Yesterday, nearly 10 stocks trading on the New York Stock Exchange traded higher for every one stock that traded lower — an unusually lopsided (and bullish) ratio.

Those animal spirits have also carried over to today’s session, where we’re seeing a similarly bullish ratio of 9-to-1.

Today, we’ll have a look at the widely followed Nasdaq 100 index, which is comprised of the largest 100 stocks trading on the Nasdaq exchange and is notoriously “tech-heavy.”

We’ll see which Nasdaq 100 stocks are catching the strongest bids…

I will also assess these stocks’ longer-term potential through the lens of my proprietary Green Zone Power Rating system, which rates stocks between 0 and 100 across six factors proven to drive market-beating returns.

Let’s get to it!

Before You Get Too Excited About This Rally

As of this morning, the Nasdaq 100 remains 14.5% from its February 19 high. This is after reaching a low of -23% on April 8, a day before Trump announced the current 90-day pause on across-the-board tariffs originally announced on April 2.

But get this…

Individual stocks in the index are showing a massive range of drawdown depth — between -1% and -63%.

That’s incredible!

Whereas Monster Beverage Corp (MNST) needs to rally just a percent or two before reaching “new highs” territory … The Trade Desk Inc. (TTD) will need to gain 168% from here to recover its 63% drawdown.

I should have mentioned that stocks bounced yesterday when Treasury Secretary Scott Bessent said he expects “there will be a de-escalation” in Trump’s U.S.-China trade war in the “very near future.”

It’s an encouraging signal, for sure.

But based on one quick study I ran this morning, it appears many investors are using the news as an excuse to buy the market’s most beaten-down names.

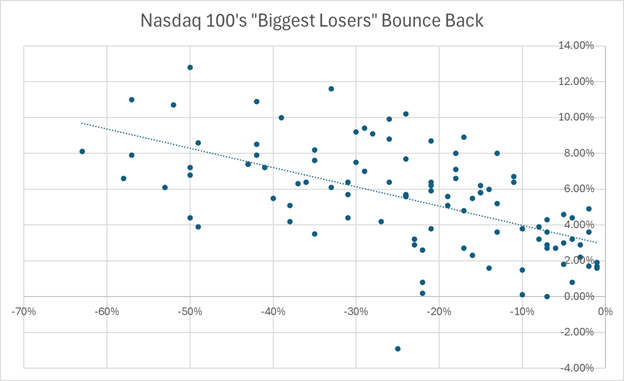

Here’s a scatterplot of Nasdaq 100 stocks. On the x-axis is the depth of drawdown for each stock, while the y-axis shows how strongly each has rallied off Monday’s close (as of 9:35 a.m. ET this morning):

The inverse relationship seen here is an indication of investors’ enthusiasm to buy the index’s “biggest losers.”

Is that a good idea?

Probably not.

The “Green Zone Advantage”

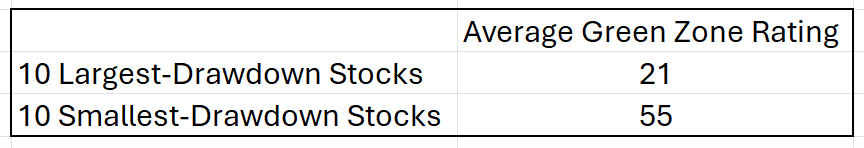

Another quick study I ran showed that low-drawdown stocks are rated far better on my Green Zone Power Rating system than high-drawdown stocks:

For reference, a Green Zone rating of 21 is “Bearish” and just one point away from my “High-Risk” category.

Meanwhile, a rating of 55 is “neutral,” but just five points shy of earning “bullish” status.

Long-time Green Zone Fortunes subscribers know well that buying stocks with higher ratings is key to building a portfolio of market-beating stocks over the long run.

So I’ll caution you against using the depth of a stock’s current drawdown as a proxy for “good value” if you’re looking to buy this dip!

What’s more, while the Nasdaq 100 is one of the most popular stock indexes … it by no means is the “only game in town,” and may, in fact, lead you to invest in poorly-rated stocks.

Consider one final study for today…

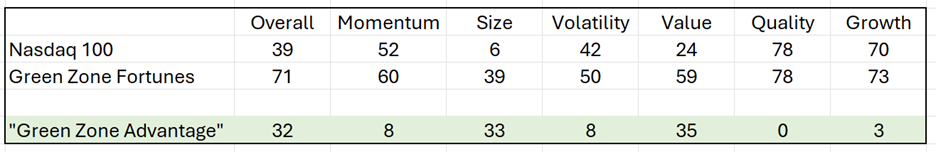

My Green Zone Fortunes portfolio currently holds 26 stocks versus the 100 stocks in the Nasdaq 100.

I ran them all through my Green Zone Power Rating system to see how our portfolio compares … is it poised for more market-beating returns ahead?

You bet it is! Have a look…

As you can see here, the average overall rating of the 26 stocks I’ve recommended in Green Zone Fortunes is a “Bullish” 71 out of 100. That compares to a “Bearish” average rating of 39 out of 100 for the Nasdaq 100.

What’s more, not only does our portfolio rank higher on my system’s overall rating … it beats out the Nasdaq 100 on each of the system’s six individual factors, with the exception of Quality, where the two tie.

All told, I truly believe my Green Zone Fortunes portfolio is “the better way” … whether or not we actually see meaningful de-escalation of the trade war, as Bessent is hinting we will.

Until next time…

To good profits,

Editor, What My System Says Today

P.S. If you want full access to my system, click here to see how you can join Green Zone Fortunes today.