In the latest escalation of the trade war with China, U.S. President Donald Trump announced via Twitter that he will add a 10% tariff to another $300 billion worth of Chinese imports beginning on Sept. 1, sending the markets sharply downward.

The tweets, strung together for readability, said:

“Our representatives have just returned from China where they had constructive talks having to do with a future Trade Deal,” Trump tweeted. “We thought we had a deal with China three months ago, but sadly, China decided to re-negotiate the deal prior to signing. More recently, China agreed to buy agricultural product from the U.S. in large quantities, but did not do so. Additionally, my friend President Xi said that he would stop the sale of Fentanyl to the United States — this never happened, and many Americans continue to die!

“Trade talks are continuing, and during the talks the U.S. will start, on September 1st, putting a small additional Tariff of 10% on the remaining 300 Billion Dollars of goods and products coming from China into our Country. This does not include the 250 Billion Dollars already Tariffed at 25%. We look forward to continuing our positive dialogue with China on a comprehensive Trade Deal, and feel that the future between our two countries will be a very bright one!”

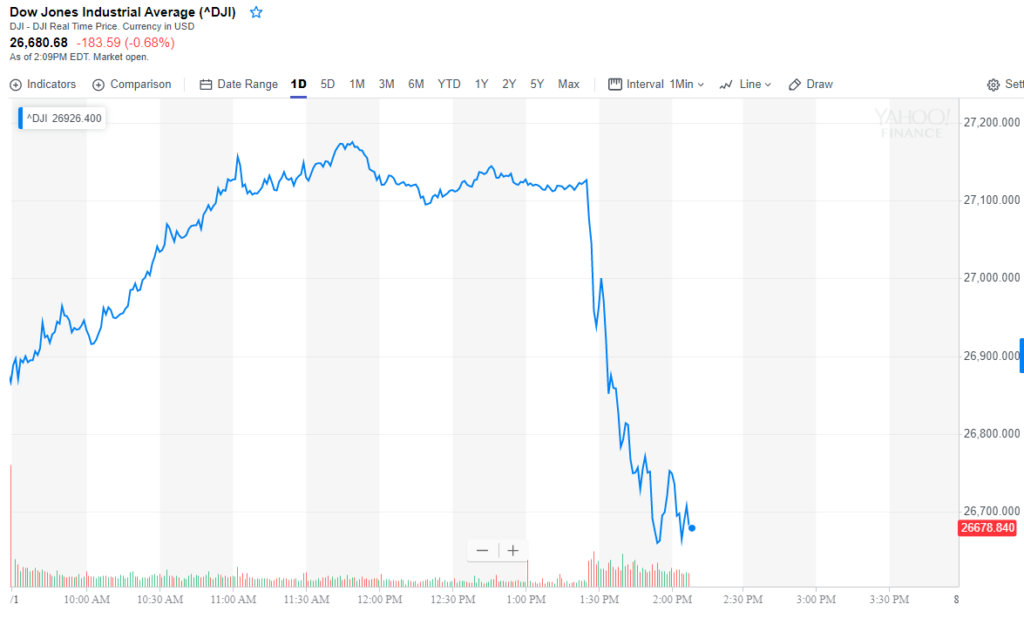

The markets, which had been up all day, immediately took a nose dive.

By just after 2 p.m. EDT, the Dow went from 27,126 all the way down to 26,685 in a matter of minutes, a 441-point dip in about a half-hour.

The S&P 500 went from 3,009 to 2,957, while the Nasdaq went from 8,293 to 8,125 over the same period of time. In addition, 10Y Treasury yield crashed to 1.89%, the lowest level since 2016

The train of thought among Wall Street pundits is that Trump will continue to ramp up the trade fight with China in order to get the Fed to continue lowering rates all the way back to zero. The Fed cut rates .25% on Wednesday for the first time since the 2008 financial crisis.

Goldman, which is firmly against cutting rates at a time while the economy is supposedly booming, says we most likely will get another .25% rate cut in September, and an 80% chance for another cut by the end of the year:

“We also see risks in the other direction, especially on a significant escalation of tariffs against China,” Goldman says.

So in other words, if an escalation to the trade war is what it will take to get the Fed to further cut rates, then Trump is going to do just that.