Editor’s note: Join our new YouTube membership program here! You’ll gain access to more exclusive cannabis content every week. Follow to link above to join us now, and read more about the YouTube join feature below.

In today’s Marijuana Market Update, I answer a reader question about AdvisorShares Pure US Cannabis ETF (NYSE: MSOS) and compare it to a couple of other ETFs on the market.

About MSOS Cannabis ETF

Recently, Joe emailed me and asked:

What are your thoughts on MSOS? I saw that the ETF covers a range of cannabis stocks, some on your watchlist. I felt this a better use of capital instead of holding a larger number of stocks. Thank you for your time, Joe.

Thanks for your question, Joe. I’m happy to look into MSOS for you.

The exchange-traded fund (ETF), managed by AdvisorShares Trust, was created in September 2020. It invests in cannabis and hemp companies in the United States.

That’s where it differs from AdvisorShares Pure Cannabis ETF (NYSE: YOLO) — another AdvisorShares cannabis ETF.

YOLO invests in global cannabis companies, while MSOS only invests in companies listed in the U.S. However, only a small portion of YOLO’s holdings are outside the U.S. and Canada.

It does, however, mean that MSOS can hold the stocks of Canadian companies — by investing in their U.S. tickers.

MSOS uses what are called derivatives (in the form of swaps) to create the portfolio. More specifically, MSOS uses total-return swaps. They swap total return on an asset for a fixed interest rate.

For example, you could pay a fixed rate to one person in return for the appreciation and dividend payment for a pool of stocks.

It presents counterparty risk, which is when the counterparty (the entity MSOS is dealing with) cannot fulfill its contractual obligation to pay the capital appreciation and dividends.

The top holdings in MSOS are:

- Curaleaf Holdings Inc. (OTC: CURLF)

- Green Thumb Industries. Inc. (OTC: GTBIF)

- Trulieve Cannabis Corp. (OTC: TCNNF)

- Cresco Labs Inc. (OTC: CRLBF)

- AYR Wellness Inc. (OTC: CNBQF)

And, Joe is correct. MSOS holds a few of our Cannabis Watchlist stocks. (For more about the Cannabis Watchlist, check out our YouTube community, where I provide a weekly video update on the watchlist and more.)

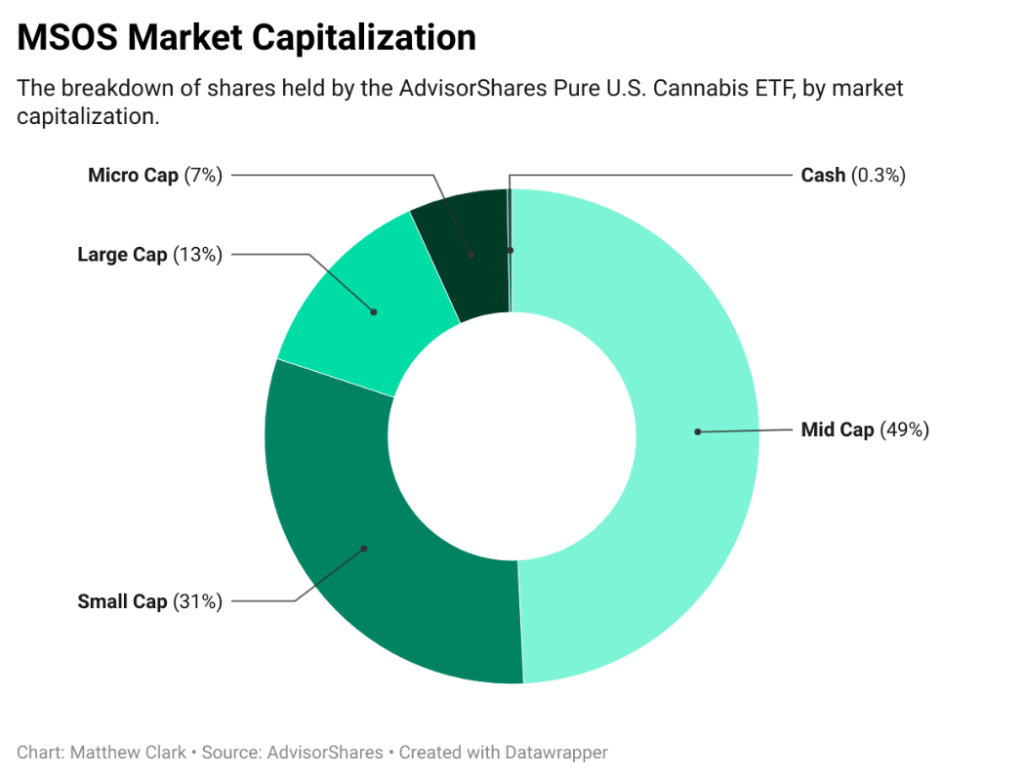

As you can see in the graph above, the ETF invests primarily in mid-cap stocks — companies with market capitalizations (share price times number of shares outstanding) between $2 billion and $10 billion.

