Doctor Copper is telling us something. He’s saying, “Don’t worry about the global economy.”

They say copper is the metal with a degree in economics. Copper prices tell us when the global economy is heating up or cooling down. That’s because everyone uses copper.

Well, copper kingpin Codelco has almost sold out of supplies for 2019. Why? One word: China!

Chinese copper demand is so strong that Codelco is selling out to the bare walls.

China’s imports of copper in September just hit a new record of 1.93 million metric tons. That’s up 24 percent from the previous month!

So maybe that’s why, after a months-long sell-off that crunched copper prices like breakfast cereal, the metal is finally starting to bottom.

Why do we have this opportunity? Starting in August, trade war fears hammered copper lower. And prices are still down 15 percent from where they started the year — but recently started to bounce.

That’s because a funny thing happened. The trade war isn’t being reflected in actual data. As I just showed you, spot sales of copper into China are booming.

China is the world’s biggest user of copper. While it has 19 percent of the world’s population and 15 percent of GDP, it’s responsible for an outsized 50 percent of global copper demand.

In fact, demand in China is up partly due to trade war fears. To stave off a cooling economy, authorities in Beijing have opened the tap on infrastructure projects and loosened credit. This one-two stimulus is lighting a fire under demand.

Here are some charts …

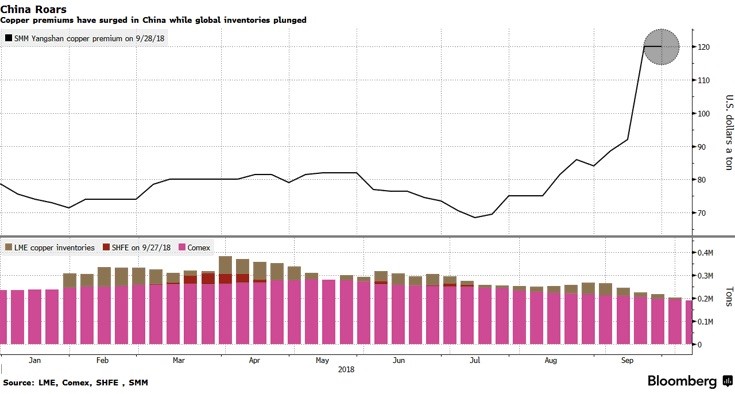

First, from Bloomberg, is a chart of the premium that copper is getting in China compared to the global benchmark price. And the bottom of the chart shows copper inventories.

You can see that the premium is skyrocketing while inventories are going down.

This is a case of the short-term trend getting back in line with longer-term forces. Longer term, due to mine closures on the one side and booming demand for copper in electric cars (and more) on the other, the world is facing a GIANT copper squeeze.

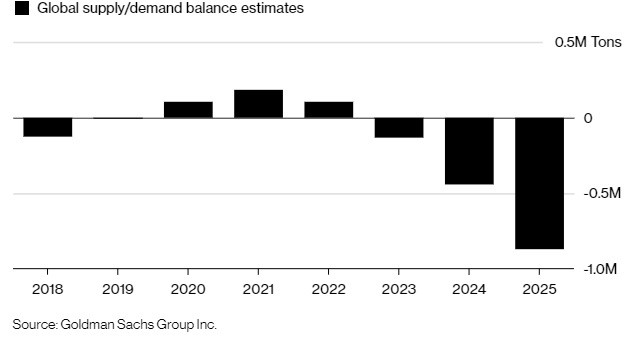

This chart from Goldman Sachs shows the forecast …

You can see that, by 2023, the world’s copper supply is projected to be in deficit. And it’s only going to get worse.

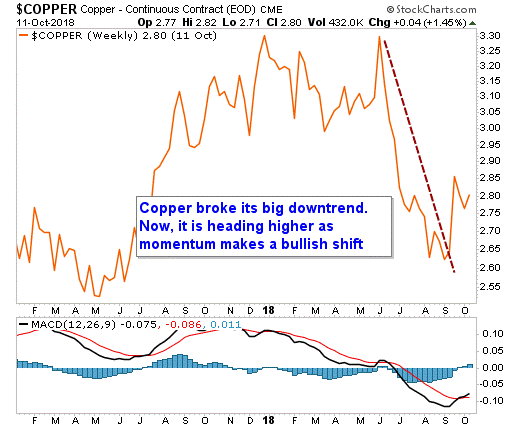

And yet, while the price of copper is up about 7 percent from its recent lows, it still has much more room to run …

On the bottom of the chart, I’ve put a momentum indicator called MACD. It’s good for catching big shifts in momentum. And now, MACD says copper is making a hard shift into the bull camp.

So, how can you play this?

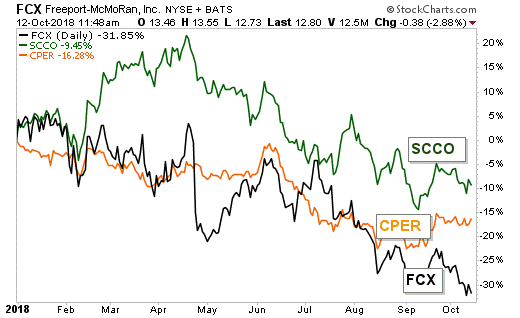

Well, you could buy the stock of a copper producer, like Southern Copper (NYSE: SCCO) or Freeport-McMoRan (NYSE: FCX). Or, you could buy a fund that tracks copper itself. The U.S. Copper Index Fund (CPER) is one of those funds.

Here’s a year-to-date performance chart of all three …

You can see that Southern Copper, Freeport-McMoRan and the U.S. Copper Index generally track in the same direction. They haven’t rallied much yet — so you can catch the biggest part of the potential move.

So far, Southern Copper has outperformed while Freeport-McMoRan has lagged. Which one do you think will outperform going forward? I have my idea, and I’ll be sharing that with my subscribers soon enough. If you’re doing this on your own, be careful.

All the best,

Sean

P.S. With the mini-bloodbath this week on Wall Street, investors should be placing a premium on safety. But choosing safe investments does NOT mean you must sacrifice profit potential. Tomorrow, Martin Weiss will present the strategy he’s using for his own retirement funds to go for big profits, safely, in good times and bad. Simply click here to gain admission to Martin’s important briefing.