Bridgewater Co-Chief Investment Officer Bob Prince wrote in a recent note the country’s boom-bust economic cycle as we know it is over, and he even went so far as to say “we are unlikely to have a boom” moving forward.

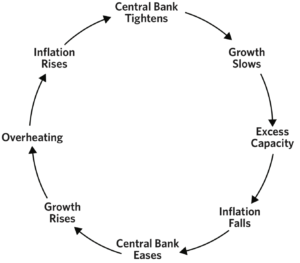

The past several decades, the economy has swung like a pendulum. As the economy starts to slow, the U.S. Federal Reserve will lower interest rates to encourage lending and spending, and boost inflation. The resulting growth at some point then overheats the economy and the Fed then raises interest rates, which in turn cuts back on the availability of credit, causing a downturn.

Prince’s reasoning behind saying the boom-bust cycle is over is because the current ongoing record-long expansion was spurred by years of zero-rate policy and quantitative easing, causing the longest but slowest expansion in history.

With rates still historically low, Prince says future Fed stimulus won’t be enough to create a “boom.”

“Starting from today, debts are still high and interest rates are now near zero, so the ability to stimulate a credit and economic boom is even more limited than it was. Ten years ago the unemployment rate was 10%. That allowed a lot of room to fall, and as it did it produced the income growth that financed above-trend growth,” Prince explained. “From today’s low unemployment rate it can’t fall much more, leaving less potential for above-trend growth.

“If the unemployment rate stabilizes, growth will converge toward trend growth. And because productivity is low and demographics are rolling over, trend growth is already slow and slowing further. So projecting forward, we are unlikely to have a boom, and we are likely to have a slowing of growth toward a level that will approach stagnation.”

Prince says we’re also unlikely to have a bust due to tightening of policy.

“The ‘busts’ in the boom-bust cycle described above occur when central banks tighten in response to perceived inflation risks, eventually causing a pullback in credit, spending, and incomes that becomes self-reinforcing on the downside,” he wrote. “Today, we are unlikely to get a preemptive tightening of monetary policy, and policy has shifted to waiting for a clear rise in relation to the target (i.e., allowing inflation to ‘average’ the target with oscillations around it).”

The Fed and other central banks are essentially “in a box,” Prince wrote, because their ability to ease is limited because rates are already historically low. And while they can tighten, they are unlikely to because of the economy’s sensitivity to it — can’t ease, can’t tighten, essentially, or we’ll see another sharp sell-off like we did at the end of 2018, when markets cratered before rebounding after Christmas when the Fed said it would stop raising rates.

“This will only change once inflation is clearly an observable developing problem,” Prince wrote.

However, this all doesn’t mean there is no risk of a downturn. It’s just unlikely a downturn will occur due to tightening of monetary policy as is generally the case in a boom-bust cycle.

The biggest risk now, Prince contends, is political.

“A slow-growth environment would amplify both domestic and international political conflict. Domestically, a slowly growing pie would lead to more fighting over the pie,” Prince explained. “And internationally, a stagnant US and Europe combined with a growing China and Asia would increase the pressure from the rising power threatening the incumbent power, probably accompanied by some blaming of weak conditions on the rising power.”

We hit the high points, but click here to read Prince’s piece in full.

Prince is Bridgewater’s Co-CIO along with billionaire founder Ray Dalio. Together, they manage over $160 billion in assets as the world’s largest hedge fund.