My 19-year-old son just told me he wants to invest in the stock market.

So, I ran through my normal points: “Invest only what you are prepared to lose.” “Invest in what interests you.”

But I also told him that one way to invest without picking through individual companies is to buy an exchange-traded fund (ETF).

You can buy and sell ETFs the same way you buy and sell shares of any stock.

An ETF is just a basket of stocks. Some ETFs only hold stocks that belong in a particular sector (think: technology, health care or agriculture).

Investors buy ETFs as a way to invest in a broad sector that they think will rise. That way, they don’t have to spend time poring over stock charts and data of individual companies.

Biotech ETF to Buy in 2021

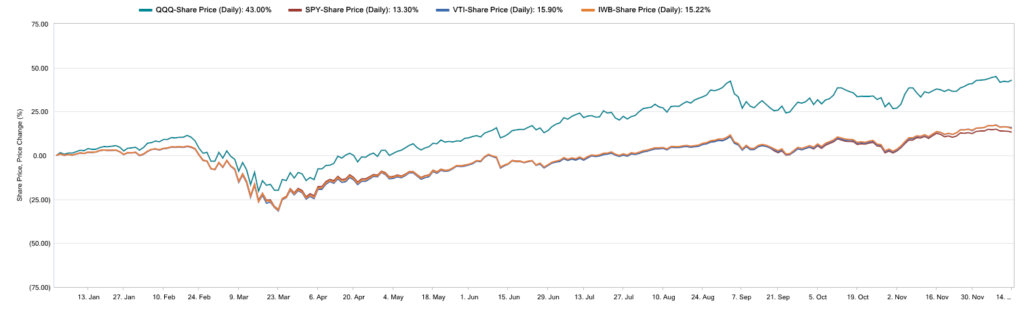

After that conversation with my son, I compared four of the most common ETFs on the market today:

- PowerShares Nasdaq 100 Index ETF (Nasdaq: QQQ).

- SPDR S&P 500 ETF Trust (NYSE: SPY).

- Vanguard Total Stock Market ETF (NYSE: VTI).

- iShares Russell 1000 ETF (NYSE: IWB).

ETFs: A Good Run in 2020

As you can see from this chart, QQQ delivered the biggest return of the four ETFs I compared — returning 43% year-to-date.

But I dug deeper and found an even better ETF to buy. It’s crushed QQQ this year, and I’m convinced that will continue well into 2021.

In this episode of The Bull & The Bear, I tell you the biotech ETF to buy for 2021.

Remember, knowing the data and the details about a specific ETF helps you determine whether it is worth investing in.

That’s why we do the work for you and give you our analysis of each one.

The Bull & The Bear

Led by Adam O’Dell and a team of finance journalists, traders and experts, Money & Markets gives you the information you need to protect your nest egg, grow your wealth and safeguard your financial well-being.

You can listen to The Bull & The Bear on Apple Podcasts, Spotify, Amazon and Google Podcasts. Make sure to subscribe and leave us a review.

Be sure to also subscribe to our YouTube channel for more videos and information.

Have something you want us to talk about? Email thebullandthebear@moneyandmarkets.com and give us your thoughts.

Check out moneyandmarkets.com, and sign up for our free newsletters that deliver you the most important and unbiased financial news, commentary, and actionable advice.

Also, follow us on:

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.