A CNBC piece about a couple making $500,000 a year has been floating around social media the past couple of days, showing that even many families making six-figures still have little to no emergency savings in their budget.

The family of four lives in New York City, the parents are both lawyers making a half-million dollars a year between them, and yet aside from their 401k savings plan have been able to save very little extra money.

Imagine making that much money and still feeling “average.” It’s all but a slap in the face to actual average American families, but here is their story, per CNBC:

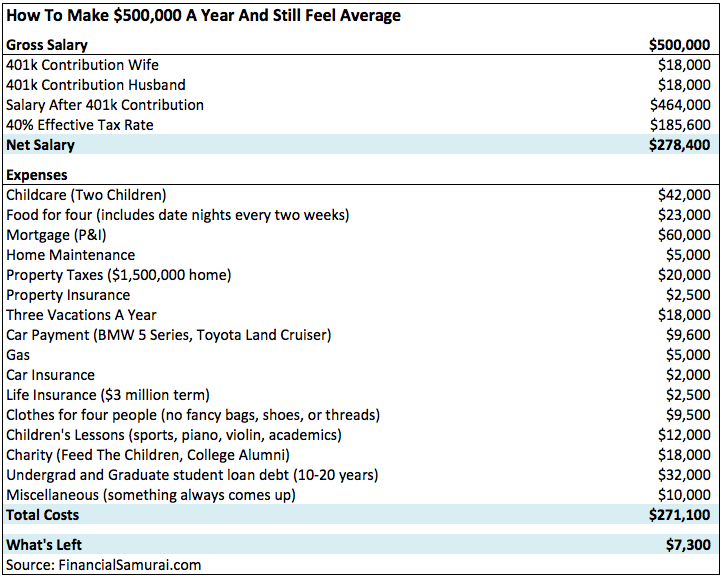

Sam Dogen of “Financial Samurai” breaks down the budget of two New York City-based spouses, each of whom makes $250,000 a year as a lawyer. They’re 35 years old and they have two young children. “This one couple shared their story and I decided to anonymously highlight their reported expenses,” Dogen tells CNBC Make It, with a focus on why they end up feeling “average” even though they’re such high earners.

Take a look at exactly where their money goes.

As you can see, they both max out their 401(k) plan each year and are working on paying down student loan debt. But, even though they qualify as “upper-class,” after taxes, fixed costs, childcare and discretionary expenses, there’s only $7,300 left each year to go towards other savings goals, investment accounts or retirement funds.

As Dogen puts it, they’re effectively “scraping by,” in part because they’re still living “paycheck-to-paycheck,” despite their generous salaries.And they’re not the only high earners having a hard time saving.

In North Fulton, Georgia, a suburban area where homes sell for $500,000 to $800,000, residents earning six figures are struggling to set aside money for retirement, college and other major expenses. Some living in the area who earn $100,000 “are living paycheck to paycheck,” the Washington Post reports, and even families earning up to $250,000 “don’t consider themselves to be high-earners.”

These situations illustrate how difficult it can be to avoid lifestyle creep, especially in expensive cities like New York and San Francisco, where highly paid Facebook engineers recently resorted to asking Mark Zuckerberg for help paying rent.Ultimately, a hefty paycheck doesn’t always guarantee wealth or financial peace of mind. By contrast, budgeting and living beneath your means, no matter your income level, can help you out tremendously in the long run.

How much do you save each year? How does that compare to how much you should have saved at every age?