With the broader market turning lower, I want to hit on how I use systems to find value stocks to avoid.

On Friday, I wrote about how my Stock Power Ratings system helps us separate true value stocks from dreaded value traps.

And if you’ve ever been stuck in a value trap, you know why this is important.

We’ve all been in this situation.

You buy a stock believing it to be a real steal … only to watch it get even cheaper due to deteriorating fundamentals.

Today, we’re going to look at two examples. The first is what I consider a solid value play. The second is a potential value stock to avoid.

Stock Power Ratings Reveals True Value

Take a look at Ethan Allen Interiors Inc. (NYSE: ETD).

It rates a stellar 97 on value, putting it in the top 3% cheapest of stocks in our universe.

ETD stock trades at a stellar price-to-earnings (P/E) ratio of just 5.3.

With the economy’s rocky outlook, Wall Street expects earnings to fall by a certain degree over the next year.

All the same, ETD shares trade at a forward P/E of just 6.7. (The forward P/E compares today’s prices to Wall Street’s consensus estimate of future earnings.)

It also trades at a low price-to-sales (P/S) ratio of 0.67.

To put all of this in perspective, here’s where the S&P 500 stands:

- It trades at a P/E of 18.5.

- Its forward P/E is almost triple ETD at 17.9.

- And its P/S ratio is 2.3.

I can’t guarantee that Ethan Allen’s stock price goes higher over the coming months.

We’re in a bear market, so ETD, along with every other stock in the market these days, is swimming upstream.

But I can tell you this with absolutely confidence: Ethan Allen is not a value trap.

It rates a 91 on my growth factor and a 98 on my quality factor. These are signs of a robust, healthy business with a long future in front of it.

It scores well across all six of my factors, which is why it boasts a 99 out of 100 rating overall.

But while momentum, size and volatility all factor strongly into my investment decision, they have nothing to do with whether a cheap stock is a “value trap,” per se.

That is a fundamental question rather than a technical question.

On the Flip Side: A Value Stock to Avoid

Now, let’s look at the other side of the coin.

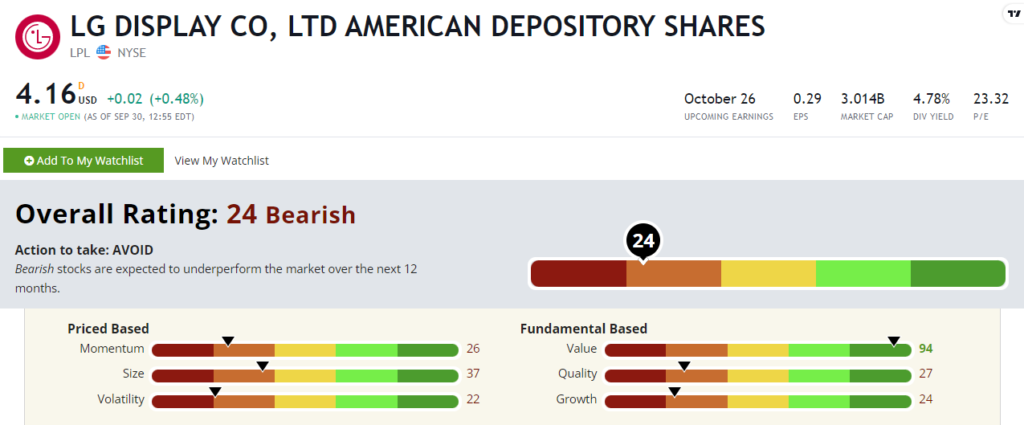

LG Display Co. (NYSE: LPL) is a leading manufacturer of TVs, monitors and a long list of other electronics.

You’ll find its products in any Best Buy, Walmart or other big box retailer. You may even own some of its tech in your home!

LG is anything if not cheap.

It rates a 94 on my value factor and trades at an almost ridiculously low P/S ratio of 0.19 and price/book value ratio of 0.36. (It looks less appealing on a P/E basis because its earnings are depressed at the moment.)

But a deeper look shows a company with significant issues.

It rates a poor 24 on my growth factor. Revenues shrank over the past 12 months by 19%!

Moreover, the quality factor isn’t much better at 27.

LG has neither profitability nor balance sheet strength, the two biggest subfactors I look at for quality. Its profitability is in the tank, and the company’s debt-to-equity ratio is a little on the high side at 96.29.

Now, I’m not suggesting that LG is going out of business tomorrow. There’s a good chance some of LG’s problems are temporary and due to the post-COVID hangover. We all gorged on electronics during the pandemic, and we aren’t buying at the same pace now that the world is back to normal.

But I also have no strong reason to believe that the company will turn things around tomorrow. This is a cheap stock that could become even cheaper if its iffy fundamentals continue.

LGL is a value stock I would avoid for now.

I’m highlighting the value factor now, because there are plenty of true value stocks that will benefit as the broader market goes lower.

In this month’s issue of Green Zone Fortunes, I dig deeper into value investing and share with you one of my favorite recommendations for the next year.

Click here to find out how you can join and be one of the first to learn about this company when my team and I drop the new issue later this month.

To good profits,

Adam O’Dell

Chief Investment Strategist