It’s the end of an era in the airline industry…

For more than 50 years, Southwest Airlines Co. (LUV) allowed travelers to check their first two bags for free, a policy that set the U.S. carrier apart from its competitors.

However, all of that changes today as Southwest ends its free checked bag policy and charges $35 for the first bag, and $45 for the second.

It got me to thinking… why?

Then, I looked at the data on how much U.S. airline carriers collect in baggage fees, and it all started to make sense.

According to the latest data from the Transportation Department, in 2023, the 13 largest U.S. airlines collected more than $7 million in baggage fees from travelers, the highest amount in a decade.

From there, I broke down the data to see how much some of the largest carriers made. Both American Airlines Group (AAL) and United Airlines (UAL) collected more than $1 million in baggage fees that year. So, it stands to reason that Southwest could collect $1 million or more in baggage fees in a calendar year.

No wonder they decided to change their policy now … just as the summer travel season kicks off.

All of this got me started down the rabbit hole … and I wanted to see how LUV stacks up with the market, its competitors and within Adam’s Green Zone Power Rating system…

LUV Stock Share Performance Uninspiring Ahead of Travel Season

With the summer season upon us, it stands to reason that if demand for something is up, its share price should follow suit.

However, demand isn’t quite where it has been in years past.

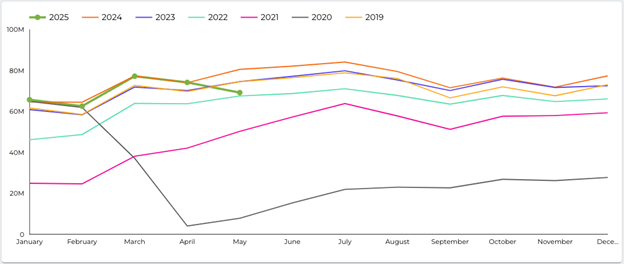

Data Shows Travel Down In 2025

According to the Transportation Safety Administration, the number of passengers passing through TSA screening has been declining (see green line in chart above) since March 2025.

Traditionally, travel picks up in the spring and summer months. However, that has not been the case this year.

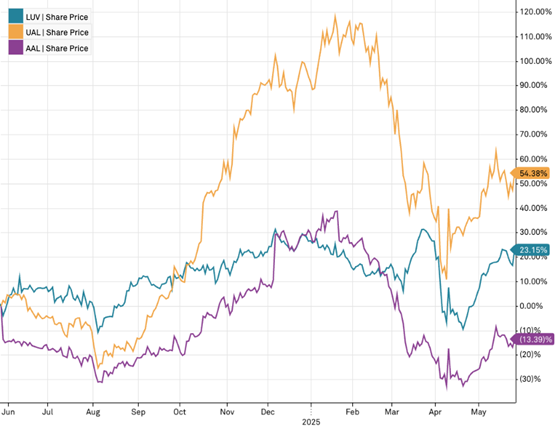

That has translated into lackluster share performance for American, United and Southwest stock:

UAL had a great run from August 2024 to February 2025, but it has given back half of those gains and is up 54% over the last 12 months.

LUV has been relatively flat after a strong push at the end of 2024. The stock is up 23% over the last year, more than double the S&P 500’s 11% gain.

AAL, on the other hand, has struggled. After a strong run to close out 2024, the stock has been on a steady decline and is down 13.4% for the last 12 months.

From here, I isolated LUV using Adam’s Green Zone Power Rating system…

LUV Stock: Weak Quality and Growth Leads to Bearish Rating

Southwest Airlines Co. (LUV) earns a “Bearish” 24 out of 100 on Adam’s Green Zone Power Ratings system.

LUV earns Bearish ratings on four of the six factors that make up Adam’s system. (To look up LUV’s full ratings page, click here to see how you can gain unlimited access to Green Zone Power Ratings.)

Focusing on Growth, where LUV rates a 23 … since August 2024, Southwest Airlines has seen a decline in both its quarterly sales and earnings per share.

After hitting $7 billion in sales in the second quarter of 2024, Southwest’s quarterly sales have dropped to $6.4 billion in the first quarter of this year.

Its earnings per share have also crossed into negative territory for the first time since Q1 2024.

On Quality, LUV earns a 21, primarily because its returns on assets, equity and investment are all nominal (ROE is just 5.6%).

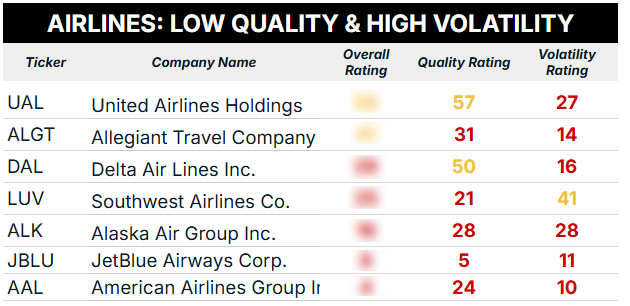

And Southwest isn’t the only airline stock that rates poorly on Adam’s Green Zone Power Rating system. Take a look:

All seven airlines rated on the system rate “Neutral” or worse overall.

All but LUV rate “Bearish” on Volatility, and only United and Delta rate above “Bearish” on Quality. This tells me we have a batch of struggling businesses with higher stock price volatility.

In all, airline stocks continue to struggle as passenger numbers decline.

For Southwest, it might take more than charging baggage fees to make LUV stock take off again in our system.

That’s all from me today.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets