But, stocks are on a roller coaster ride. If you’re getting a bit nauseous with the violent day-to-day swings, you may appreciate a little stability to balance out your portfolio.

Whether you’re looking for dividends, sanity or both, you’ve come to the right column. Let’s take a spin around Bondland and rank ’em worst to first.

It will be worth your time, as we will highlight some bond vehicles that will provide you with actual meaningful income. I know, it’s hard to believe in any bonds when most of them max out at 2% or so today. But it is possible to find real income in fixed income — we just have to hunt off the beaten trail.

Avoid Yesterday’s News: Floating Rate Bonds

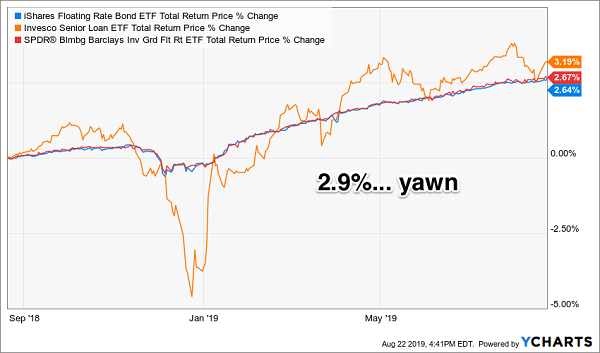

I know it’s obvious, but if you are still hanging on to any floating rate bond funds, it is time to sell. It made sense to hold these in 2016, 2017 and 2018 when rates were trending higher, because “floaters” pay more and more as rates tick higher and higher.

Without that catalyst, these vehicles will put you to sleep. For example, the three largest ETFs have turned in a pedestrian 2.9% average return.

Floating… Just Barely

Also, without interest rate upside, these funds lean too much on “perceived safety.” They strive to buy floating rate US Treasuries but in reality they own more investment grade corporate debt (as businesses issue the majority of floating rate bonds). But competition for investment grade bonds is high, as big buyers like pension funds can only buy debt that is blessed by the ratings agencies.

The result? Low yields. In a moment, I’ll show you how to boost your income from similar bonds without increasing risk. First, let’s review the “next worst” type of bond to buy right now.

Ring the Register On: U.S. Treasuries

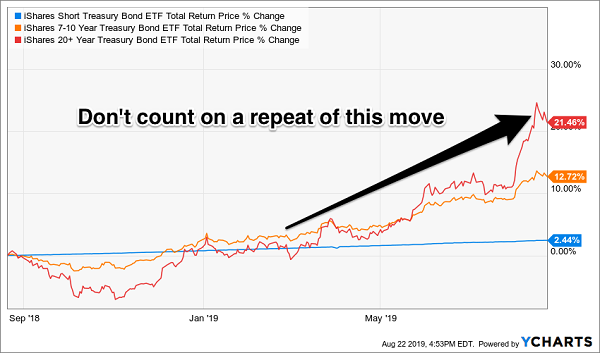

The past 12 months was about “as good as it gets” for U.S. Treasury bonds. Their yields collapsed, especially recently, and their prices soared. Investors who held popular Treasury ETFs enjoyed once-a-generation windfalls from these safe bonds:

The Impromptu Party in Long Duration Treasuries

This party is unlikely to last because, well, it’s running out of room. Even if long rates do go to zero, the 10-year pays just 1.6% today. A breather is in order.

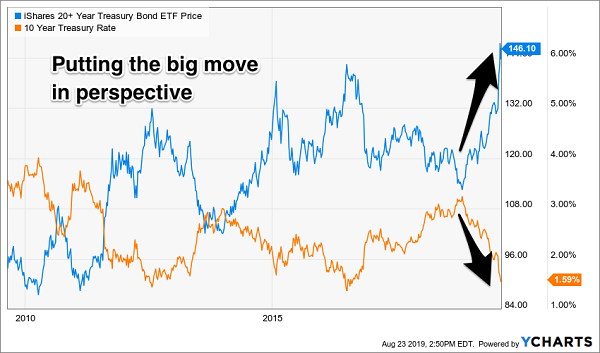

Let’s put the recent rager in perspective. Here’s the last decade in bond prices versus the iShares Treasury 20+ Year Treasury Bond (TLT), the ETF that went bonkers. It doesn’t happen often:

Bond Prices Rarely Go “Parabolic”

Remember, over the long run, bonds return their yields. If you buy something paying 1.6% today, that’s roughly the total return you should reasonably expect in your portfolio.

This is what tempts investors to buy the popular “junk bond” ETFs. These funds can be OK investments, but they always make me a bit nervous.

Be Careful With: Junk Bond Funds Like HYG and JNK

The most popular “junk bond” tickers have a few fatal flaws that’ll doom you to underperformance at best, or leave you hanging in the event of a market meltdown at worst.

