Last month I said the next act in the Brexit Saga was beginning. Now we’re less than a week away from the European Parliamentary elections, which will change the course of British (and possibly EU) politics for the next century.

At the end of the day the EU will fail at every level — politically, socially, economically. It cannot survive if the people don’t want it to. Its productivity in the aggregate has peaked.

Political opposition to the path of the European Union is hardening. Now even Dutch Prime Minister Mark Rutte is begging voters not to abandon him after disastrous local elections, just two years after eking out a victory over populists there led by Geert Wilders’ Party for Freedom. The Polls have them in a dead heat.

As of right now, Euroskeptic parties, according to Politico, are set to take just over 250 seats in the 751 seat European Parliament. Those numbers could easily rise to 260 or 270 depending on how voters turnout. And that’s before counting Hungary’s Fidesz Party led by chief Euroskeptic Viktor Orban, who is still counted among those allocated to the European People’s Party (EPP). The truth is Orban could easily shift the Euroskeptic coalition above 280 seats or 37%. This is up from just under 15% after 2014’s elections.

Euroskeptic parties have the momentum and the passion at this point. They are winning local elections and see the opportunity to use these results as a springboard to greater success later. So voter turnout could push them to that level or higher if complacent social democrats stay home.

The focus has been on Britain and the monumental realignment happening there. What I’ve been saying for months is happening. The traditional right/left political divide is breaking down. It’s no longer about shifting the priorities of governments a little to the social welfare side or back toward the ‘’personal responsibility’ side.

It’s about sovereignty versus globalism. Nigel Farage branded his sovereigntist movement perfectly.

The Brexit Party. This is the fulcrum issue in the U.K. and the main parties were tasked to keep the people fighting about details while the political elite undermined the fundamental issue of sovereignty.

That was Theresa May’s job. That was the Labour Shadow Cabinet’s job — to rein in Brexiteer-at-heart Jeremy Corbyn.

Euroskepticism rises across Europe because it is obvious that the leadership in Brussels, led by German Chancellor Angela Merkel, is devoted to the EU first and the needs of Europeans second. People are voting to protect their local communities dying from the political parties over-promising and under-delivering results while Brussels makes ever more bizarre and Byzantine law to stifle innovation and growth.

At the end of the day the EU will fail at every level — politically, socially, economically. It cannot survive if the people don’t want it to. Its productivity in the aggregate has peaked.

It’s share of global trade continues to remind me of Microsoft (NASDAQ:MSFT) under Steve Ballmer, bolting on new parts to add revenue, while buying up competition to the cash cows of Office and Windows but not actually increasing shareholder equity (wealth).

The expansionist policies of the EU stem from the belief of having more market share gives them more power to dictate terms of trade and political power.

If you listen carefully to the main arguments against Brexit it supports this maximalist view. Britain, as a small country, can’t compete with the mighty EU because of sheer size. I hear this over and over from Tony Blair’s sycophants like Alistair Campbell and Dominik Grieve. This is, of course, nonsense, just a talking point crafted to sound good when repeated as a post-hoc rationalization by a Remainer out of fear of change.

The truth is Germany’s economy is headed off a cliff; a reflection of the slowdown both internally and globally — retail sales are drying up, overall factory orders are slowing while exports remain high, which keeps the euro overvalued.

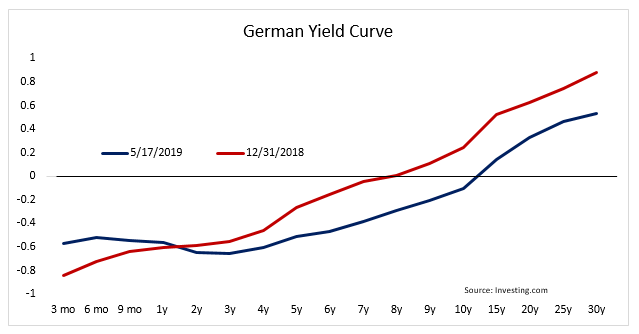

We’ve seen a massive move into safe-haven European assets in the past few months. German 10-year bunds continue to rise in price, with the 10-year closing this week at an insane -0.106%. While at the same time the short-end is rising on short-term liquidity fears over the EU elections.

