Semiconductors are a lucrative space to invest, but there are so many companies within the industry. Here’s an overview of Broadcom stock and how it rates so you can determine if it deserves a spot in your portfolio.

Broadcom is an American semiconductor company that designs and manufactures software and hardware products for use in data centers, networking and storage systems.

Founded in 1991, Broadcom quickly became one of the world’s most successful technology companies and remains a major player in the industry. Let’s take a look at the company’s history and outlook for 2023.

Broadcom History

Broadcom was founded in 1991 by Henry Samueli, who had been working on designing integrated circuits for the 10 years prior. Together with his wife, Susan, Samueli set out to establish their company within the growing technology sector.

The company went public just two years later in 1993. Since then, it has grown to become one of the largest semiconductor companies in the world. It has acquired more than 50 companies over the past three decades and currently employs more than 20,000 people worldwide.

In 2020, Broadcom announced that it would be acquiring CA Technologies for $18 billion. It marked a major milestone for the company as it solidified its position as one of the largest providers of enterprise software solutions in the world.

In 2021, Broadcom continued to expand its portfolio with acquisitions of businesses such as Symantec Corporation and Brocade Communications Systems Inc., both valued at over $10 billion each.

Outlook for 2023

Broadcom’s outlook for 2023 looks bright due to its continued success in mergers and acquisitions as well as its strong financial performance over the past few years.

The company is also investing heavily into research & development to ensure that its products remain competitive in a rapidly changing market landscape.

With its focus on innovation and customer satisfaction, Broadcom is poised to continue its growth trajectory over the next few years and beyond.

Additionally, with an increasing number of businesses turning to cloud computing solutions to lower costs while increasing efficiencies across their operations, Broadcom stands ready to meet their needs with industry-leading solutions.

But have all of these developments helped or harmed Broadcom stock as 2023 kicks off in earnest? Let’s see what our proprietary system says.

Broadcom Stock Power Ratings

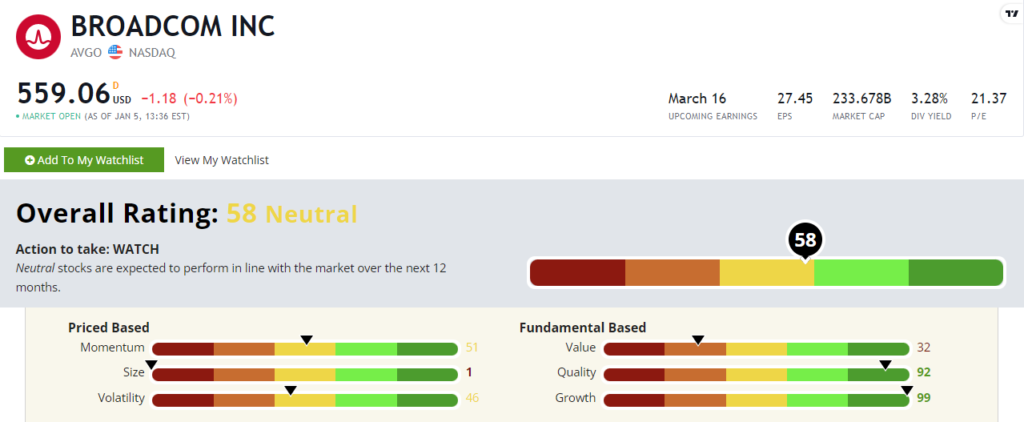

AVGO rates a “Neutral” 58 out of 100 within Stock Power Ratings. That means it’s set to perform in line with the broader market over the next 12 months.

Years of growth and establishing a healthy business has created strong factor ratings on growth (99 out of 100) and quality (92).

But this is still a tech stock in a market that is shunning tech almost across the board. Even so, Broadcom stock has not fallen as much as some of its peers. Its lost 12% of its value over the last 12 months, while the broader iShares Semiconductor ETF (Nasdaq: SOXX) is 35% lower.

That’s why AVGO rates in the middle of the road on momentum (51) and volatility (46).

If you follow Stock Power Ratings, Broadcom stock is one to watch.

Do you own AVGO? Let us know how you’ve made out investing in this stock by leaving a comment below!