Let’s pick on the widely followed and owned iShares iBoxx High Yield Corporate Bond ETF (HYG) as an example. It has attracted $15 billion in assets because:

- It’s convenient — as easy to buy as a stock.

- It’s diversified (for better or worse, as we’ll see shortly) with 981 individual holdings.

- It pays — 5.6% today, to be specific.

The accessibility of funds like HYG seems cute and comfortable enough. But remember, ETFs are marketing products. They are designed to attract capital and not necessarily earn you a return on it.

Big money is spent on television, print and online advertisements. Less cash and thought are put into the actual income strategies that ETFs employ, and their lagging returns reflect it.

And here’s the “market meltdown” kicker on why you should always avoid bond ETFs:

They are subject to meltdowns if panic selling occurs.

If you sell HYG today, you’ll get your money in exchange for your shares. And it will be iShares’ problem to settle up their end (by selling those 981 bonds en masse).

Problem is, we’re talking about bonds rather than stocks here, and there is no readily available liquid market for those bonds. Which means if a lot of selling occurs, HYG itself may take a hit if it has to unload its bonds at a discount (say, 70 or 80 cents on the dollar) to meet investors’ withdrawals. It may have to sell at any price!

We contrarians should instead focus on lesser known funds that can actually liquidate positions without dissolving their entire market.

Better Bets: ETFs and Mutual Funds Paying Up to 6.4%

Recently we discussed 21 safe bond funds that pay up to 6.4%. I gave the list to my money manager friend who was looking for fixed income ideas that actually pay. Then, I shared it with you in the article itself.

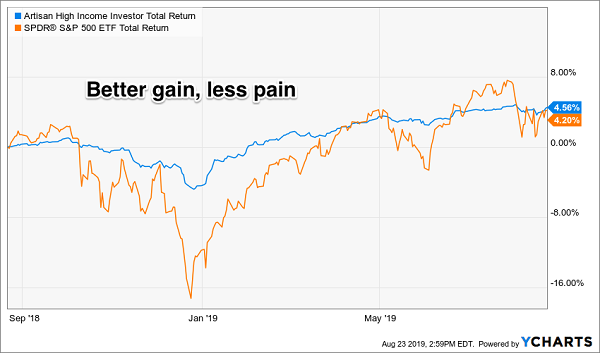

Most of these funds never go down. That’s nice during pullbacks and times of volatility like these. Let’s take one of my favorites, the Artisan High Income Investor Fund (ARTFX), which pays a steady 6% and never goes down. Its investors have enjoyed a more profitable last 12 months, minus the drama, too!

Better Return, Less Heartburn

Another advantage to these rock-solid funds? Their “betas” are in the basement at 0.2 or below. This means if the S&P dropped 2% this afternoon, we’d expect these bond prices to move just a fraction of that. They may even move up as stocks move down.

(Again, you can click here to review our recent discussion of these 21 fixed income “silver medalists.”)

My only problem with ARTFX (and its steady bond brethren) is that their prices never go up much, either. Their collective “ceiling” prevents me from formally recommending them to my Contrarian Income Report subscribers. After all, with 7%+ yields and 11% total returns since inception, we can’t have dead weight slowing us down.

For double-digit returns from safe bonds, we must move beyond all of this mainstream nonsense. Mutual funds and ETFs simply won’t do. The good news is that we can boost our returns without taking on additional risk. Here’s how.

Best Bets: CEFs That Pay 8% and Trade for 85 Cents on the Dollar

Aberdeen’s Asia-Pacific Income Fund (FAX) is a closed-end fund (CEF). It trades like a stock or ETF, yet management cannot issue or remove shares at will (hence “closed”).

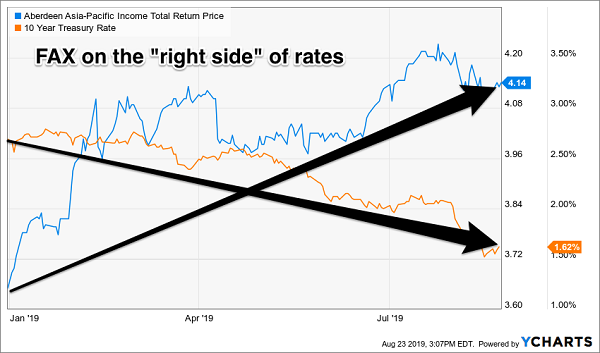

The fund pays 8% today and demonstrates how we contrarian-minded income investors profit from out-of-favor bond funds in 2019. As we’ve been discussing recently, interest rates in the Europe, Japan and now the US are once again heading toward zero (or lower) This is a nightmare for bond investors looking for income, but it’s a dream for FAX longs like us.

