. Warren Buffett said it best:

“If you don’t find a way to make money while you sleep, you will work until you die.”

Income investors look for assets that pay out cash regularly … usually in the form of dividends.

These investments help build and maintain wealth.

And there are many ways to go about it:

- Exchange-traded funds.

- Real estate investment trusts.

- High-quality bonds.

- Mutual funds.

- Certificates of deposit.

- Business development companies.

Let’s focus on the last of that list with one low-cost business development company (BDC) stock that pays an 8% dividend.

BDCs Are Here to Help

Business development companies are financial firms that invest in small- and medium-sized companies.

They tend to invest in companies during the early stages of development.

These BDCs take capital from investors and turn it over to private companies, usually in the form of a loan.

BDCs make their money from earnings or interest payments from the private company. And they give at least 90% of that back to investors.

They help private companies that need capital and pay investors a dividend.

I found one BDC with a low stock price and an 8% dividend.

Not “That” BlackRock

You might know about BlackRock Inc. (NYSE: BLK). It manages almost $8 trillion in assets.

But you may not know about BlackRock TCP Capital Corp. (Nasdaq: TCPC).

It’s a BDC managed by Tennenbaum Capital Partners LLC, an indirect subsidiary of BlackRock Inc.

TCPC lends money to middle market companies — those with $10 million to $500 million in earnings.

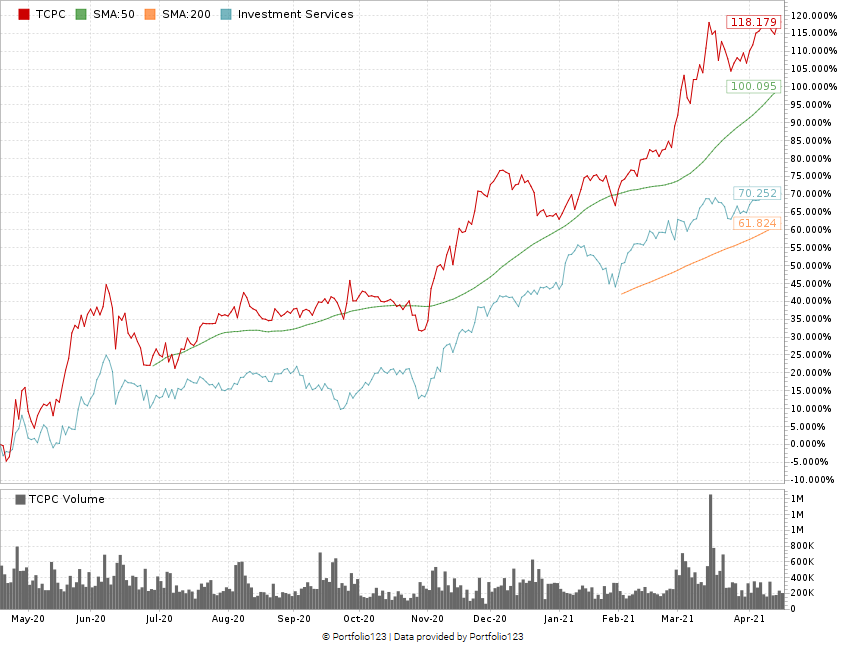

TCPC Climbs 212% Off March 2020 Lows

Over the last 12 months, TCPC’s stock price has jumped more than 118%.

What’s more, the stock is up 212% off its March 2020 low of around $4 per share.

It has almost tripled the investment services sector rise of just 70% in the last 12 months.

Looking at chief investment strategist Adam O’Dell’s six-factor Green Zone Ratings system, TCPC scores a 96 overall.

BlackRock TCP Capital Corp.’s Green Zone Rating on April 21, 2021.

That means we are “Strong Bullish” on the stock. We expect it to outperform the market by three times over the next 12 months.

It rates in the green in five of the six factors we track.

- Momentum — This stock has been in a steady uptrend for months now, earning it an 87 on this metric.

- Value — TCPC’s price-to ratios are all better than those of its investment services industry peers. Considering its low price, there’s no surprise to it earning an 87 on value.

- Growth — The company has a one-year annual sales growth rate of 40.5% and an earnings-per-share growth rate of 136.5% — giving it a rating of 84.

- Volatility — TCPC’s upside has come with very little downward movement. Any downtrend has been short-lived as the stock has rebounded to new highs … earning it a 76.

- Size — BlackRock TCP’s market cap of $843.4 million is the perfect size for our model. It earns a 72 on this metric.

And here’s the most important part of this story.

TCPC has a forward dividend yield of 8.2%, which comes out to about $1.20 per share per year.

It was paying $0.36 per share per quarter but recently dropped it to $0.30 per share per quarter at the end of 2020.

However, in the third quarter, TCPC generated a net investment income of $0.35 per share, which more than covered the $0.30 per share dividend.

The bottom line: Income investors want companies that pay nice dividends. BDCs are one way to achieve that.

More importantly, they want companies that can make dividend payments with ease from net investment income.

TCPC hits that mark and then some.

It also comes at a low cost of around $14 per share.

That’s why TCPC is one stock that deserves a spot in your income portfolio.

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.