And while everyone is focused on the inversion of the U.S. yield curve, it should be Germany’s that bothers you the most. During the last market meltdown in December due to trade war worries and hawkish central bank policy that saw equity markets around the world spiraling downward, the German yield curve, while bumpy, was still upward sloping.

No liquidity worries in evidence. Contrast that to today and we’re staring at a much different picture. Germany now stands exposed as vulnerable to not only Brexit and a global trade slowdown thanks to Trump’s ignorance on the basics of modern trade, but also a political earthquake that will lessen Germany’s control over EU politics and bring greater policy uncertainty to the next five years.

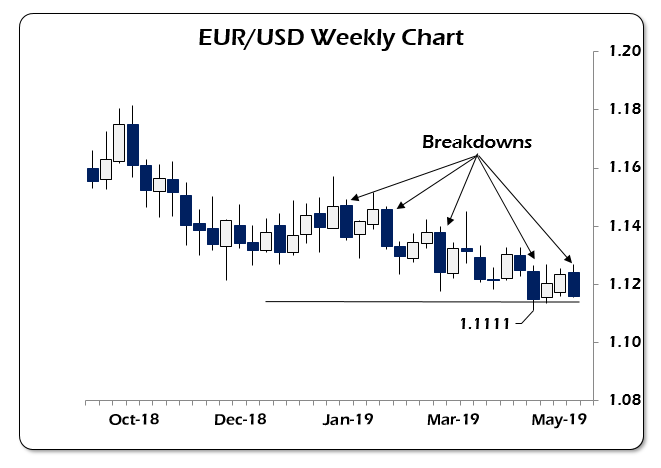

At the end of April, the world was hitting a peak of dollar illiquidity that saw the euro and British pound fall out of their ranges, below $1.12 and $1.30, respectively. We’ve had a relief rally up until this week in the euro as the focus was taken off it by Trump’s bipolar tweetstorms in his trade war with China.

These issues were resolved definitively as Trump has secured his place as Herbert Hoover for this cycle, raising tariffs to slow global trade and dollar velocity. But he’s combined that with something we haven’t seen before: Clamping down hard on the use of dollars by anyone who disobeys the U.S.

Much of the sanctions policy is out of his hands when it comes to the Magnitsky Act and CAATSA, which was specifically written to strip the President’s authority. The Treasury Secretary and Secretary of State have most of the power in this process. When it comes to Iran, Trump is in cahoots, but in other areas, he doesn’t have much say.

And now that we’re in this full-blown trade war regime definitively, the euro and the pound have resumed their march lower. The high Nigel Farage’s Brexit Party polls the quicker the pound sinks. The pound shed nearly $0.03 this week, dropping every day this week after it was confirmed that Tory leadership demands Theresa May’s resignation by early next month and the Brexit Party opened up a massive lead in the Polls.

As of right now the pound is on its way to the lowest monthly close in more than two-years. A move below $1.264 will see it re-test the 2017 low at $1.20, and possibly lower to $1.18.

The euro finally fell back through $1.12 on poor German economic data, coupled with the growing realization that Trump is serious about extracting concessions he cannot get from China.

There’s nothing to suggest in the euro’s price action that it is headed anywhere except its 2017 low of $1.034. The US Dollar Index closed the week just shy of 98, confirming its recent breakout from range below 97.5. And so with everything set in motion all that is left is for the markets to realize there won’t be any policy savior’s coming to their rescue as the central banks have already tapped out.

• Money & Markets contributor Tom Luongo is the publisher of the Gold Goats ‘n Guns Newsletter. His work also is published at Strategic Culture Foundation, LewRockwell.com, Zerohedge and Russia Insider. A Libertarian adherent to Austrian economics, he applies those lessons to geopolitics, gold and central bank policy.