There’s a lot of talk in the mainstream financial media about Big Tech.

Rightfully so, when the Magnificent 7 stocks dictate how the market performs more than any one group of stocks.

When a group of seven stocks garners that much attention, it usually means other sectors and groups are going unnoticed by Wall Street analysts.

I was asked a question recently on a podcast that yielded an answer that seemed silly at the time.

Now, however, the data tells us that my answer to the question was more accurate than even I realized at the time.

Let’s get into it…

The Question And The Answer

At the end of August, I was invited to a podcast where we discussed everything from Fed rate cuts to Big Tech.

However, a question in the middle of the podcast got me thinking…

What are you seeing right now using your system-based approach that might be an opportunity for investors over the next few months?

Of course, the obvious answer would be to stick with the AI trend, or pivot to something related, such as energy, specifically nuclear power.

That was not the direction I went…

I think there is biotech. I hate to say it because biotech doesn’t sound exciting, especially with high interest rates. But, I think there’s a case to be made where biotech has a potential for a comeback here… I think there’s something to be said about that market being very oversold. I think there is some potential there.

Of course, I also mentioned materials and industrials, but I focused on biotech.

I remembered running scans for stocks that were trending higher in momentum and outpacing the benchmark S&P 500, and found that many biotech and biopharma stocks made the cut.

I was also expecting (along with everyone else) that the Fed would trim back its base rate, which would help small-cap stocks, like biotech, start to gain a little steam.

It seemed to throw the host of the podcast a curveball as I noticed a slightly confused look on his face (I was later told that it is not an unusual look and likely had nothing to do with my answer).

Fast-forward to today, and we can see whether I was right on the mark, or crazy…

The Curious Case Of Biotech

The first part of the analysis starts with Adam’s Green Zone Power Ratings system.

I started with the SPDR S&P Biotech ETF (XBI), which holds 133 various biotech stocks.

I ran all of the holdings through what we call an X-ray. This X-Ray shows me the ratings of every stock in the ETF, and allows me to average those ratings out.

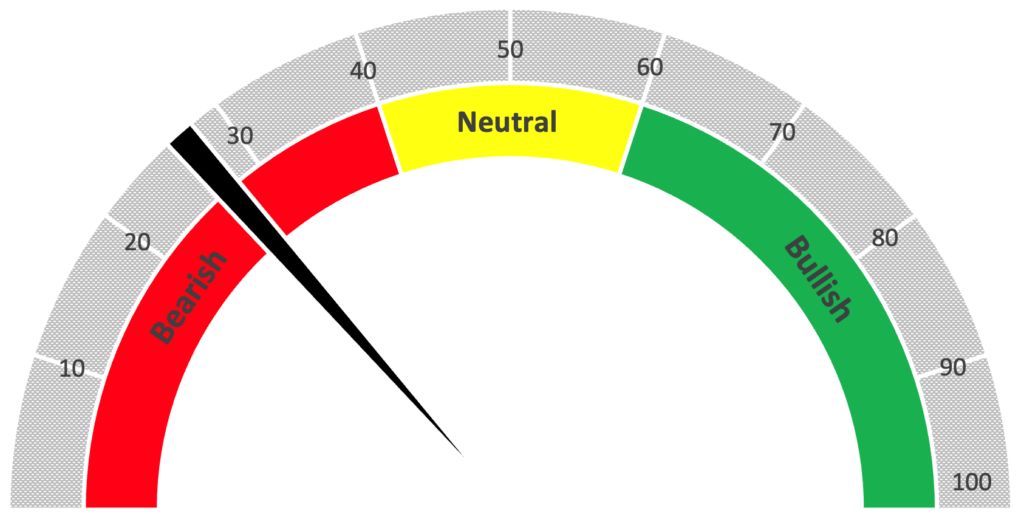

XBI Rates Bearish

The overall average rating of stocks held in XBI is a “Bearish” 26 out of 100.