Around 31% of its holdings are small-cap stocks — companies with market caps between $300 million and $2 billion.

In terms of performance, MSOS has done well over the long term.

How MSOS Stacks up to Other Cannabis ETFs

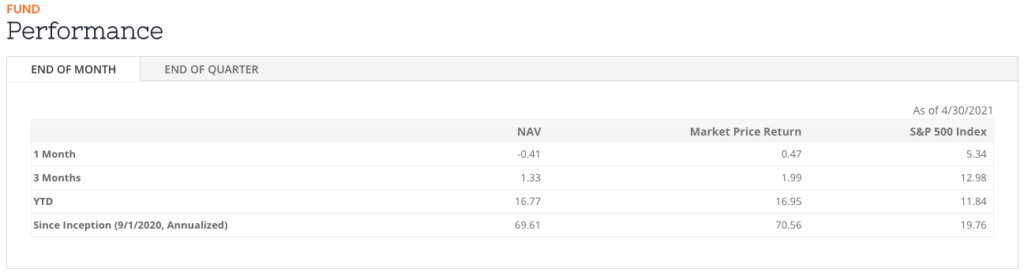

Take a look at the table above. MSOS’ market price return since it launched in September 2020 is 70.56% on an annualized basis.

To compare, the S&P 500 index returned 19.76% during the same time.

However, let’s look at MSOS’ short-term performance.

In the last three months, the ETF returned about 2%, compared to 13% for the S&P 500.

So, if you invested $100 in MSOS when it launched, you made $170.56, compared to $119.76 if you invested the same $100 in the S&P 500.

If you invested $100 in MSOS three months ago, your return is around $102 compared to $113 if you invested in an ETF tracking the S&P 500.

You’ll want to keep the short-term return in mind if you’re considering buying MSOS.

To compare, let’s look at MSOS against similar cannabis ETFs YOLO and MJ (ETFMG Alternative Harvest ETF):

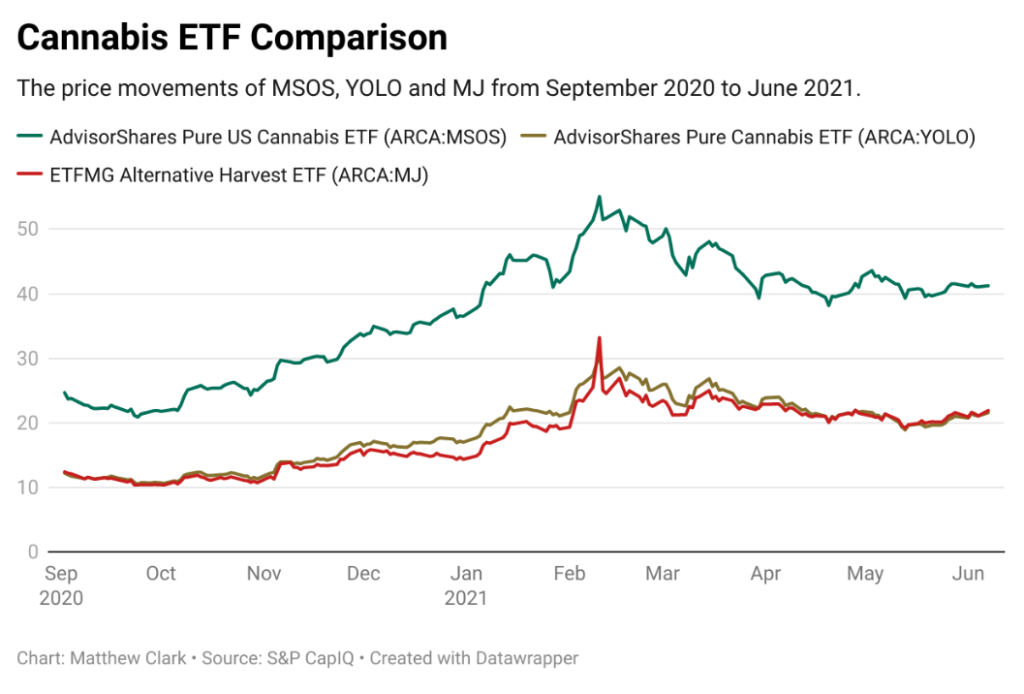

I plotted all three on the chart above, so you can see the similar price movements.

That is because they invest in similar baskets of stocks.

However, I found subtle differences.

