The world’s economy is showing signs of slowing down, but is the first global recession since 2009 really on the horizon?

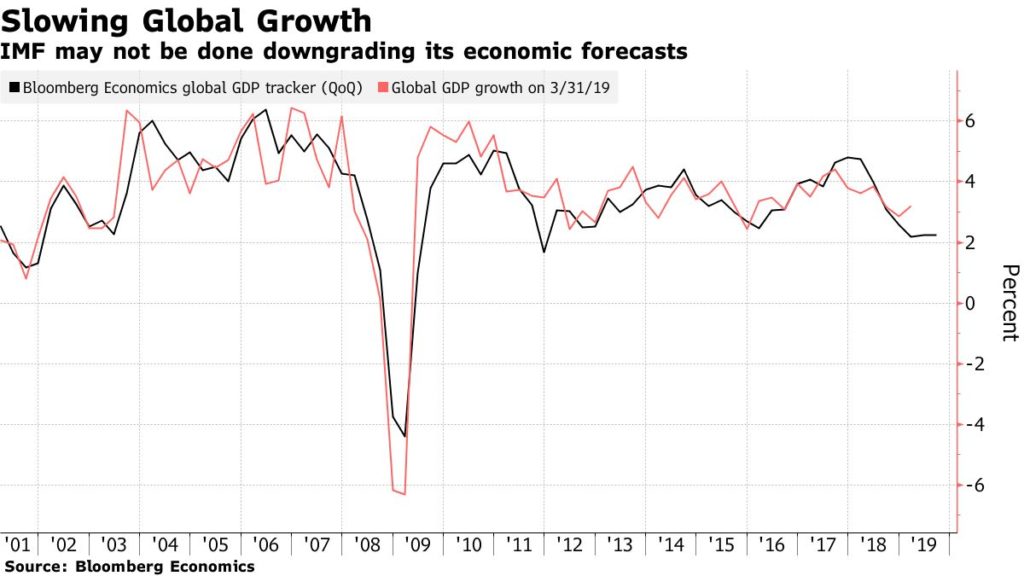

The International Monetary Fund is meeting in Washington this week for its annual meeting, and one of the biggest topics of discussion has to be the slowing economic growth. Bloomberg Economics’ global GDP tracker shows that since the start of 2018, its metric has plummeted from 4.7% to 2.2% in the third quarter of 2019.

Kristalina Georgieva, who took over as IMF chief recently, said there is a “serious risk” of slowdown that will spread. She also hinted that the IMF will most likely downgrade its 2019 global growth forecast Tuesday. It is already at 3.2%, its weakest level since 2009.

Bloomberg Economics Chief Economist Tom Orlik says “a lot needs to go right” in order for the global economy to evade a major slowdown. Here are some of reasons to worry — or not — about the world going into its first recession in a decade:

REASONS TO WORRY

Trade War

The U.S. and China managed to work out a trade truce Friday with U.S. President Donald Trump announcing he would not impose a tariff hike on $250 billion in Chinese exports that was supposed to go into effect this week. Beijing, in turn, agreed to buy $40 to $50 billion in U.S. agricultural products.

