I grew up in Kansas.

I didn’t live on a farm, but my dad did.

His family works on that farm in south central Kansas to this day.

I still remember my dad’s stories about how hard it was on the farm.

Not the work, mind you, but the ability to make money. The price to sell, say, wheat or corn never really allowed for a lot of profit when you compare the cost to plant those crops.

Now, farmers planting corn and soybeans have extra incentive to produce those two crops … biofuels.

You see, biofuels are transportation fuels (think ethanol) that are made from biomass materials … like the oil that comes from corn, soybeans and even animal fats.

The biofuel industry is now a multibillion-dollar market … and it seems to keep growing.

I used Money & Markets Chief Investment Strategist Adam O’Dell’s Green Zone Ratings system and found a biofuel stock that has the potential for 65% gains over the next 12 to 36 months … with the possibility of even more.

I’ll talk about that in a second.

First, I’ll tell you about the biofuels industry, where it’s going and why it matters.

Tax Credits Fuel Bio Movement

It seems that no matter the price of a gallon of gas is, it’s always too high.

Couple high gas prices with carbon emissions from gasoline-powered cars, and you have the potential for a movement.

Enter into the picture: biofuels.

Lawmakers in Washington decided to give a leg up to the biofuel industry by providing a $1 tax credit for every gallon of biofuel produced.

That’s created a boom in the biofuel industry.

Biofuel Market Value to Jump by 2024

I’ve found a biofuel stock that has the potential for strong double-digit gains in the next 12 to 36 months.

This Biofuel Stock Has a 65% Upside

With at least a 13% increase in the market value of biofuels in the next four years, companies with a strong presence in the market today will flourish.

Renewable Energy Group Inc. (Nasdaq: REGI) produces and sells low-carbon transportation fuels in the U.S. and internationally.

Components of their advanced biofuels include:

- natural fats

- oils

- greases

- distilled corn

- and used cooking oils (such as soybean and canola)

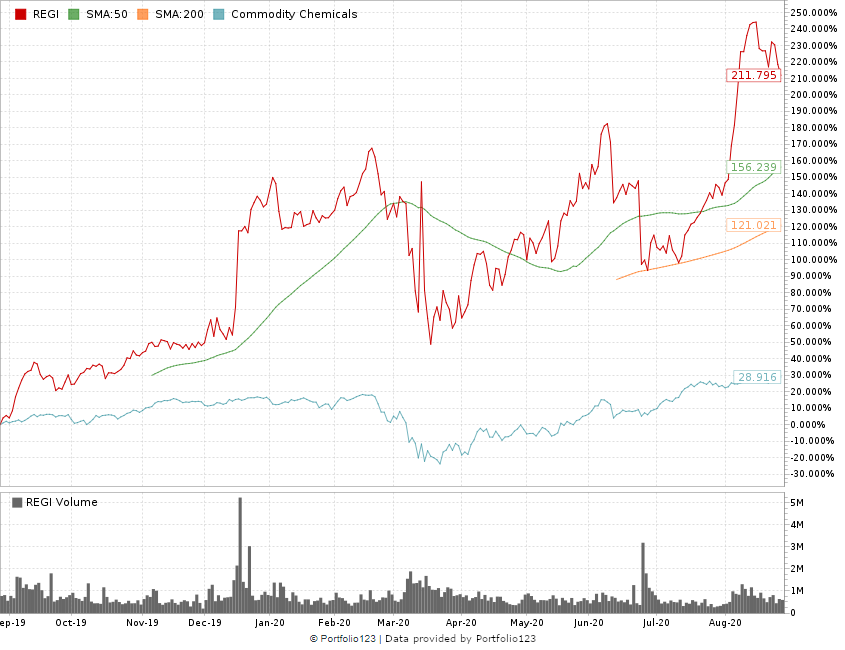

This biofuel stock has climbed in recent months:

REGI Jumps Triple Digits Since March 2020

As you can see, REGI stock dropped in March 2020 along with the rest of the market.

However, it’s climbed more than 100% since then.

In 2020, REGI navigated a rough coronavirus-filled second quarter and came out the other side with a net profit and a rebound in prices that sets the company up for an even stronger Q3.

REGI experienced a loss of $58 million in net income from operations in Q2 2019. The company turned things around and reported net income of $1 million in Q2 2020 — a $59 million turnaround in a year.

Renewable Energy Group earns a ranking of 99 overall on Adam’s Green Zone Ratings system. This means only 1% of the rest of the market is better. Its highest marks come in quality, value and growth.

Let’s take a closer look at how REGI rates:

- Quality — Renewable Energy Group rates a 97 on quality. It has strong returns on investment, assets and equity as well as good cash flow and marginal debt.

- Value — On value, REGI earns a 97, based in large part on price-to-sales, price-to cash flow and price-to-book ratios that beat the rest of the commodity chemical industry. Its current value suggests REGI is likely to outperform in the future.

- Growth — The company rates a 96 on growth because of a 762% one-year annual earnings-per-share growth rate and a 21.6% annual growth rate in sales.

What You Should Do With Renewable Energy Stock

These metrics and Renewable Energy Group’s overall ranking on Adam’s system leads us to a strong bullish position on the stock. We consider this stock a “buy,” as we expect it to outperform the market by three times over the next 12 months.

Analysts at BWS Financial Inc. have rated REGI a buy and set a 12-month price target of $58 per share.

That’s an upside of more than 65%!

BWS issued its guidance the day after Renewable Energy Group issued its strong Q2 earnings.

The bottom line: Renewable Energy Group is already a leader in the biofuels industry. As that industry continues to grow, so will REGI’s stock. Now is the time to jump in to take advantage of the double-digit gains to come for this biofuel stock.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.