I use online banking all the time to check my balance and pay bills.

The ubiquity of online access to banking is something that we Americans tend to take for granted.

Not all countries provide online banking access to their residents as we do.

Take Argentina for example:

Statista estimates that online banking penetration (the percentage of people using online services) in Argentina will go from 9% in 2020 to 17% by 2025.

Today’s Power Stock is a $1.8 billion bank in Argentina leading the charge in online banking services: Banco Macro S.A. (NYSE: BMA).

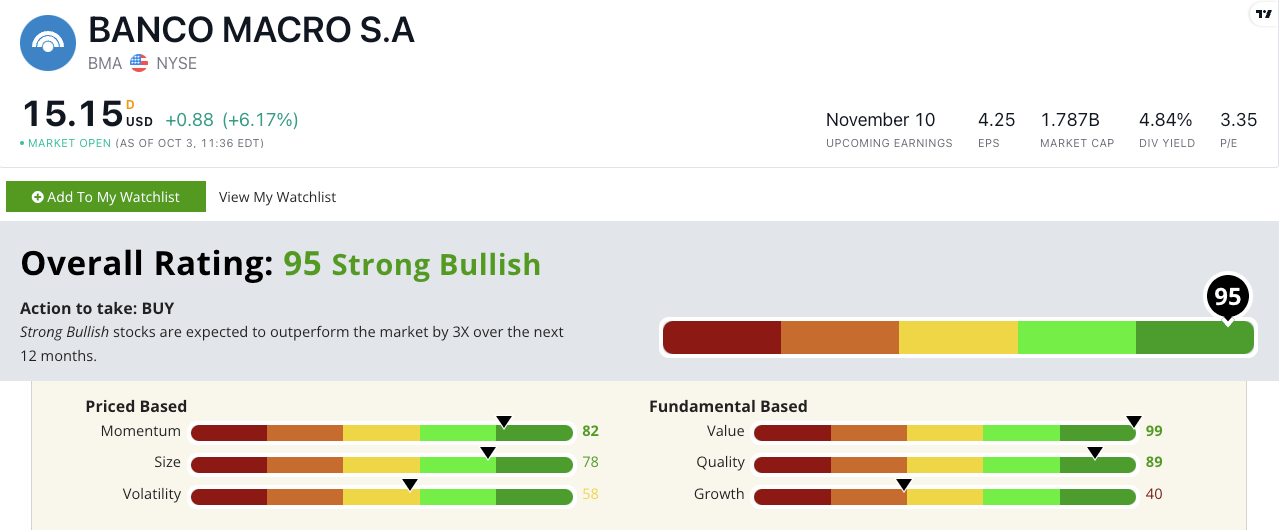

BMA’s Stock Power Ratings in October 2022.

Banco Macro serves low- and middle-income individuals and small- and mid-sized companies.

BMA stock scores a “Strong Bullish” 95 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

BMA Stock: Excellent Quality and Value

Two items stood out after my deep dive into BMA:

- For the second quarter of 2022, BMA recorded $1 billion in total revenue — a 69.8% year-over-year increase.

- It’s on track to equal or beat its total annual revenue from 2021 — a company record.

The Stock Power Ratings above show that BMA’s fundamentals are terrific. It rates highest on value and quality.

Its price-to (earnings, sales and book value) ratios are all lower than the international bank sector average — making it an excellent value compared to its peers.

BMA’s return on investment is 10%, compared to an industry average of just 4%.

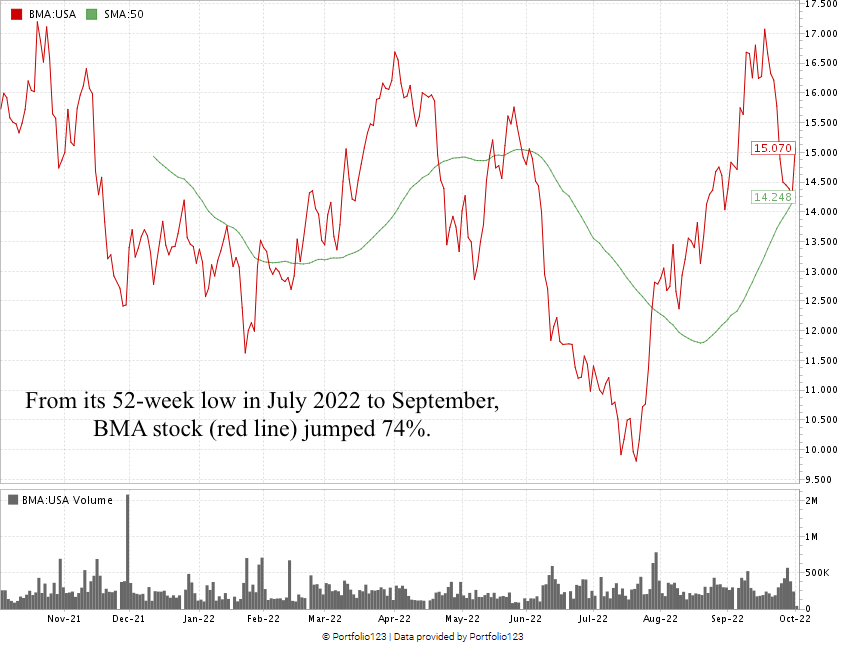

Created in October 2022.

BMA stock hit a 52-week low in July 2022.

By the middle of September, the stock raced up 74% … showing the “maximum momentum” we love to see in stocks.

Broader market headwinds pared some of those gains, but I see another uptrend in the making — meaning BMA could go after another 52-week high.

Banco Macro’s stock scores a 95 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Online banking is on the rise in Argentina.

Banco Macro is leading the charge to provide a wider range of banking services for low- to middle-income individuals and businesses.

This is why BMA is a strong candidate for your portfolio.

Stay Tuned: Electrical Equipment Stock With Massive Value

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on an electrical equipment company that provides critical infrastructure used in the energy, telecom and agriculture industries.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.