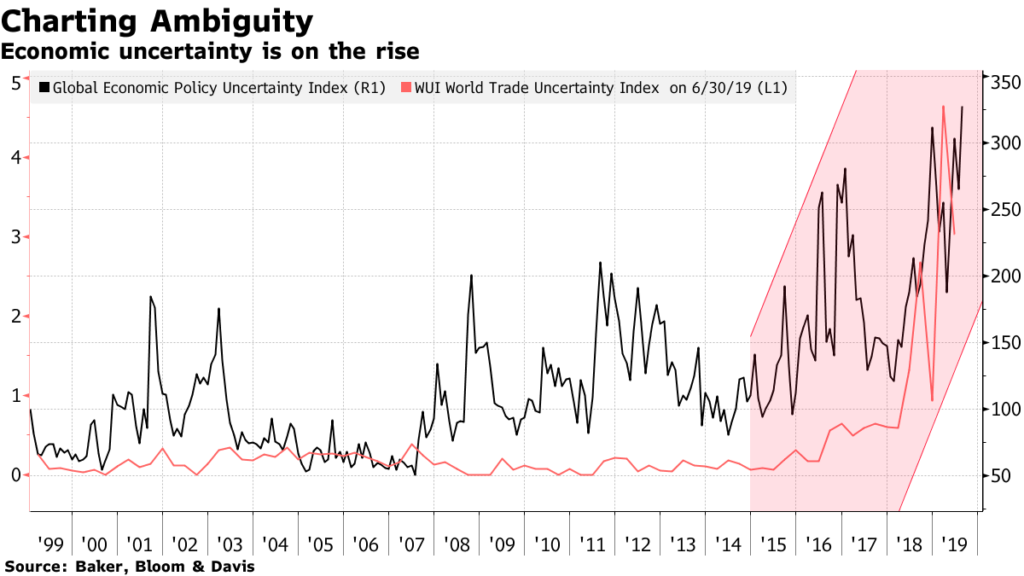

But there are still major sticking points in the negotiations that are holding up the prospects of a more substantial deal — chiefly, U.S. accusations of Chinese intellectual-property theft and forced technology transfer. Trump could also target European automakers with new tariffs, which he has threatened in the past.

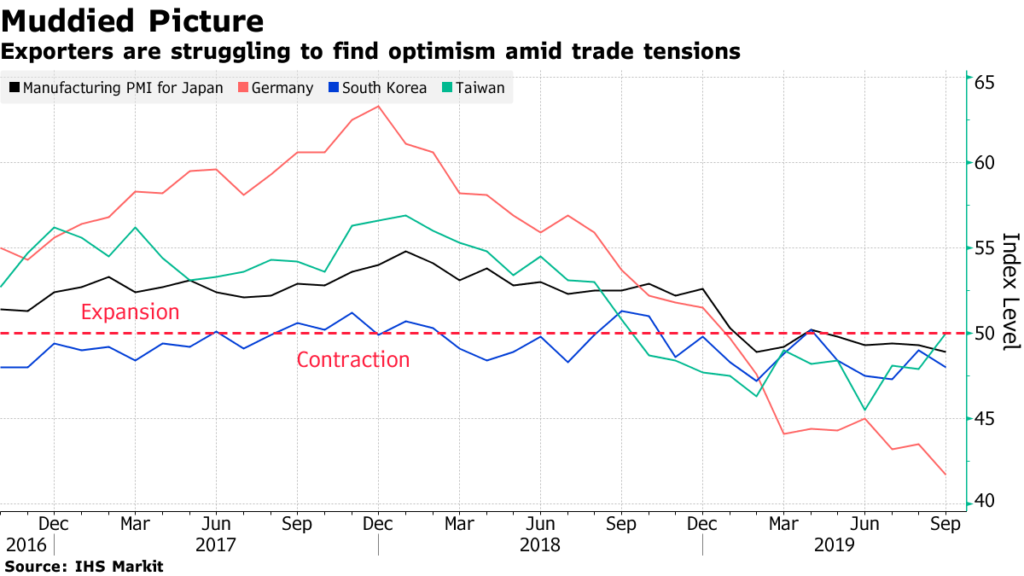

Manufacturing

The trade war has hit the manufacturing sector hard around the world, despite Trump’s naysaying, and global activity has been in contraction for five straight months. Automakers in Asia and Germany have been especially affected because they rely on exports so much.

Geopolitics

Global politics are also cause for worry, per Bloomberg:

As well as the U.S.-China skirmish, the U.K. and EU have yet to seal a Brexit deal. The U.S. is at odds with Iran after a drone attack on Saudi Arabian oil fields and an Iranian oil tanker caught fire after an explosion near the Saudi Arabian port of Jeddah on Friday. That risks a jump in oil prices. Protests in Iraq have turned violent, Turkey launched an offensive in Syria and marches in Hong Kong might tip that economy into recession. Argentina is facing another fiscal crisis and looks likely to oust a market-friendly government, and Ecuador, Peru and Venezuela also have political problems. An impeachment probe into Trump as well as the 2020 election campaign could also prompt him to ramp up his anti-globalization agenda.

Reasons Not to Worry

The U.S.

