Last week, the real estate sector (XLRE) led the charge during a slightly muted (and holiday-shortened) trading week.

It was a nice change after seeing tech, industrials, and consumer discretionary stocks pull a lot of the weight so far in 2025. Broader market trading breadth is always a good sign for the health of the bull market overall.

But one week isn’t a trend, and real estate is definitely in a tough spot with interest rates remaining high and a tight housing market.

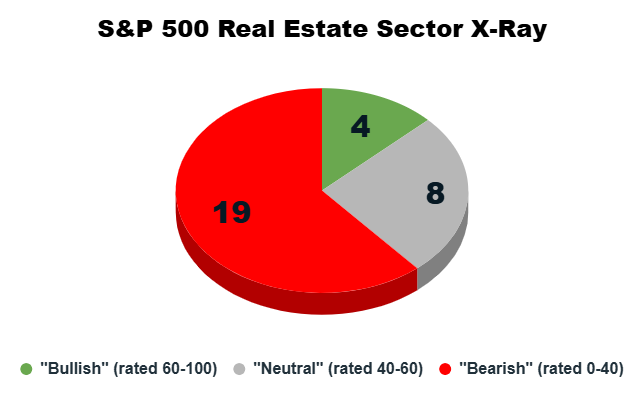

My Green Zone Power Rating system paints a clear picture below.

Let’s dig in…

Real Estate Sector X-Ray

Step #1 in assessing a sector’s strength is done simply by noting the general direction of its trend — is it “up” or “down”?

Step #2 involves judging the individual stocks within the sector, which is generally called “breadth” analysis. Most of the time, if a majority of individual stocks within a sector are sending a “bullish” message, a bullish trend in the sector’s market prices can be trusted.

Over the last six months, the real estate sector has actually lost 5% of its value during a steady downtrend. Last week’s 2.7% outperformance was quite a reversal of the trend.

It’ll be interesting to see how the 31 real estate sector stocks in the S&P 500 look when viewed individually through the lens of five of the factors that underpin my Green Zone Power Rating system.

First, we’ll consider my system’s Overall rating for each of the real estate sector’s stocks, which can broadly be categorized into one of three buckets:

- Bullish (rated 60 – 100).

- Neutral (rated 40 – 60).

- Bearish (rated 0 – 40).

The pie chart below effectively “x-rays” the 31 real estate sector stocks in the S&P 500, asking how many of them currently rate Bullish, Bearish or Neutral.

Have a look…

Right off the bat, we can see that this sector leans heavily on the “bearish” side of my Green Zone Power Rating equation. A full 61% of stocks (19) rate “Bearish” or worse in my system, meaning they are due to underperform the broader S&P 500 from here.

Only four stocks (12%) are rated as “Bullish,” so you have to really dig through the fund to find those stocks worth investing in.

Next, let’s examine the characteristics of individual factors of these stocks based on my system…

Real Estate Stocks Trade at a Premium

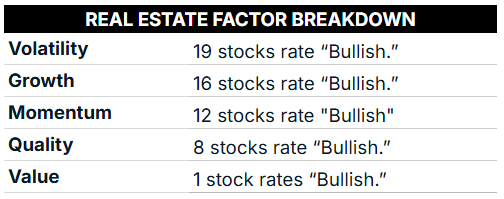

Beyond looking at each stock in the sector’s overall Green Zone Power Rating, we can also see its positive aspects by checking how many rate bullish or better on individual factors.

Here, I’ve listed in descending order the factors with the most “bullish” stocks. As always, I have left the size factor out of the equation since all of these are S&P 500 stocks with large market caps, marking a qualifier for landing on the index. Here’s how the real estate sector shapes up:

Looking at this breakdown, I’d characterize the sector as mostly steady (low-volatility) with solid growth, but almost every stock trades at a premium based on low Value factor ratings.

Only one stock rates “Bullish” on my Value factor, meaning 30 of 31 stocks have had their stock prices bid up by investors as they chase growth in the sector. Roughly half of the fund (16 stocks) are rated “Bullish” on the Growth factor, and only 12 are rated “Bullish” on Momentum, which means investors are paying out the nose and possibly not getting rewarded for it.

We’ll have to wait and see if this positive trading trend in XLRE continues. This sector could become very strong if investors pivot away from tech in the hunt for greater gains in the ongoing bull market.

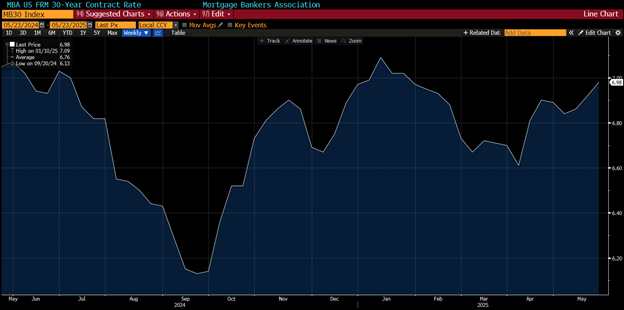

Of course, with 30-year mortgage rates stuck in a range between 6% and 7% for the last year, we’re still dealing with an expensive real estate market. And the Federal Reserve doesn’t seem to be in a rush to bring interest rates down.

30-Year Mortgage Rates Stuck in a Range

To close, I wanted to highlight the one stock within XLRE that boasts a “bullish” Value rating. That stock is Host Hotels & Resorts Inc. (HST), which has a “neutral” overall rating of 44 out of 100. Neutral stocks are slated to track the broader market’s performance over the next 12 months.

If you’re a paid-up Green Zone Fortunes subscriber, click here to see HST’s full ratings page (non-members can see how to join by following that link as well).

That’s a wrap for today. Matt Clark will hit you with a new edition of What My System Says Today … tomorrow!

To good profits,

Editor, What My System Says Today