While U.S. voters complain about vaccine mandates and inflation, voters in the U.K. complain about their prime minister’s partying.

U.K. Prime Minister Boris Johnson stands accused of “breaking COVID laws amid numerous allegations of parties and gatherings that were held by government staff, with some attended by Johnson, during lockdown.”

Some details shock British voters: “Johnson admitted to Parliament last week that he had attended a drinks party at Downing Street, the prime minister’s office and which he lives next door to, during the U.K.’s first COVID lockdown in May 2020 but said he believed it was a ‘work event.’”

Johnson said that another picture showing him and his wife, as well as 17 Downing Street staff members, drinking wine and eating cheese in No. 10′s garden at a separate event in May 2020 showed “people at work.”

That isn’t a major political scandal by U.S. standards. Many politicians were caught maskless at gatherings and not voted out. But in the U.K., this scandal could lead to Johnson’s downfall.

Johnson Unlikely to Affect Stocks

Judging by market action, traders don’t seem concerned that Johnson could lose his job.

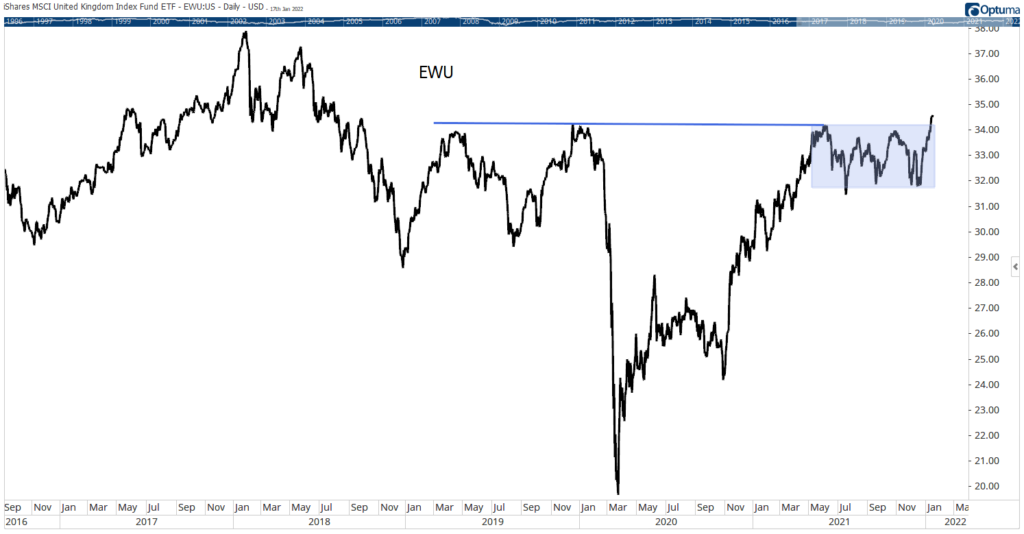

The benchmark FTSE 100 Index is trading at a 23-month high. U.S.-based traders can access the U.K. market with exchange-traded funds (ETFs). These baskets of stocks include the iShares MSCI United Kingdom ETF (EWU).

EWU trades at a 39-month high and appears to be breaking out of a yearlong consolidation.

EWU Unaffected by Boris “Party Boy” Johnson

Source: Optuma.

With its recent rally, EWU broke above a resistance line that has held for almost three years. Based on the chart pattern, a long-term bull market could develop. If that happens, expect to see EWU in the high $40s, a gain of about 40%.

Analysts point to several reasons that U.K. stocks could move higher — such as international fund managers underweighting the market for three years and standard valuation metrics showing the market about 30% undervalued.

The yield is attractive compared to other global equity markets.

Johnson is in trouble, but investors might be wise to buy the market now, especially when U.S. stocks are overvalued and appear vulnerable to a sell-off.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.

Click here to join True Options Masters