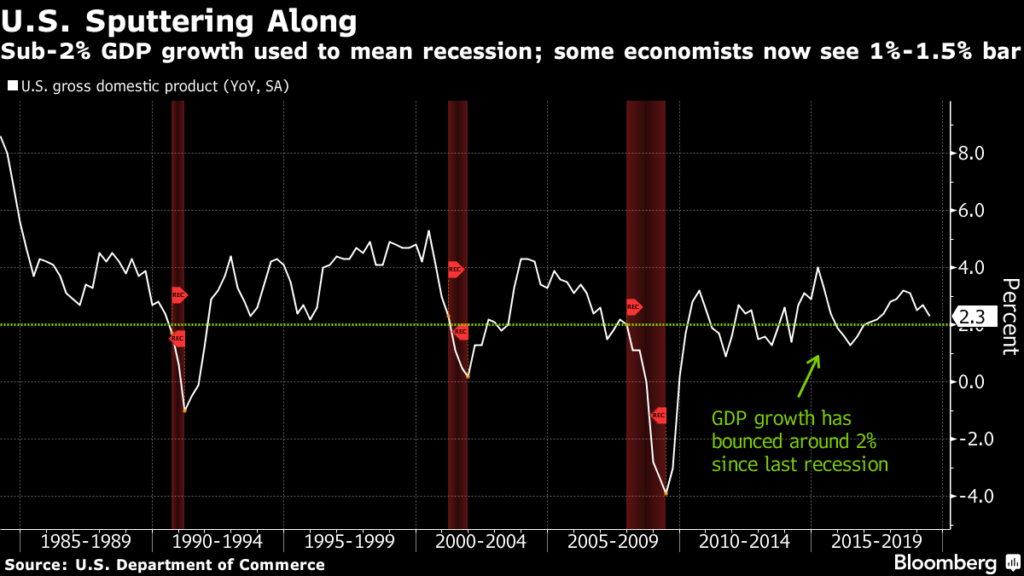

A Bloomberg Economics model puts the chances of a U.S. recession in 2020 at only 25%, and that could be enough to hold the rest of the world up. A recession could still happen to the world’s largest economy, but there is hope that the downturn would just stall out and putter along at 1.5% growth. It also helps that the U.S. economy is more closed off from the rest of the world, so expansion can continue while the rest of the world contracts.

Central Banks

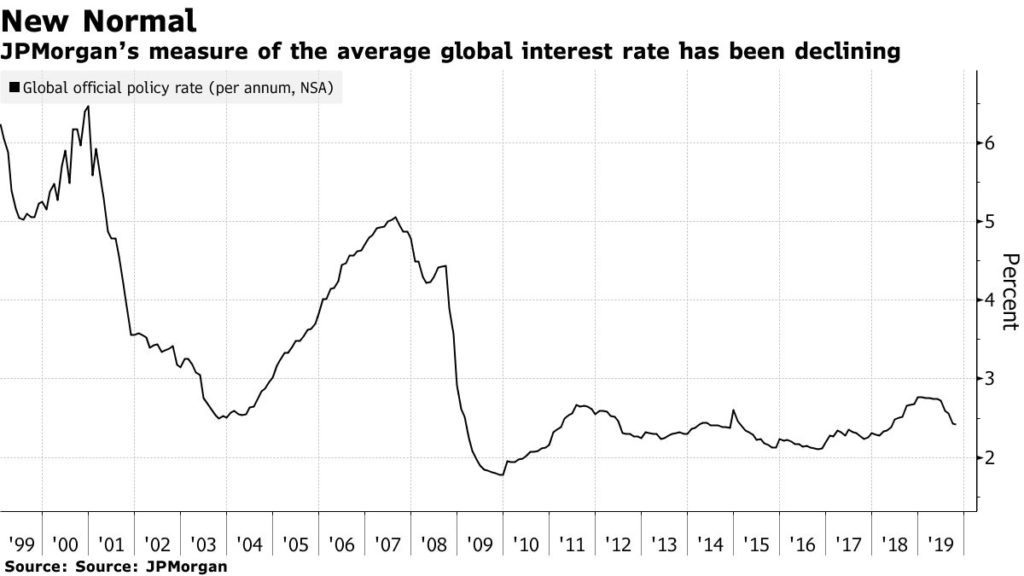

The fact that central banks around the world are taking action through key interest rate cuts and relaunching bond-buying programs in the European Central Bank’s case should be encouraging. The U.S. and EU have led the charge with cutting rates, and many other countries are following suit, so lower rates may just be the new norm.

Fewer Excesses

There aren’t as many fear bubbles as has been the case in past recessions, per Bloomberg:

Prior slumps were driven by a correction of excesses such as the run-up in inflation in the 1980s, the bursting of the technology bubble in the U.S. at the start of this century or the collapse of housing a decade later. This time around, inflation is generally weak and while stock prices are elevated they are arguably not in bubble territory. Although home prices in Canada and New Zealand are frothy, households in many economies have cut back leverage.