I am very, very — VERY — pleased with the performance of the uranium explorers and miners I recommend to my subscribers. Heck, I just recommended a new explorer developer this week to Supercycle Investor subscribers, and it’s already up 10% as I write this. Other recent uranium-leveraged positions are up 14% and 59%. But you know what? As much as I’d like to, I can’t take all the credit.

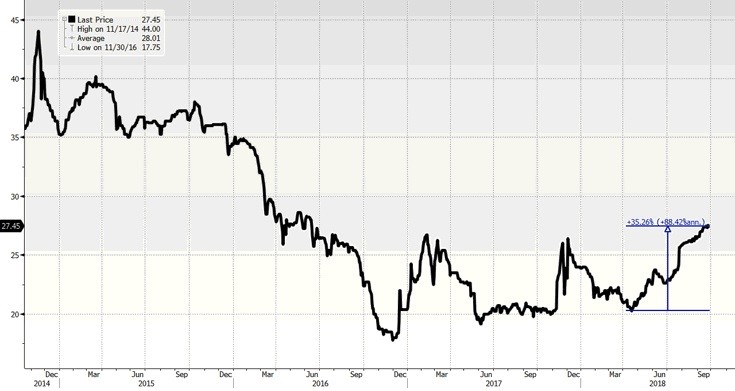

Nope. Most of the credit goes to the subject of this chart I made on my Bloomberg terminal today …

That’s a chart of the spot price of uranium. It’s up more than 35% since it bottomed in April. Can you say the same for copper … nickel … lithium … platinum … silver … gold?

Ha! Ha! Ha! Ha! Ha! HA-A-A-A-A-A-A-A-A!

Hell, no, you can’t. Because those metals are left in the dust by this atomic rocket. This atomic rocket of pricing power is sending select uranium miners, developers and explorers much higher.

This nuclear tide isn’t lifting all boats. But it’s lifting the good ones. As this tide rolls in, we are quickly separating the power players from the pretenders. And the uranium universe is so small — there are maybe 40 or 50 playable names, if you include markets in Canada, Australia and Britain.

And this tide is JUST STARTING to roll in.

- Major producers shutting down production. Basically, because it’s cheaper to buy uranium on the open market than mine it. In fact, when one of the biggest, producers, Cameco, shut down its McArthur River Mine, it not only stopped 18 million pounds a year of production. It now needs to buy 11 million to 15 million pounds to meet the rest of its 2018 and 2019 delivery commitments.

- A 7-million-pound deficit in global uranium production this year — a deficit that will only get worse.

- Sensing blood in the water, new funds are moving into the uranium space to buy up the metal while it’s still cheap. This only makes the supply/demand squeeze tighter.

- Utilities have “underbought” uranium for years. Because it was always getting cheaper. Somebody has some catch buying to do.

- And there is a whole fleet of new nuclear power plants coming online worldwide.

So, big upcycle. Massive megatrend. How can you play it?

I used to recommend the Global X Uranium ETF (NYSE: URA). But truth be told, URA is making some moves that leaves me scratching my head. It is selling down its positions in many miners that poised for massive gains. And it’s adding more positions in the utilities that will have to pay higher costs.

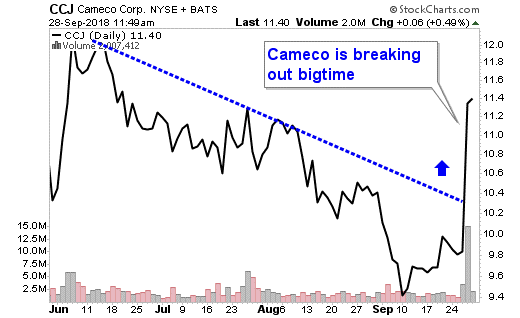

So, perhaps a better choice would be Cameco Corp. (NYSE: CCJ). It’s the western world’s pre-eminent uranium miner, even though it recently shut in production at one of its big mines, as I mentioned above.

But Cameco recently got some good news. A favorable tax ruling in a Canadian court that is going to save it billions of dollars. Unless the ruling is appealed, Cameco is going to get new reassessments for the 2003, 2005 and 2006 tax years. That could result in the company getting a refund with interest.

And that made Cameco’s stock do this …

Whoo-whee!

But that’s not the end of the potential good news. Other tax years are in dispute. This paves the way for more billions in unlocked profits.

And that means this breakout could be the start of something bigger.

Now, let’s add in that first chart — the spot price of uranium on a relentless march higher. That chart makes all of Cameco’s assets look better and better.

All this gives me a price target of $18.50 on Cameco in the next year. Now, if you’re more conservative, you could wait and see if Cameco pulls back below $11 a share. Maybe it will, maybe it won’t.

But the countdown is running on this atomic rocket. It’s smoking on the launch pad. Climb aboard, if you want to aim for sky-high profits. You don’t want to be left behind when blast-off comes.

All the best,

P.S. In early November, I’ll be speaking at the New Orleans 2018 Investment Conference. It will be a great show, with all sorts of experts sharing their insights. And I’ll give my best picks. You can find more about that incredible conference HERE. I hope to see you there!