Because MSOS only invests in stocks listed on U.S. exchanges, the ETF has missed some international cannabis stock gains.

Since September 2020, MSOS has risen almost 70%, whereas both MJ and YOLO jumped nearly 77% during the same time.

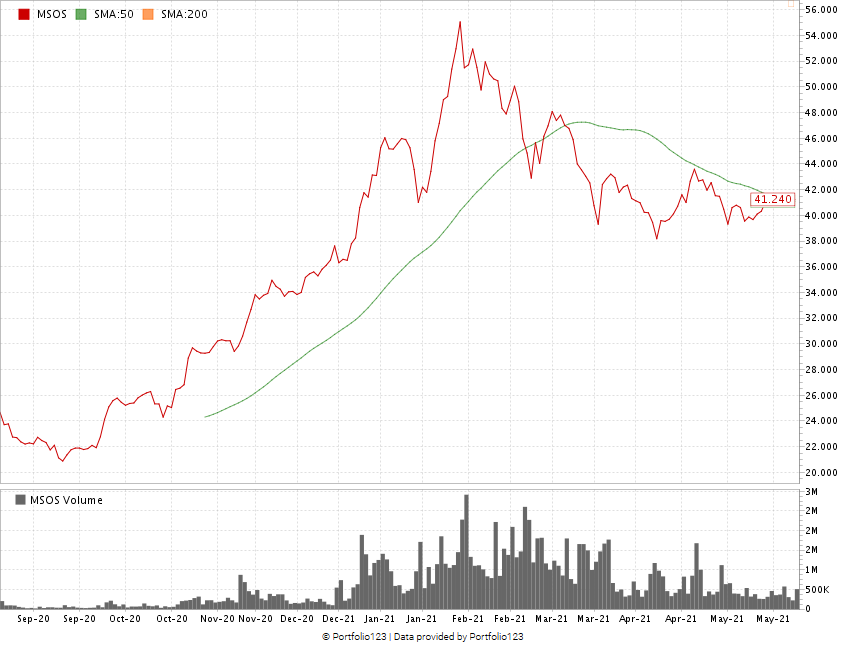

MSOS Stock (Red) Pares Back Gains After January ’21

From the chart above of MSOS’s stock performance, we can see the ETF reached a high price of around $55 per share in late January 2021.

It has since pared those gains back a bit — the cannabis industry has faced some headwinds due to a lack of activity on U.S. federal legalization — and trades around $41 today.

Takeaway

You could do worse than investing in MSOS if you want broad exposure to the cannabis market.

However, you could also do better.

Both YOLO and MJ start at a lower price point (around $22 per share today).

Plus, because YOLO and MJ have more exposure to international cannabis stocks, their returns have been better.

The net expense ratio — the measure of operating costs to assets — is the same for all three funds (0.75). This takes the total fund costs and divides them by the total fund assets.

And I will tell you that I’m looking at one ETF to add to our Cannabis Watchlist in the near future. (On that note, click here or on the image below to participate in our Poll of the Week!)

I talk more about our Cannabis Watchlist in a separate video as part of our YouTube membership community.

Speaking of which…

New YouTube “Join” Feature

The newest additions to our YouTube channel are available to you! Just click “Join” on our channel’s homepage to find out how you can become a part of this great new community.

Click here or watch the video below to get the full story:

After a lot of hard work from the team, we’re thrilled to announce that we’ve enhanced our community by creating a new membership opportunity.

After a lot of hard work from the team, we’re thrilled to announce that we’ve enhanced our community by creating a new membership opportunity.

Before you ask, nothing you see now will change — I’ll still bring you cannabis market insight each week.

However, we’re offering members new exclusive content, including:

- Interviews with cannabis insiders.

- Blog posts, stock analysis and company breakdowns.

- More content related to our Cannabis Watchlist.

- Monthly live chats with me, where we’ll discuss cannabis stocks, the cannabis sector and much more.

To find out more, please click here.

That said, I want to thank all of you who watch our videos. We do it because we want to bring you the best insights into cannabis and investing.

If you do have a cannabis stock you’d like me to look at or want to share your thoughts on our community expansion, email me at feedback@moneyandmarkets.com.

Where to Find Us

Coming up this week, we’ll have more on The Bull & The Bear podcast and our Money & Markets Week Ahead, so stay tuned.

Don’t forget to check out our Ask Adam Anything video series, where we ask your questions to Chief Investment Strategist Adam O’Dell.

Green Zone Fortunes co-editor Charles Sizemore also has a weekly series called Investing With Charles, where he breaks down dividend investing each week.

Remember, you can email my team and me at feedback@moneyandmarkets.com — or leave a comment on YouTube. We love to hear from you!

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.