Looks like Brexit is back on the menu, boys — or at least that’s what new British Prime Minister Boris Johnson wants us to believe in his first couple of days as the boss.

Gone are over half of Theresa May’s cabinet. Out with the Brussels Boys, in with the fellows of the European Research Group. There’s a saying in politics: Personnel is policy.

Nowhere is that more true than in Donald Trump’s cabinet as neocons run amok around the world starting fires, which Trump is now trying to stamp out.

It was, sadly, just as true in Theresa May’s cabinet. In all of those in powerful positions were arch Remainers, committed to only the weakest of Brexits because they themselves were committed to the European Union’s goals of building a transnational superstate far more tyrannical and unresponsive than any other government in the history of man with the possible exception of the Soviet Union, on which it is modeled.

For months as the Brexit drama dragged on, both the British pound and the euro weakened. And that weakness continues. But that weakness for the pound may be coming to an end.

Why?

Because with Johnson’s appointments to key cabinet posts, notably arch-Brexiteer Jacob Rees-Mogg to the position of Leader of the House of Commons, we finally have a bit of clarity in British politics for the first time in 2019.

Markets love clarity; even clarity they don’t like.

Since Theresa May unveiled her truly awful withdrawal treaty and cynically pushed it down the throats of the world for months on end, we watched the dissolution of business as usual in the British House of Commons. Competing agendas and party politics mixed with the most over-the-top media campaign to scare the British people into accepting a Brexit worse than staying in the EU dominated the headlines for the past eight months.

And it led to the return of Nigel Farage and the meteoric rise of his Brexit Party, which swept the EU elections in May and have maintained their polling strength during the lengthy Prime Minister selection process.

It is that reflection of voter vitriol toward both Labour and the Conservatives about their betrayal of Brexit that pushed Johnson to make such a definitive statement about the personnel who now staff his cabinet.

That gives markets the clarity they crave as to where things are headed over the next three months. Brexit is less than 100 days away. Johnson’s cabinet appointments and initial words as Prime Minister make it clear he is ready to do what Theresa May never even entertained: Prepare the U.K. for a Brexit without an agreement and begin trading purely on World Trade Organization rules.

The markets may not like that outcome but at least they can prepare for it with a touch more certainty.

That is today’s reality. What’s also real today is that the Remain camp are not strong enough to take down Johnson’s government.

Because if they were, Labour Leader Jeremy Corbyn would have tabled a motion of no-confidence on Thursday. It was his last chance to do so and effect a snap election before the Brexit deadline of Oct. 31. There simply isn’t enough time, by law, to do so at this point. (Thanks to Mike Shedlock for pointing this out to me.)

And with Rees-Mogg controlling the dispatch box, there is precious little that Remainers can do to make things even worse procedurally like they did while Mrs. May was in charge.

In fact, in watching the proceedings in Parliament it was clear to me that the Remain camp knew their only option was to continue throwing up roadblocks with their current level of power, because a general election would see their numbers decrease.

Jeremy Corbyn questions Boris Johnson on Iran & instantly regrets it as Boris takes Corbyn & McDonnell apart! 👏👏👏

This is why Corbynistas hate Boris because they know Corbyn can’t beat him!

— BrexitTory (@_BrexitTory) July 25, 2019

Corbyn is done as Labour Leader. The markets have been discounting the pound, not over the fear of a No-Deal Brexit but over the idea of Corbyn becoming Prime Minister. Now, as far as I’ve ever been concerned, that was never going to happen.

Corbyn was subjected to just as much, if not more, sabotage than Mrs. May was when she led the Tories. His own people have pushed him, as Johnson points out in the clip above, into a Remain position he doesn’t believe in. He’s a weak leader and it gives a political cypher like Johnson every opportunity to grandstand, push for Brexit and rally the Tories from the brink of extinction.

He will be removed as the leader of Labour right after the general election that Johnson is setting up for himself. Because Corbyn had his chance to become Prime Minister and he blew it completely.

And that’s why the pound stabilized over the past few trading days while the euro continues to push toward lower lows.

I don’t usually take data at the daily level and draw any conclusions from it, but I think in this instance it is warranted.

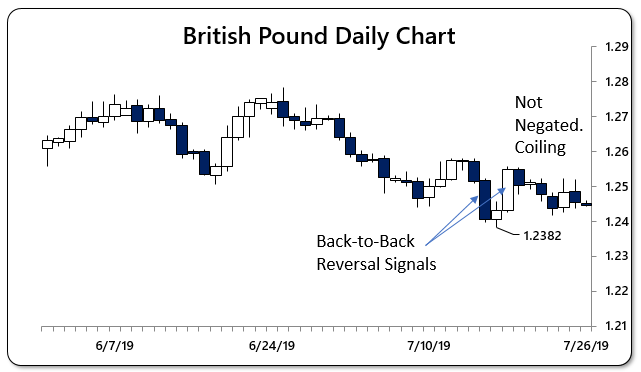

The pound broke down earlier in July below $1.24, but immediately reversed that breakdown. After that it spent the seven days trading within the range of that bullish reversal bar (see blue arrow on chart), coming nowhere close to the low at $1.2382.

If that low holds next week and the pound continues trading sideways, that would raise the odds of a major low having formed. If that occurs while the euro breaks below support at $1.11, then it will be an even stronger signal that the markets believe that Johnson can and will deliver Brexit at the end of October.

Johnson has a real opportunity for greatness here. This is especially true if the reports of him reaching out to Nigel Farage are true. These two men could lead a complete overhaul of British politics that could change the course of Europe completely.

I’m not convinced Boris is going to do this. I’m not convinced he won’t cave to the pressure of tweaking the current treaty and, in Trump-like manner, claim victory for the Tories. But, as of right now, with the personnel he’s put in place to set policy it looks like circumstances have forced his hand to be something more than anyone thought him capable.

Speculators should be willing to begin layering in a short EUR/GBP trade now if this week closes the way it did on Thursday after Johnson’s performance in Parliament. Because the euro should continue to weaken on terrible data and political disunity while the pound strengthens on a clear path for the future.

• Money & Markets contributor Tom Luongo is the publisher of the Gold Goats ‘n Guns Newsletter. His work also is published at Strategic Culture Foundation, LewRockwell.com, Zerohedge and Russia Insider. A Libertarian adherent to Austrian economics, he applies those lessons to geopolitics, gold and central bank policy.