COVID-19 pushed biotechnology companies into overdrive in search of a vaccine.

From big vaccine producers to smaller companies that provide DNA to test those vaccines, the entire industry shifted into high gear.

And stocks within the industry followed suit.

Investors piled into biotech stocks right after the March 2020 COVID-19 crash.

Biotech Index Jumps Triple Digits After March 2020

From March 2020 to February 2021, the S&P Biotechnology Select Industry Index jumped 168%.

Then, the tech sell-off happened. Investors moved out of growth stocks and into value-based stocks.

This recent sell-off of biotech stocks is cyclical and not likely to last. The broader Nasdaq Composite already regained most of its losses. It even hit new record highs last month!

Typically, I reserve this space to find you a great stock to buy from our weekly hotlist.

Pro tip No. 1: You can still access our weekly hotlist here.

But this is the perfect opportunity to buy into high-growth biotech stocks at a reduced price.

It’s just a matter of finding the right company within one of the hottest — yet unknown — sectors of the market. That’s where Adam O’Dell’s Green Zone Ratings system comes in.

SIGA Technologies Brings Security to Biotech

The stock I’m sharing with you today is SIGA Technologies Inc. (Nasdaq: SIGA).

SIGA creates therapies for rare and infectious diseases. It has a partnership with Cipla Therapeutics to continue developing drugs against various biothreats.

According to SIGA, its smallpox treatment TPOXX was one of the first small molecule therapies delivered to the Strategic National Stockpile (SNS).

The SNS is a government program aimed at accelerating research and development of “effective medical countermeasures against chemical, biological, radiological and nuclear agents.”

SIGA’s Small-Cap Fluctuations

SIGA is a very small company with a market cap (number of outstanding shares times share price) of just $560 million. Its stock price will fluctuate.

However, just about every time the stock price dipped, it rebounded to test even higher than before its dip.

SIGA recently pared back from around $7.60 per share to $6.90, meaning it’s set to test that high mark again.

Its 50-day moving average (green line in the chart above) is on pace to overtake the 200-day average (orange line), signaling another potential uptrend.

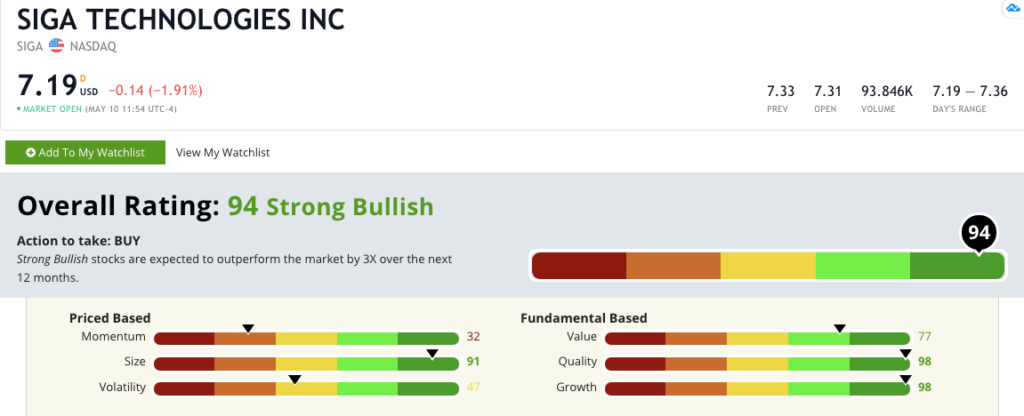

SIGA rates a 94 overall on Adam’s Green Zone Ratings system. That means we are “Strong Bullish” on the stock and expect it to outperform the broader market by three times in the next 12 months.

SIGA Technologies’ Green Zone Rating on May 10, 2021.

SIGA rates in the green in four of our six factors:

- Quality — Returns on assets, equity and investments are all above 50% for SIGA. Average return-ons for the rest of the specific biopharmaceuticals industry are below minus-50%. SIGA earns a 98 on quality.

- Growth — SIGA has a one-year annual sales growth rate of 367% and a one-year annual earnings-per-share growth rate of 572%. That massive growth earns the company a 98 on our growth metric.

- Size — As I mentioned before, SIGA is a very small company with a market cap of just $560 million. That is a great size for our model, and it gives SIGA a 91 on the metric.

- Value — The price-to ratios for SIGA are all in single digits compared to the industry averages that are significantly higher. For example, SIGA’s price-to-earnings ratio is 8.98 compared to the industry average of 55.81. That gives SIGA a 77 on value.

Its back-and-forth price movement over the last 12 months is the primary reason why SIGA rates a 32 on momentum and a 47 on volatility.

Remember, this stock’s price is lower. Be prepared for some price fluctuations.

But its high growth, high quality and high value more than make up for these weaker ratings.

The bottom line: There are a lot of threats out there that we can’t even see.

SIGA is a company on the front lines of developing therapies against potential bio attacks. It works to protect us against nefarious actors looking to harm us in unconventional ways.

And SIGA’s stock is trading at a discount with the potential to pop higher as investors rotate back into the tech sector.

That’s why SIGA Technologies Inc. may be the perfect biotech stock for your portfolio.

Pro tip No. 2: Chief investment strategist Adam O’Dell and Green Zone Fortunes co-editor Charles Sizemore are bullish on biotech. They’ll reveal their next biotech stock recommendation this week in May’s monthly Green Zone Fortunes issue. I urge you to check out Adam’s presentation on what he calls “Imperium.” He’s confident this DNA trend has the potential to be bigger than internet stocks in the ’90s. Click here to find out more. If you subscribe to Green Zone Fortunes today, you’ll find out how to get in on the ground floor with Adam and Charles’ next biotech recommendation.

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.