FAX buys safe government and corporate bonds that pay 6%, 7% and even 8% or more. Its portfolio increases in value with each decrease in rates here in the US. Its NAV is up 2.5% in the last three months alone. If you believe that rates are more likely to head lower than higher, then funds like FAX are great places for income and price appreciation:

Just the FAX: 10-Year Yield Down, NAV Up

Thanks to its closed-end fund nature, FAX trades at a 15% discount to its NAV. This means we’re able to buy its collection of bonds for just 85 cents on the dollar. Contrast this with mutual funds and ETFs, which always trade around “par”–100 cents on the dollar.

Why the discount? There are protestors in Hong Kong, tariffs coming from China and FAX’s middle initial starts with “Asia.” No joke, discounts in CEFville can often be this obvious. (Reminds me of when everyone dumped anything “energy.” There were bargains to be had. Just like Asia today.)

With a market cap of barely a billion dollars, billionaires can’t swoop up this discount like you and me. Someone putting millions or more into one of these funds would move the price and eliminate the discount he or she was trying to buy. Fortunately, we don’t have these country club problems.

More Best Bets: Safe Dividend Machines That Pay 10% Today

But what if you need more income? Our newest “perfect income play” pays a safe 10%.

That’s right. 10%. Safe.

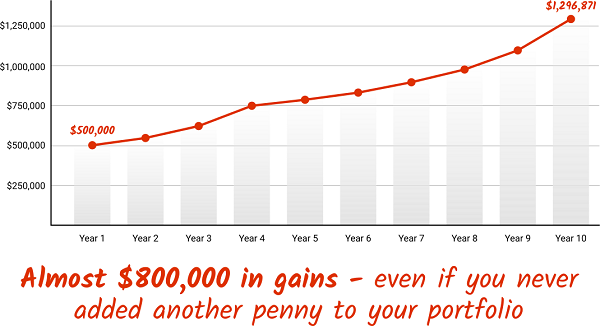

Put $50,000 into this stock and you’ll see $5,000 per year in dividends. Or $50,000 in annual dividends on a relatively modest $500,000. You get the idea.

What’s the ticker? Well, that’s what I’m here to show you today.

After years of keeping it my personal secret, I’m finally revealing my Perfect Income Portfolio. A simple, proven, and time-tested strategy you can use to double, triple, even quadruple your income — almost immediately!

Plus, I’m also going to give you three specific investments you can buy right now for maximum income combined with maximum stability!

This is a strategy I could easily charge thousands of dollars for.

But today, I’m handing you the keys to the kingdom right here on this page.

All you’ve got to do is take action and implement what you’ve discovered. If you want to take charge of your retirement income, you can easily build a portfolio which returns 10%+ per year — without ever having to withdraw from your savings.

Now, compare this to the S&P 500’s 1.9% dividend and we’re talking about a $40,500 difference on a $500,000 portfolio—every single year. That’s the sort of life-changing money that can provide true security and freedom.

Best of all, as you’ll see today, it only takes a few minutes to set up this vastly more profitable portfolio.

When I talk about the Perfect Income Portfolio, I’m speaking about a collection of safe dividend stocks and funds that:

- Pay you 7%, 8% or more consistently and predictably — even if there’s a crisis, crash or pullback.

- Give you a safe, secure, and steady income of $10s of thousands per year in cash — not just “paper gains.”

- Pay out exclusively from your investment income and NOT require you to withdraw cash from your savings or assets.

- Avoid overly-complex, high-risk investments that can wipe out decades of hard-earned money in a matter of weeks or months.

- Are simple to set up and simple to manage — so you’re not glued to your screen all day and you can actually enjoy life.

- Are backed up by a proven track-record of 10% total returns per year since inception.

As I mentioned, this was built from years of painstaking research, trial and error, and financial modelling. I designed it for my own personal portfolio and my desire to enjoy a large income … without exposing myself to too much risk or withdrawing from my savings.

And, in the obsessive pursuit of this goal, I quickly realized traditional income strategies just weren’t going to cut it.

So, instead of listening to the mainstream advice like … invest in the Dividend Aristocrats … withdraw 4% per year … lower your expenses … cut back on luxuries … I decided to carve my own path instead.

This journey led me to uncover three little-known investment ‘vehicles’ that can safely and securely double, triple or even quadruple your income —almost immediately.

So, right now, I’m pulling back the curtain and showing you how you can build the Perfect Income Portfolio today. Click here and I’ll show you how to get access to my full research, recommendations and stocks to buy today (including their tickers and buy prices).

To learn more about generating monthly dividends as high as 8%, click here.

• This article was originally published by Contrarian Outlook. You can learn more about Brett Owens and Contrarian Income Report right here.