I have bad news and good news. Let’s do the bad news first.

China is preparing for war. The past couple of months have seen headline after headline after headline about China’s military buildup — even how it could threaten more than its most well-known target, Taiwan.

Bad news may be an understatement. Any armed conflict is especially scary in the modern age, where weapons and politicians alike are more capable of disrupting the world order than ever before.

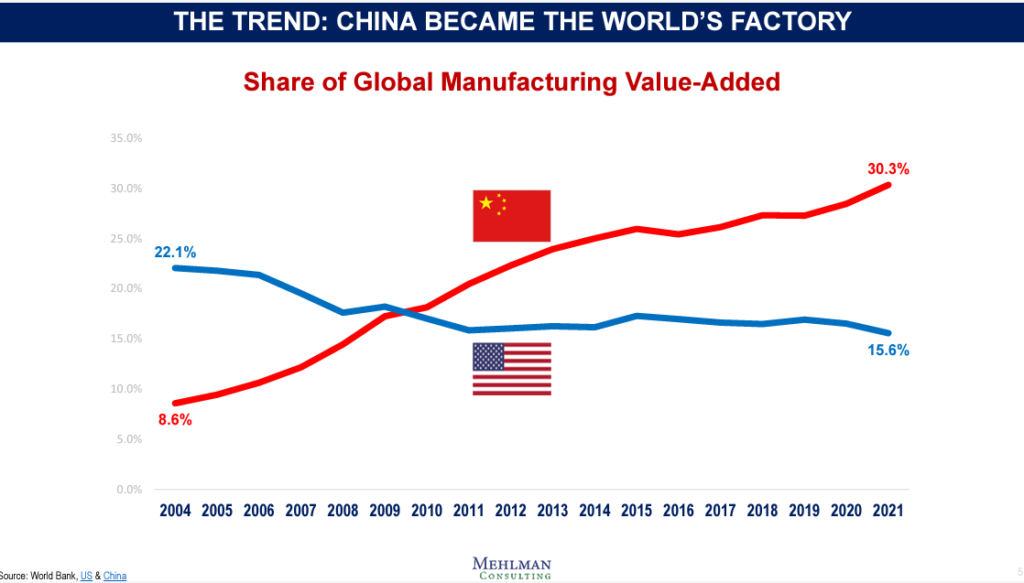

War with China is even worse. China is “the world’s factory,” supplying us with everything from cheap plastic toys to high-value computer parts. If that supply cuts off, which war certainly would entail, the inflation we’ve seen so far would seem tame.

It’s hard to imagine there’s any good news to come from this. But there is.

Right now, the United States is taking crucial steps to clip China’s wings. We’re unwinding the immense manufacturing leverage China holds over the U.S. and much of the entire world.

Because of actions we’re taking today, we’re mitigating the threat of this war to great effect.

Want even better news? This mitigation is highly investable. And our very own Green Zone Power Ratings system has identified a stock that could 2X the market over the coming year as this trend plays out.

I’ll share the name and ticker of this stock with you in just a moment.

But first, we need to understand why we’re in this mess in the first place…

Hooked on Cheap Goods

Chinese exports more than doubled in 1995, the year after President Clinton ended sanctions against the country.

Exports soared more than 400% by 2002, the year after China was admitted to the World Trade Organization.

Then they grew more than 630% in the next 10 years and now account for more than 2.5% of U.S. gross domestic product.

This massive, rapid growth in Chinese exports shows how the U.S. became addicted to cheap goods from the production giant.

This addiction isn’t hard to understand. Consumers liked the low prices. Policymakers liked the low inflation. China liked the revenue. Everyone was winning.

But when the pandemic hit, it exposed a major problem.

China also controls the supply chains for vital goods. We learned that the U.S. was no longer able to manufacture many critical items for health care, defense and transportation. We needed China more than ever.

Of course, this problem didn’t develop overnight. It unfolded over 20 years, as Chinese manufacturing grew from a small presence on the world stage to an indispensable supplier. At the same time, the U.S. allowed its manufacturing capacity to contract by almost a third.

The chart below shows this inverse relationship since 2004.

Some of the gains in China’s global manufacturing position was the right thing to do. China had cheap labor and low shipping costs. It made sense for China to manufacture low-value products like toys and cheap clothing. These items would be too expensive to make in the U.S.

However, the U.S. should have maintained manufacturing capacity for high-value items, like computer chips. It also should have accepted the higher price of cheap goods, like hand sanitizer and face masks, which we needed during the outbreak.

U.S. companies already stepped up and proved we could manufacture these cheaper items during the pandemic.

And now, faced with the threat of war with China, we’re proving we can manufacture our own computer chips, too.

Breaking Free of China

In the past year, over 50 new semiconductor projects have been announced across the U.S. These include the construction of new semiconductor manufacturing facilities, along with others that supply the materials and equipment used in chip manufacturing.

Investments in those projects will top $210 billion and generate an estimated 44,000 new high-quality jobs. Construction spending and needs in the tech sector will create thousands more.

Heavy reliance on China for manufacturing is a critical issue, especially as we see conflict on the horizon. But the U.S. is working to break its addiction to cheap Chinese goods.

Recovering from that mistake will involve some pain. But it will also reward us with new opportunities.

Among those opportunities is Analog Devices Inc. (Nasdaq: ADI). The company makes integrated circuits that are used in electronic devices. As part of the American manufacturing rebound, ADI is completing a $1 billion expansion of its manufacturing facility in Oregon.

ADI scores an 80 on the Green Zone Power Ratings system. This is a “Bullish” score, and stocks in this category are expected to outperform the market by 2X over the next 12 months.

The stock ranks especially high in momentum and growth, factors that could indicate ADI is about to make a significant short-term move.

I believe there will be many more American stocks with similar potential in the next couple of years. As the U.S. moves in the direction of rebuilding and ramping up its manufacturing infrastructure, I’ll be watching for the next American companies set to benefit from this changing economy.

Until next time,

Mike Carr

Senior Technical Analyst