To break it down further, only nine of the stocks rate 70 or above overall on Adam’s system. On the other hand, 87 stocks in the ETF rate 30 or lower overall.

The interesting thing is that on average, XBI earns a 50 on Momentum as 35 of the stocks rate above 70 on that factor.

Thirty-two of the stocks rate above 60 on Quality as well.

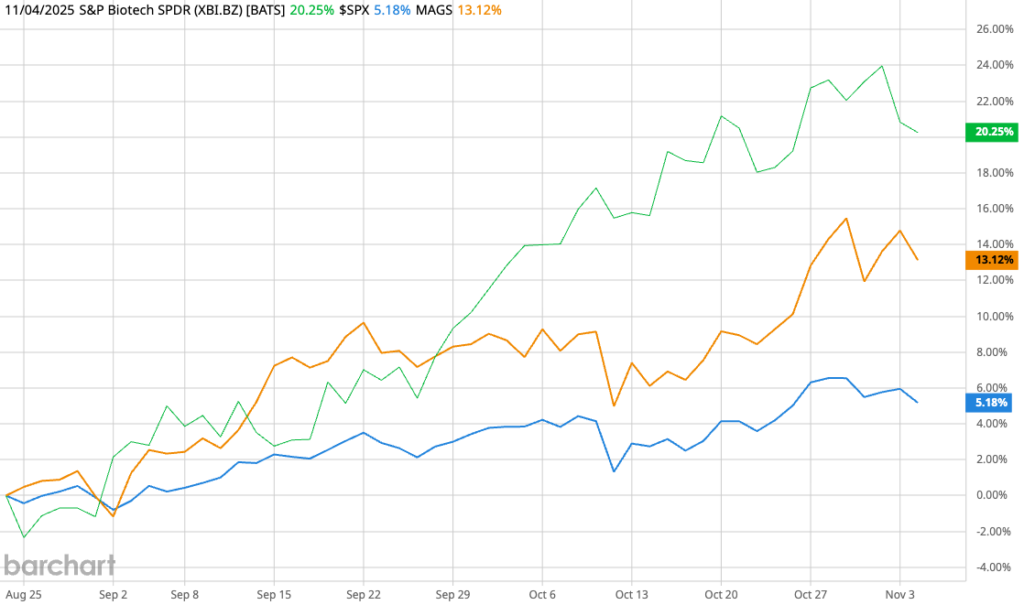

After isolating the anomaly in the Momentum ratings, I examined how XBI has performed since the day of the podcast.

XBI Advances 3x The S&P 500

Since August 22, XBI (the green line in the chart above) has increased by 20.3%, outperforming the S&P 500’s (blue line) 5.2% return.

This means XBI is advancing 3x more than the broader market.

For reference, the Roundhill Magnificent Seven ETF (MAGS), which tracks the performance of the Magnificent 7 stocks (represented by the orange line), is currently up 13.1%.

One thing to keep in mind is that Momentum often precedes fundamentals, such as Growth, because fundamentals are backward-looking, whereas technicals are in real-time.

The technicals, such as Momentum, often lead the fundamentals, so this could be just the start of a run in the biotech sector.

The point here is that it is easy to look at where everyone else is looking for gains (such as Big Tech).

To find potentially even more substantial gains, it’s sometimes best to look where no one else is.

And as far as those tech stocks go? Well, there’s certainly an “elephant in the room” for that bears mentioning…

I’m talking about the looming AI Stock Crash that my colleague Harry Dent is currently warning investors about.

Harry’s a legend in the industry, a generational talent and one of the market’s most influential forecasters — predicting everything from the early 1990’s recession to the 2008 financial crash and beyond.

But this promises to be his biggest prediction yet, potentially making a fortune for those lucky few investors who hear and heed his advice.

I’ve just gone LIVE with a special broadcast to share Harry’s urgent warning with Money & Markets readers. Click here to watch it now.

That’s all from me today.

Until next time…

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets